What is Book Building?

In this blog, we will learn what Book Building is, why do we need Book Building in Investment Banking, various steps that should be followed for Book Building processes, and a lot more.

Given below are the following topics we are going to discuss:

- What is Book Building?

- Types of Book Building

- Characteristics of Book Building Process

- Various Steps for Book Building Process

- Advantages of Book Building

- Conclusion

Watch Intellipaat’s Youtube video on How to Become an Investment Banker

{

“@context”: “https://schema.org”,

“@type”: “VideoObject”,

“name”: “How to Become an Investment Banker in India”,

“description”: “What is Book Building?”,

“thumbnailUrl”: “https://img.youtube.com/vi/a0gERn2-2zk/hqdefault.jpg”,

“uploadDate”: “2023-04-10T08:00:00+08:00”,

“publisher”: {

“@type”: “Organization”,

“name”: “Intellipaat Software Solutions Pvt Ltd”,

“logo”: {

“@type”: “ImageObject”,

“url”: “https://intellipaat.com/blog/wp-content/themes/intellipaat-blog-new/images/logo.png”,

“width”: 124,

“height”: 43

}

},

“contentUrl”: “https://www.youtube.com/watch?v=a0gERn2-2zk”,

“embedUrl”: “https://www.youtube.com/embed/a0gERn2-2zk”

}

What is Book Building?

As per SEBI regulations, Book Building is essentially a method used in Initial Public Offering (IPO) to obtain effective price discovery. An Initial Public Offering (IPO) is opened for that specific time period, and then bids are gathered from investors at a range of values that fall within the price range set by the issuer.

This process is directed forward to both institutional investors as well as retail investors. The issue price is determined when demand is generated in the process. In simple terms, Book Building is a process used by companies raising capital through Initial Public Offering(IPO) to find out the price and demand discovery.

Book Building is a capital-distribution method used primarily for promoting an equity share offering to the general public by aiming at both wholesale and retail investors. Following the bid closing date, the issue price is chosen based on a set of evaluation criteria.

In India, Book Building is done using a method where the issuer establishes a base price and a price band that is roughly equivalent to the filing range used in the US. This is the main reason why this term is getting popular and used more frequently in the Investment banking sector.

Looking forward to become an Investment Banker? Enroll in our Investment Banking Course now!

Types of Book Building

There are also two different sorts of Book Building processes: 75% Book Building and 100% Book Building. Let us see the basic difference between the two so that we can have a better understanding of how the two types differ fundamentally:

- 75% Book Building: In accordance with this procedure, 25% of the issue must be sold at a fixed price and the remaining 75% must be offered through the Book Building procedure.

- 100% Book Building: In this type, either 100% of the total profits from the book-building process are offered to the public or 75% of the net offer to the public is made through the Book Building process, and 25% of the net offer made to the public at the amount decided through the Book Building process.

Both types play a fundamental role in the banking sector as both types provide versatile features that can be used to decide the price of an IPO(The concept of Book Building in the field of Investment Banking is relatively new in India. However, it is a common practice in most developed countries like USA, UK, France, Germany, Japan, China, and many others.

Want to know how many types of investment banks exist? Check out our blog Types of Investment Banking.

Characteristics of Book Building Process

In the above section, we have seen what exactly Book Building means. Now let us see the most significant characteristics of the Book Building process:

- The number of securities to be offered, as well as the price range for the bids, is specified by the Issuer.

- The book is generally available for a period of five days.

- Bids must be submitted within the price range that has been indicated.

- Bidders have the option to amend their bids before the book closes.

- The book runners analyze bids on the basis of demand at different price levels once the Book Building period has come to an end.

- The issuer who intends to make an offer appoints one or more lead merchant bankers to act as ‘book runners’.

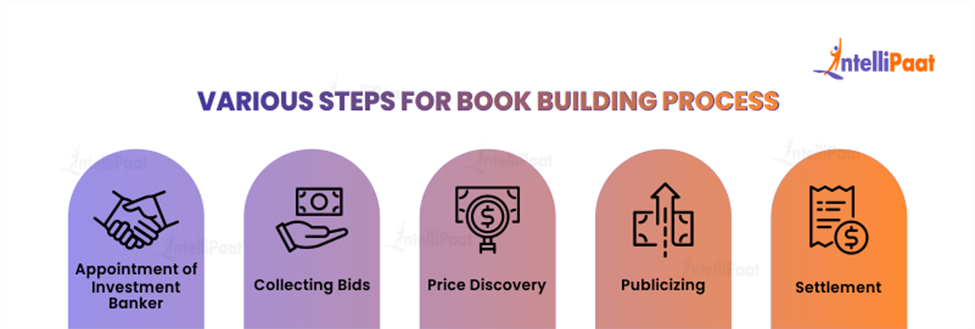

Various Steps for Book Building Process

In the Book Building process, we have to follow several steps to make the Book Building efficient in the field of Investment Banking. Let’s see the detailed process of Book Building one by one:

