Positive customer experience driving customer loyalty

Blog: Capgemini CTO Blog

An explosion of new technologies, rising customer expectations, and new-age competition from non-financial services firms such as FinTechs and BigTechs have spurred unprecedented changes in the banking industry. Banks no longer compete exclusively with other banks. Bigtechs, FinTech firms, and challenger banks, all provide next-generation products and services that continually raise the customer experience bar. Channels and touchpoints are growing exponentially, and customers expect banks to provide a consistent experience across them all. Banks need to step-up and adopt a true data-driven delivery of personalized products and services, to enable them to build and maintain customers’ trust and loyalty.

Understanding customer stickiness

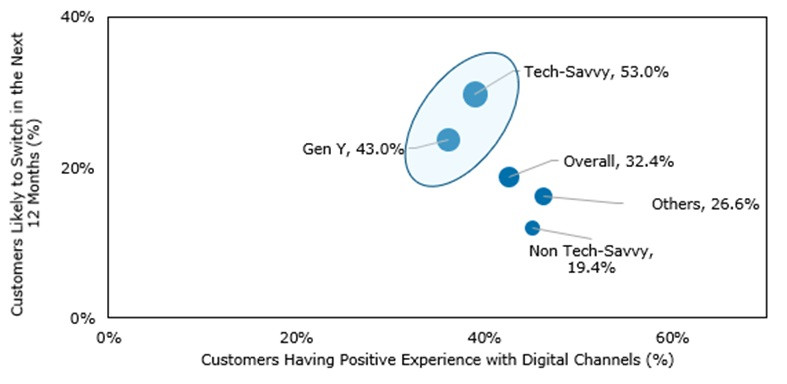

We are witnessing a shift in the industry, with nearly one-third of banking customers (32.4%) saying that they are likely turn to BigTechs for financial products and services. Furthermore, among individuals who are expected to switch banks in the next twelve months, the likelihood that they will consider BigTechs increases to 70.2%. The number of younger people considering BigTechs for their banking needs is higher, with 43% of Gen Y customers ready to consider BigTechs. Also, customers with comparatively lower positive experiences with digital channels are more inclined to consider BigTechs for their financial needs.

Figure 1: Customers’ Switching Propensity vs. Positive Experience across Digital Channels vs. Customers

Considering BigTechs, by Demographic Segment (%), 2018

Notes:

(1) The size of the bubble indicates the percentage of customers willing to consider BigTech firms (such as Google, Apple, Amazon, Facebook, Alibaba, etc.), for their financial services needs if they start offering financial products or services.

(2) Digital channels are defined as Internet and Mobile.

Sources: Capgemini Financial Services Analysis, 2018; Capgemini Voice of the Customer Survey, 2018.

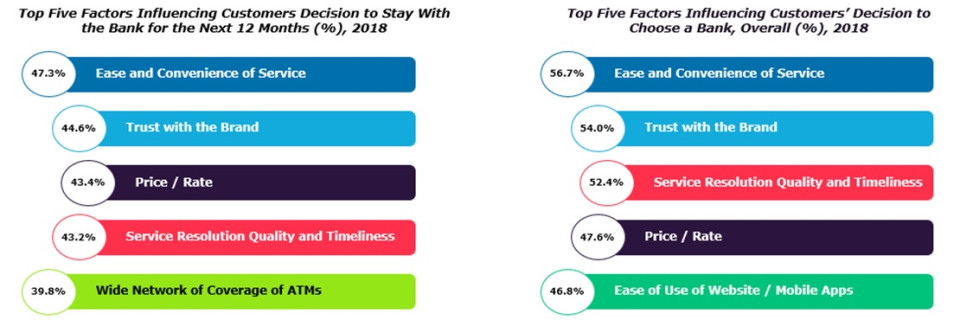

Customer stickiness or loyalty to banks depends on several factors, such as availability of easy and convenient banking, trust with the brand, and service resolution time. The evolution of technology has changed the way customers interact with banks. We now live in a world in which all aspects of customers’ lives has a digital footprint, and digital is the only answer to how banks can provide ease and convenience, and quicker service resolution to the customer.

Figure 2: Factors Influencing Customer Stickiness

Notes:

(1) The percentages for both graphs represent customers who gave a rating of 6 or 7 on a scale of 1–7 for each of the factors.

(2) Only the top five factors are shown in the figure.

Sources: Capgemini Financial Services Analysis, 2018; Capgemini Voice of the Customer Survey, 2018.

Taking a cue, HSBC is providing an entirely new value proposition to its customers through an app called “Connected Money’” that allows them to view account information from all their providers in one place. Customers can see their current accounts, savings accounts, mortgages, loans, and cards held across 21 banks. It also provides spending analysis and features suggesting where customers can save money. Similarly, SCB offers an all-in-one lifestyle-banking application called SCB EASY” that caters to customers across different segments and lifestyles. This one-stop application enables customers to process any transactions and payments (such as purchasing movie tickets, etc.).

Nearly half of the customer base (49.1%) claims to have had a positive digital experience with banks that proactively offer personalized services. The positive-experience rate drops to 39.5% for customers who say that their banks did not proactively offer them personalized services. Globally, several banks are committing to personalized offerings and superior services.

The Bank of Ireland merged its offline and online data to improve their customer engagement activities by providing personalized and accurate content to the right audience at the right time.[1]

The USAA has implemented a contact handoff system. Whenever customers click on “contact us” in the mobile app, they are connected to a service representative who already has their basic information and context for which they are being contacted, thus enabling a faster response.

For retention and growth of the customer base, banks will need to adopt a more customer-centric approach and treat customers’ demands for convenience, faster response time, and higher value for their money as opportunities.

In addition to a digital mindset, banks need to have a next-level understanding of the power of data. Artificial technology is readily available, and most banks have already implemented AI. By collaborating with FinTechs and BigTechs banks can adopt the true culture of delivering a data-driven customer experience to their customers. Adopting such a data-driven culture will enable banks to stay ahead of the customers’ expectations curve.

Banks’ investment in customer experience augmentation, along with data-driven delivery of personalized products and services, will enable them to build and maintain customers’ trust and loyalty.

To learn more on how positive customer experience will continue to play a crucial role in driving customer loyalty, feel free to get in touch with me on social media.

# # #

[1] Market-1st Omni-Channel Personalization – Efma Innovation in Retail Banking Portal.

Leave a Comment

You must be logged in to post a comment.