What’s driving digital transformation for retail banks?

Blog: Capgemini CTO Blog

In an increasingly competitive market, banks are working to meet rising consumer expectations by enhancing customer experience. Customers are used to convenience and personalization from retail and e-commerce, and now they seek the same multi-channel ease of use from their banks.

As online and mobile banking become more popular among consumers, financial services disruption shows no sign of slowing down.

The rise of FinTechs has forced banks to accelerate their adoption of digital technology. FinTechs are bringing a new wave of technologies that help combine digital with data analytics to set new industry standards. Encumbered by archaic legacy systems and unable to swiftly digitize and innovate, many traditional retail banks are at a disadvantage when it comes to catering to loud-and-clear customer demands for better experience.

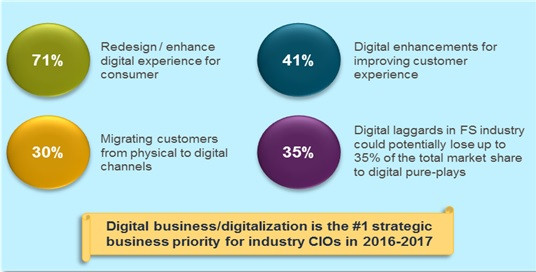

Digital transformation ranks as the leading strategic priority for industry CIOs, and laggards could see their market share erode by as much as 35% as digital pure plays and nimble FinTechs pick up the slack. Financial services executives say their strategic priorities revolve around digital enhancements and augmenting customers’ digital experience.

Banking CIOs’ strategic priorities

Source: Capgemini Financial Services Analysis, 2018, Capgemini Top-10 Technology Trends in Retail Banking: 2018

As banks increasingly look to digitally transform, a focus on boosting the top-line, optimizing costs, becoming more efficient, and developing new products and services is driving their efforts. Now, banks across the globe have dedicated initiatives and investments for driving digital transformation. In the United States alone, retail banks’ spending on digital transformation initiatives is expected to grow at a compound annual rate of 22.5% until 2020, with 40% of IT budgets expected to be spent on digital transformation. Citigroup invested heavily in digital transformation and now generates 36% of its product sales from its digital platforms, a substantially high percentage compared with an average of 15% for other big banks. Additionally, Citigroup witnessed a nearly 26% increase in the number of mobile users.

Wells Fargo is another example of a large bank investing aggressively into digital banking, by rolling out a P2P payment platform (Zelle) for its digital customers, as well as launching a chatbot pilot for Facebook Messenger.

Santander launched an initiative ― called “Walk Out Working” (WOW) ― for opening accounts that enables customers to set up their digital banking tools on site and “Walk Out” with fully activated and accessible mobile and online accounts. Santander also redesigned its consumer app and provided new functionalities, including a fingerprint login option for users who have Touch ID technology on their mobile devices.

Pure play digital players are growing very fast and making a mark on the retail banking space by launching digital wallets with full-fledged banking capabilities at lower costs. Revolut, for example, doubled its user base, reaching two million, between November 2017 and June 2018, and is planning to launch a commission-free trading service, while TransferWise quadrupled its revenues in two years, between 2016 and 2018, generating over $151 million in revenue in 2018. These new entrants are forcing the larger players to rethink their propositions and pricing.

In an increasingly digital economy, digital transformation will no longer be an option but an imperative for banks needing to drive agility and innovation, automate manually-intensive processes, and lower costs.

Expected transformation initiatives for 2018 include enhancing or re-designing products and services for the digital age and beefing up use of mobile and other digital technologies. Retail banks must deliver highly convenient and empowering products and services to customers across all touchpoints and channels to build trust and bolster relationships.

Digital is allowing banks to move towards an ecosystem of partners to provide end-to-end value to customers, offering choice and personalization at new scale through APIs.

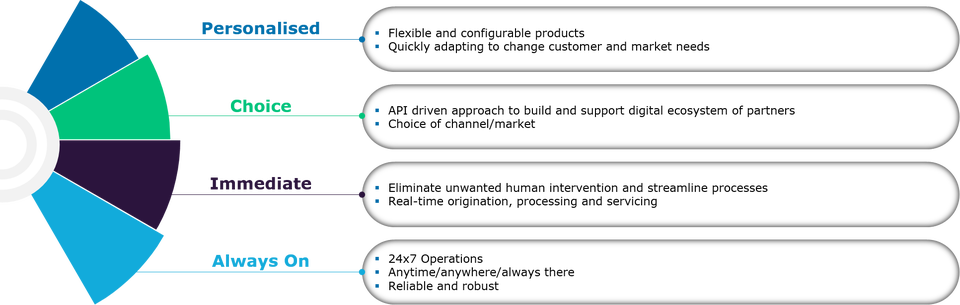

However, delivering on the digital customer promise requires going digital to the core. If banks are to reap the full benefits of going digital, they need to implement a much more flexible core digital banking platform that is always-on, real-time, and offers choice and personalization to customers.

The diagram below depicts the key features of a digital core banking system.

Simply put, banks not investing adequately into digital transformation risk becoming a mere back-office utility. Superior digital banking capabilities lay the groundwork for personalized customer service. Infusing customer engagement touchpoints with real-time insight into customer behavior also improves banks’ cross-selling ability. Finally, banks will also be able to enhance their digital analytics and processes, deliver a superior customer experience, and meet the expectations of empowered and tech-savvy customers.

For more on how digital is disrupting retail banking, connect with me on LinkedIn.

# # #

Leave a Comment

You must be logged in to post a comment.