Interest Rate Risk

This beginner’s guide to interest rate risk covers everything you need to know about this important concept. We will take an in-depth look at interest rate risk, including its definition, examples, causes, components, effects, and how to manage it.

Learn how to successfully manage Interest Rate Risk and how it may impact your investments.

{

“@context”: “https://schema.org”,

“@type”: “VideoObject”,

“name”: “Investment Banking Course & Training”,

“description”: “Interest Rate Risk”,

“thumbnailUrl”: “https://img.youtube.com/vi/S4hRXmuuk3w/hqdefault.jpg”,

“uploadDate”: “2023-04-28T08:00:00+08:00”,

“publisher”: {

“@type”: “Organization”,

“name”: “Intellipaat Software Solutions Pvt Ltd”,

“logo”: {

“@type”: “ImageObject”,

“url”: “https://intellipaat.com/blog/wp-content/themes/intellipaat-blog-new/images/logo.png”,

“width”: 124,

“height”: 43

}

},

“contentUrl”: “https://www.youtube.com/watch?v=S4hRXmuuk3w”,

“embedUrl”: “https://www.youtube.com/embed/S4hRXmuuk3w”

}

Appendix

- What is Interest Rate Risk?

- Types of Interest Rate Risk

- Causes of Interest Rate Risk

- Interest Rate Risk Components

- Effects of Interest Rate Risk

- Highest Interest Rate Risk

- How to Manage Interest Rate Risk

- Conclusion

What is Interest Rate Risk?

An investment’s vulnerability to changes in the market’s ordinary interest rates is measured by its interest rate risk. When interest rates rise or fall, investments that are dependent on those particular rates may be affected more than those which have less dependency on outside variables such as inflation and economic growth levels. As a result, when standard interest rates rise or fall, some assets become considerably more desirable due to increased yields while others lose value because of declining returns.

Diversification allows investors to distribute their funds among several asset types with varying degrees of dependency on interest rates received from lenders. This is a great strategy for managing this type of risk.

Interested in a career in investment banking? Enroll in our Investment Banking Course to kickstart your journey!

Types of Interest Rates Risk

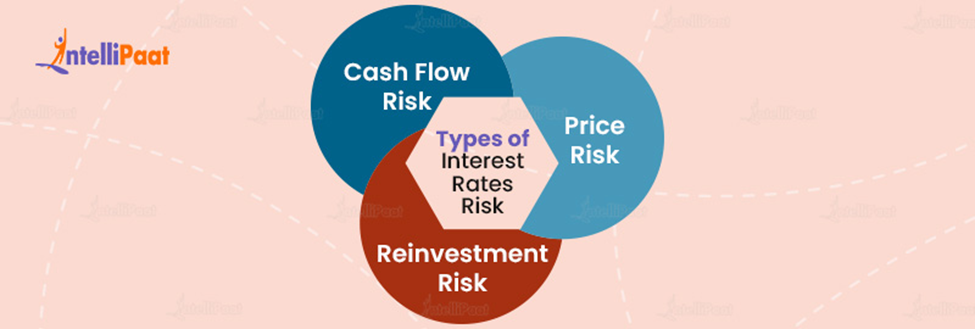

There are several types of interest rate risks that can affect financial institutions, investors, and borrowers. Some of the most common types include

- Price Risk – The possible loss brought on by changes in the market’s value of stocks or bonds, referred to as price risk, is also referred to as market risk. In general, bond prices decline as interest rates rise and vice versa. This is because rising interest rates raise the cost of borrowing, decreasing the value of existing bonds to investors.

- Reinvestment Risk – This kind of risk develops when a shareholder reinvests the earnings from a financial product, like a bond or a CD(certificate of deposit), at a lower interest rate. Bonds and CDs, which have fixed interest rates, are examples of fixed-income products that are most relevant to reinvestment risk. When interest rates decline, the investor may reinvest the money at a lesser rate, and their profits can be less than anticipated. On the other hand, if interest rates increase, the investor might reinvest the money at a greater rate, and their returns might be more than anticipated.

- Cash Flow Risk – Changing cash flows from investments, loans, or other financial instruments can result in potential losses, which is what is meant by “cash flow risk.” For instance, if an organization borrows money at a set interest rate and rates rise, it could have to pay more in interest, which would affect its cash flow and profitability.

