Use of Utilities for Digital Start-ups in the Energy Sector: New Challenges

Blog: Capgemini CTO Blog

Digital transformation, falling renewable technologies costs, and new storage solutions are accelerating the energy transition. The energy sector is being completely transformed by these technological advances and is moving towards the concept of “Internet of Energy.”

Consumers have new expectations. They want to reduce their energy bills, secure and decarbonize their energy supply, and benefit from local production and a service package facilitated by new technologies. If the movement started with residential customers thanks to the distributed PV and self-consumption—the “prosumers”—it is being closely followed by the industrial and tertiary sectors. In emerging markets, industrials realize that distributed renewable energies provide a more reliable and less expensive supply than conventional energy (mainly diesel). In developed economies, large companies have to adapt to new consumer demands, and this is reflected in the RE100 initiative, in which 102 international companies (Ikea, Bloomberg, Coca-Cola, Facebook, Google, etc.) committed themselves to use 100% renewable energy by 2020 or 2025.

These new trends in consumer behavior, accelerated by digital levers, push utilities to rethink their value proposition that was previously based on the sale of commodities. The energy companies are planning to provide a complete set of energy services, installations, energy supply, demand management, equipment maintenance, operation of local means of production and infrastructure, etc. To build this new value proposition, utilities must collect (using Internet of Things (IoT) technologies), aggregate, and monetize data from several sources (load profile, weather, renewable production, building information, market price, etc.). However, traditional players lack data management tools, human resources with software or data science experience, and, more generally, knowledge of their consumers. For example, even though smart meters are now being deployed in Europe, the systematic exploitation of consumption data is not yet implemented in many countries.

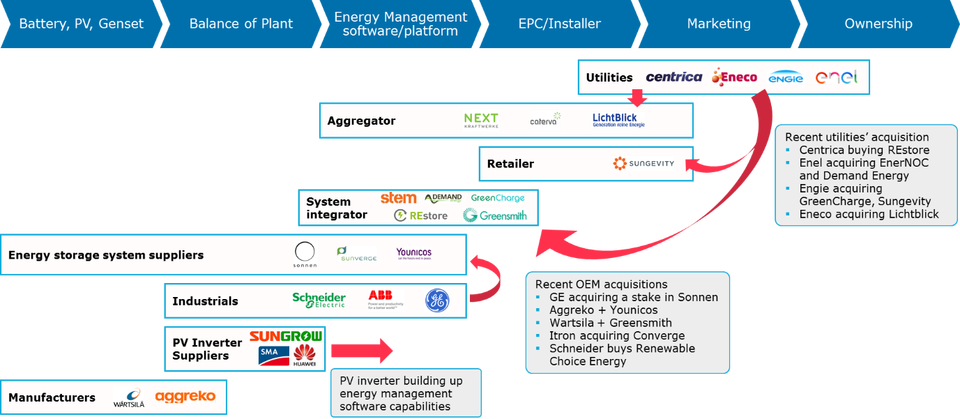

In parallel, the major equipment manufacturers—GE, Siemens, Schneider Electric—seek to get closer to their industrial customers with whom they have a closer relationship than utilities. In order to differentiate themselves from their competitors, these players broaden their portfolio of offers by adding software solutions for controlling and analyzing data. Over the last few months, OEMs have increased the number of start-ups and software solution providers acquired: GE has taken a stake in Germany’s Sonnen (a provider of energy storage systems that recently became a supplier of electricity), Schneider Electric acquired renewable developer Renewable Energy Choice and Wärtsilä acquired the US energy storage integrator Greensmith Energy. In addition, the new digital players are entering the energy sector thanks to the emergence of decentralized energy production and their privileged relationship with end-users. These digital natives, be they start-ups or Web giants like Google and Apple, are much more agile, customer-focused, and capable of driving a vast ecosystem of consumers and start-ups. As they master digital tools (IoT, artificial intelligence, data lake, etc.) and attract talent like “data scientists,” they quickly generate new business models.

High M&A activity to bring expertise in house

Mergers and acquisitions in the energy and utilities sector have been at their highest in 10 years. Cleantech and digital start-ups are an important target of these operations. As decentralized renewable generation capacity grows on the grid and as consumer demand increases, the need to collect data from multiple sources (consumption profile, weather, renewable production, consumer data, market price, etc.), and to analyze and value them rises (demand response, energy efficiency, network services, back-up, etc.). What motivates these actors can be the acquisition of new skills (web developer, data architect, UX designer), new technologies, or a position in a new market.

The vast majority of transactions take place in the United States, as European utilities buy start-ups. As the transformation of the utilities market in Europe accelerates, traditional players with a strong US presence such as Enel and Engie are looking for innovative business models that could be imported to Europe. In this way, the acquisitions of EnerNOC and Demand Energy bring expertise and technologyin demand response, and a better understanding of industrial customers. In fact, the industrial and tertiary sectors offer higher volumes and the possibility of expanding the service offer. However, this requires better knowledge of their profiles and consumption habits. In Europe, Engie acquired American developer Sungevity, which uses data analysis solutions to target residential customers and offer them PV installations.

Recent M&A Deals in Energy (residential, commercial and industrial segments)

Source: Capgemini Consulting

Create a new entity?

Some go further in their transformation by creating a dedicated entity or by setting up a subsidiary with a partner. In 2007, the American utility AES Corp launched a dedicated company, AES Energy Storage, to develop energy storage projects around the world. At the end of 2016, AES decided that its energy storage subsidiary would be solely dedicated to the sale of energy storage systems with an in-house energy management platform, while AES would continue to develop projects. In 2017, AES went one step further with the launch of the Fluence joint venture with Siemens to sell energy storage systems. More recently, Enel created a new division called “e-solutions” to develop innovative products and services that are customer-focused and digital.

The battle between utilities, OEMs, web giants, and other players will certainly intensify. The ability to rapidly acculturate the workforce to new digital tools will be crucial and could pose a major threat to the transformation of utilities. The risk is even greater as customers start to shy away from traditional players. In Europe, self-consumption is already increasing while utilities’ revenues decrease. Lastly, industrial and tertiary customers could acquire energy supply and control solutions for their own use.

A double acceleration is necessary

Beyond the models set up to welcome start-ups and value their contributions, all players are actually engaged in a double speed race. How to be the first to identify the prize? Many strategies have been tried successfully: to be in immediate proximity to innovation zones (to have their own laboratory or observation post in San Francisco), to finance innovation projects with ad-hoc structures (venture capital), or to continue organizing innovation contests.

Be the first to propose an innovation to the markets, and if successful, scale up as quickly as possible to occupy the opening economic space. It is the battle of scale-up; it is more difficult to win than that of ideation. Innovation is key. The first major successes that are changing the markets are expected soon.

Written by Florent Andrillon (Vice President) and Marianne Boust (Manager)—Capgemini Consulting

Leave a Comment

You must be logged in to post a comment.