Paving the Customer Journey with Mobile

Blog: Kofax - Smart Process automation

Banks are digitally transforming the way they do business to meet increasing customer demand for an engaging and efficient user experience.  Customers are on a digital journey that continues to evolve, with mobile now their channel of choice, and banks need to be an integral part of this journey to stay relevant.

Customers are on a digital journey that continues to evolve, with mobile now their channel of choice, and banks need to be an integral part of this journey to stay relevant.

Customers cannot be taken for granted; banks realize this and are turning every process on its head to ensure they are looking at their business from the outside in. Banks have grown through acquisition, which has led to silos of products and systems; data on a customer could be in one system, but not accessible by another system. This divide of information disrupts employee productivity, resulting in delays and frustration in getting accurate, timely and relevant information to customers. This dissatisfaction is a concern for banks, and it’s what is causing customers to seek financial services from fintechs or other financial institutions that make the user experience seamless and simple.

Mobile is the self-service channel that empowers you to acquire new customers. It may be the first interaction you have with a potential customer, so the engagement must be seamless and easier than walking into a branch, yet still have the personalized feel of interacting with a branch representative. But however positively this relationship can begin, it often does not end fruitfully: according to Javelin Strategy & Research, almost 90% of customers abandon account applications before they’re completed. And although there has been a huge shift in moving to digital engagement, banks are missing the mark and failing to make the experience intuitive and simple.

Customers are also looking to conduct complete transactions and acquire products through digital channels in real time. Customers demand instant notification and status updates, very much like an experience with Amazon, for example. When onboarding a new customer, make it simple and take unnecessary steps out of the process, alleviating the burden on the customer. If they need to provide data points from an ID, don’t ask them to manually input their details through the tiny keyboard on their phone; instead, allow them to snap a picture of their driver’s license. The bank should do the perceived heavy lifting of automatic extraction and validation of their ID to ensure compliance with KYC (Know Your Customer) regulations, and provide instant approval for the opening of a bank account. This helps reduce the cycle time of customer onboarding from days to minutes, delivering a frictionless experience that satisfies your customers.

Don’t forget that acquiring the customer is merely the first phase of this digital onboarding journey—the key is retaining your customer throughout the entire journey.

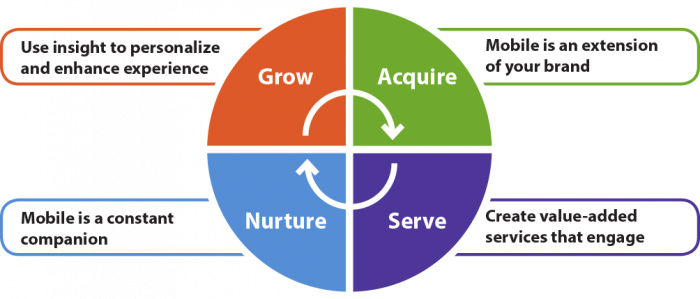

451 Research¹ has developed a mobile lifecycle that shows how each of the phases flows into the next. Acquire moves into Serve and Nurture, which is about ensuring effective communication and personalized services throughout the relationship. Once you get to know more about your customer and build a sturdy foundational relationship with them, it’s then time to grow that relationship through cross-selling and upselling. Adhering to this lifecycle ensures the customer is at the heart of what you do and helps you deliver an engaging experience through the customer journey.

See how ING Bank is using intelligent capture and analytics as an integral part of customer engagement and is digitally transforming their business and approach. They are seeing success in raising the bar for customer delight by delivering a seamless experience through mobile.

If you are interested in learning more how to integrate mobile into your bank, download “How to Win with Mobile” EBook now.

References: How Digital Transformation Drives Better Customer Experience & Engagement: Sheryl Kingstone, Director of Research, 451 Research

Leave a Comment

You must be logged in to post a comment.