Let’s look at an example to better grasp how interest rate risk functions. Consider investing $10,000 in a bond with a $10,000 face value and a 5% coupon rate. The bond has a 7-year length and a 10-year maturity. As a result, you will earn $500 (5% of $10,000) in annual coupon payments for the following ten years, and then you will receive the face value of $10,000.

Let’s say that interest rates increase by 1%. Your bond’s value will decrease as a result of its coupon rate being reduced in comparison to the new interest rates. By using the duration formula and multiplying the period of your bond (duration of 7 years) by the 1% increase in interest rates, we can determine that the value of your bond will decrease by about 7%. Your bond will now be worth $9,300 rather than $10,000 as a result.

Duration Formula = [ ∑in-1 i*Ci/(1+r)i + n*M/(1+r)n] / [∑in-1 Ci/(1+r)i + M/(1+r)n]

Where,

- C = Coupon Payment Per Period

- M = Face or Par values

- r = Effective periodic rate of interest

- n = Number of periods to maturity

Further, the denominator, which is the sum of the discounted cash inflow of the bond, is equivalent to the present value or price of the bond. The difference between the face value of $10,000 and the new value of $9,300 equals a loss to you of $700. This loss serves as an illustration of price risk because it was brought on by fluctuations in the bond’s value as a result of shifting interest rates.

Cause of Interest Rate Risk

- Monetary Policy – Interest rates are affected by monetary policy decisions made by central banks, such as the Federal Reserve. When the Federal Reserve raises interest rates to control inflation, the value of fixed-income securities falls, and investors may face losses. On the other hand, when the Federal Reserve reduces interest rates to boost the economy, the value of fixed-income securities increases, and investors may profit from higher returns.

- Inflation – Another element that has an impact on interest rates is inflation. The Federal Reserve may increase interest rates in order to reduce inflation when it is high. When inflation is low, on the other hand, the Federal Reserve may decrease interest rates to boost the economy.

- Economic Growth – Growth in the economy has an impact on interest rates as well. Credit is in higher demand and interest rates go up while the economy is expanding. On the other hand, when the economy is in a recession, loan demand declines, and interest rates drop.

If you are looking forward to crack your next interview examines the Investment Banking Interview Questions!

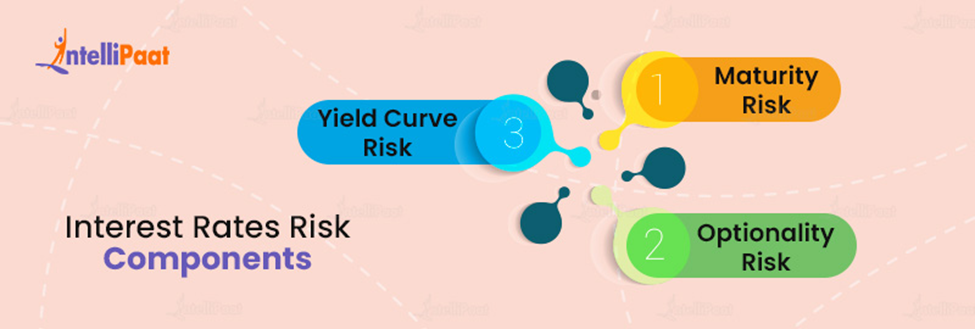

Interest Rate Risk Components

We read about the many types of interest rate risk that can have an impact on institutions and financial markets. Let’s now examine the various risk categories that make up interest rate risk, which is a complex phenomenon. Investors and financial professionals alike must understand these elements in order to effectively manage their exposure to interest rate risk and make sound decisions. The main elements of interest rate risk will be examined in this part, along with their effects on various financial instruments and markets.

- Maturity Risk – The potential loss brought on by changes in interest rates as a bond’s or security’s maturity date draws near is referred to as maturity risk. Short-term bonds are less sensitive to changes in interest rates than long-term bonds.

- Yield Curve Risk – Yield curve risk refers to the potential loss due to changes in the shape of the yield curve.Long-term bonds lose market value when the yield curve flattens or inverts, making them less desirable.

- Optionality Risk – If a bond is callable or prepayable, options risk refers to the possible loss resulting from changes in interest rates. Issuers can decide to execute their call option when interest rates decline, which would lower investor returns.

