Open Banking for CMA–Making sense of it all

Blog: Capgemini CTO Blog

Despite the continuous and frequent regulatory changes in the banking industry, it can be rare that the actual benefit to the customer surfaces through all the red tape and loop holes that walk hand in hand with regulatory change.

There does seem to be some light at the end of tunnel however, coming from The Competition and Markets Authority (CMA), whose two-year review of the UK banking market predicts changes that will ultimately benefit the end consumer.

The CMA’s detailed review shows that larger, more established banks—especially the “big four” (Lloyds, HSBC, Barclays, and RBS)—have been barring new and smaller competitors from the market.

When only the largest players come to the table, competition is stifled and innovation stalls. This affects both the costs of banking services, and the quality of these services for the consumer.

The answer—open banking.

Open banking as a concept has been on the financial roadmap for several years, and affects all UK banking institutions that deal with payments.

Alasdair Smith, the chair of the CMA’s retail banking investigation, has said:

“The reforms we have announced today will shake up retail banking for years to come, and ensure that both personal customers and small businesses get a better deal from their banks.”

Simply put, Open banking, according to the CMA, means that with customer consent personal and small business customers will be able to share data securely with other banks and third parties through APIs. Ideally, this will allow consumers to manage everything from current accounts to mortgages using a single mobile app.

There is a list of criteria banks will be required to meet.

Aden Davies singled out the API element as the most significant:

“Of all the measures we have considered… the timely development and implementation of an open API banking standard has the greatest potential to transform competition in retail banking markets.”

Crucially, these reforms herald increased transparency and fairness for the consumer, because by opening up access to customer information, they make room for new players. The UK’s competition watchdog has said that:

“With greater customer engagement we would expect banks to have stronger incentives to compete and develop products to benefit all customers.”

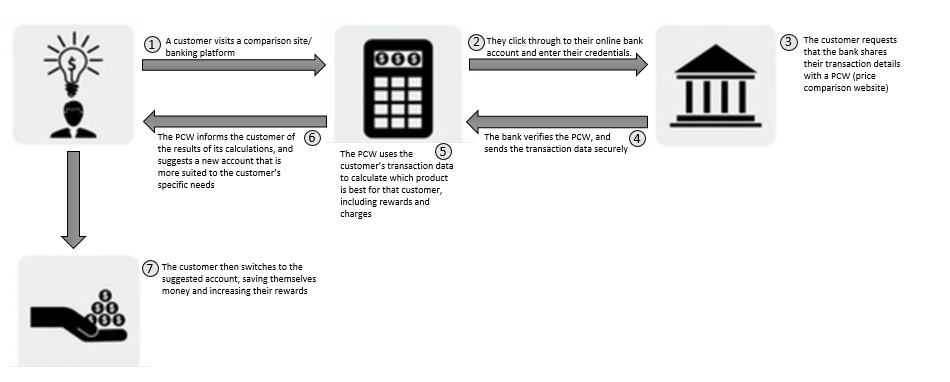

Below is an example of a potential user scenario based on the slides presented by the CMA:

For legacy banks, this means more than just meeting the aggressive timelines set by the CMA. To retain a competitive edge over banking fintechs, legacy banks must also stay on top of all other BAU digital transformations on their roadmaps. An example of one such fintech is Monzo, which offers highly personalised customer service while easily adapting to regulatory changes thanks to its small size.

Large companies are like vast ships when it comes to change; changing course can take a long time once the wheel has been turned. The “big four” retail banks combined represent almost 77% of the personal current accounts market, and nearly 85% of business current accounts. In effect, it is the very traits that make these banks colossal vessels to steer that open up a passage for smaller firms and innovators.

Markos Zachariadis of the Swift Institute discusses the pioneering concept of banking as a platform:

“Banking-as-a-Platform (BaaP) describes the premises upon which banks can adopt a platform strategy model and change the rules of competition… banks will need to revisit their role as financial intermediaries and prepare to become re-intermediaries.”

Simply put, if retail banks want to keep their seat at the table they must look beyond the banking status quo and toward companies like Uber and Airbnb. They must become part of the sharing economy and focus on collaborative consumption and on personalizing customer experience.

One message is clear: the regulatory changes taking place in the banking sector mean legacy players must shift from the current closed model toward an open one, both in terms of their technology structure and their thinking. These players need to consider all changes strategically and use them to gain a competitive advantage over newcomers.

They already have the customer base. All they need now is the right mindset.

Leave a Comment

You must be logged in to post a comment.