- Step 1: Appointment of Investment Banker

The first step starts with the appointment of the lead investment banker. The main role of this person is to conduct due diligence. They propose the size of the capital issue that must be conducted by the organization.

Then investment banker also proposes a price band for the shares to be sold. If the management agrees with the propositions of the investment banker, the prospectus is issued with the price range as suggested by the investment banker.

- Step 2: Collecting Bids

The market participants are asked to submit bids in the second step to purchase the shares. They are asked to submit a bid for the number of shares they are prepared to purchase at various price points. It is suggested that these bids be sent to the investment bankers together with the application fee.

It should be highlighted that not a single investment banker is in charge of collecting bids. Instead, the main investment banker can designate sub-agents to use their network specifically for gathering bids from a bigger number of people.

- Step 3: Price Discovery

This is the third step in which lead investment bankers once aggregate all the bids, then they begin the process of price discovery. The final price chosen is simply the weighted average of all the bids that have been received by the investment banker. This price is set to be the cut-off price.

- Step 4: Publicizing

Stock markets all throughout the world demand that businesses disclose the specifics of the bids they received for the sake of transparency. Investment bankers are responsible for running advertising for a specified amount of time that includes information on the bids received for the purchase of shares. Several markets’ authorities also have the option of physically inspecting the bid applications.

- Step 5: Settlement

Finally, shares must be distributed and the application amount that has been credited from the individual bidders must be adjusted. For instance, a call letter requesting payment of the remaining balance must be sent if a bidder offers a lower price than the cut-off price.

But, if a bidder placed a bid that was higher than the cut-off, a refund check must be prepared for them. The settlement procedure makes sure that investors are only paid the cut-off amount, not the shares that were sold to them.

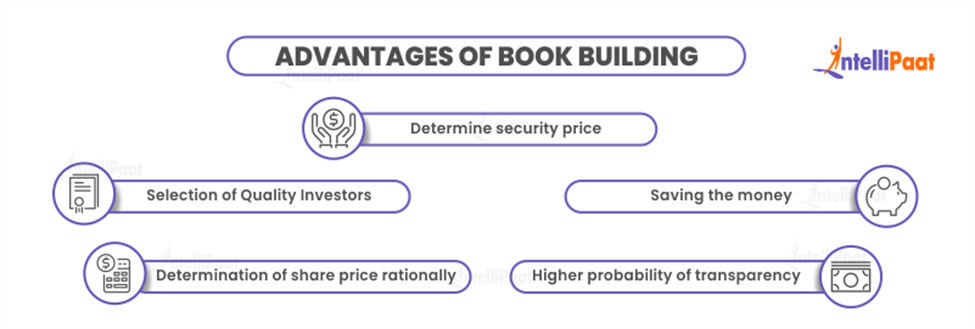

Advantages of Book Building

Although the Book Building process has many benefits, we’ll focus on the following five that stand out the most:

- Book Building can help to determine a security’s price and the intrinsic worth of its shares.

- When we issue the company we can get the benefit of selecting quality investors.

- The Book Building process results in saving money as we know funds that are being spent on marketing and advertising activities are saved after using the book-building process.

- Share price can be determined rationally by looking at the demand for the same in the market.

- Book Building process informs the general public about the bidding information due to which there is a higher probability of transparency.

To ace, your next interview examines the Investment Banking Interview Questions!

Conclusion

Every corporate organization needs money to conduct its operations. It has the ability to raise money from both internal and external sources. Companies employ a variety of methods when they are looking for external sources. In industrialized nations, Book Building is a prevalent activity that has recently begun to spread in emerging economies like India, Brazil, China, etc.

Do you still have any perplexing questions in your head? Feel free to visit our Community Page!

The post What is Book Building? appeared first on Intellipaat Blog.

Blog: Intellipaat - Blog

Leave a Comment

You must be logged in to post a comment.