Effects of Interest Rate Risk

Interest rate risk can have varying effects on financial institutions, borrowers, and investors. Some of the potential effects include

- Impact on Financial Institutions – Changes in interest rates can directly impact a bank’s profitability. If a bank has more liabilities than assets that are sensitive to interest rates, an increase in rates could result in higher interest expenses and lower net interest revenue.

- Impact on Borrowers – For borrowers, a rise in interest rates can increase the cost of borrowing, making it more expensive to service existing debt or take on new loans. Conversely, a decline in interest rates can make borrowing more affordable.

- Impact on Investors – When interest rates rise, investors who hold bonds or other fixed-income instruments run the danger of suffering capital losses as the market value of their holdings falls. Additionally, the yield and overall return of fixed-income portfolios can be impacted by changes in interest rates.

- Market Volatility – Interest rate risk can increase market volatility, leading to fluctuations in stock prices, currency exchange rates, and other financial instruments.

Highest Interest Rate Risk

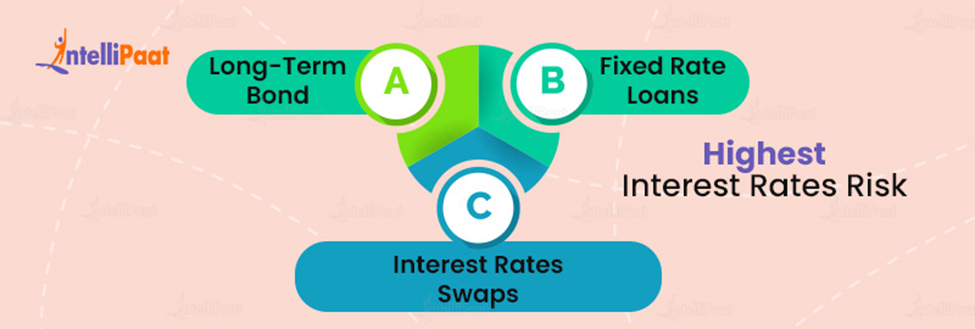

Even though all kinds of interest rate risk can have negative effects, specific circumstances may put investors, borrowers, and financial institutions in the greatest danger of interest rate exposure.

- Long-Term Bond – Interest rate risk poses a significant threat to investors who hold long-term bonds. Long-term bonds often lose more value when interest rates rise than short-term bonds, which increases the possibility of capital losses.

- Fixed Rate Loans – Borrowers with fixed-rate loans may face the highest interest rate risk when interest rates decline. While they continue to make the same loan payments, they can be paying more interest than borrowers on variable-rate loans.

- Interest Rates Swaps – Financial institutions that engage in interest rate swaps, a type of derivative contract, can also face a high level of interest rate risk. If interest rates change in an unfavorable way, the bank may incur significant losses.

How to Manage Interest Risk

Managing interest rate risk is crucial for investors, borrowers, and lenders to mitigate potential losses and maximize returns. Here are some strategies for managing interest rate risk

- Diversification – By holding a variety of fixed-income assets with various maturities, durations, and credit quality, investors can diversify their portfolios. This can lessen the impact of interest rate swings and help spread out the risk.

- Hedging – Interest rate derivatives, such as interest rate swaps, caps, and floors, can be used by borrowers and financial institutions to reduce their exposure to interest rate risk. These tools may help in preventing unfavorable changes in interest rates.

- Duration Management – By altering the length of their fixed-income portfolios, investors and financial institutions can control the risk associated with interest rates. They can lessen the sensitivity of their portfolios to changes in interest rates by shortening or prolonging the duration.

Conclusion

Every investor needs to be familiar with the crucial notion of interest rate risk. It alludes to the potential loss that an investor can incur as a result of interest rate changes. Bonds, mortgages, and other financial instruments are all impacted by interest rate risk.

Investors can make sensible judgments and efficiently manage their portfolios by being aware of the various types, root causes, contributing factors, and implications of interest rate risk. It’s also crucial to keep in mind that, depending on whether interest rates rise or fall, interest rate risk can be both a risk and an opportunity.

Do you still have any questions in your head? Feel free to visit our Community Page!

The post Interest Rate Risk appeared first on Intellipaat Blog.

Blog: Intellipaat - Blog

Leave a Comment

You must be logged in to post a comment.