InsurTech distributors offer partnership value within new insurance ecosystems

Blog: Capgemini CTO Blog

InsurTech firms are making an impact in almost all areas of the insurance industry. Most notably, however, they are redefining the insurance landscape through distribution.

A range of InsurTech distributors have emerged over the years, bringing about online marketplace models and streamlining the insurance purchase process through convenience, transparency, and speed.

What do Distributors bring to ecosystems?

Distributor InsurTech firms are slowly developing ecosystems that open a broader base of potential insurance customers. Not surprisingly, established insurers are keen to partner with them to widen their own reach. For example, Massachusetts-based auto insurance comparison site EverQuote offers referrals to customers via its online insurance marketplace, which has more than 70 carrier partners, including AllState, Liberty Mutual, and Progressive, and more than 5,000 agencies. The InsurTech’s value proposition is that it can match insurers with customers who fit the right risk profile because not all insurers seek the same kinds of customers.

Nearly 67% of InsurTech executives interviewed in Capgemini’s inaugural World InsurTech Report (WITR) said that the ability to collaborate and integrate into ecosystems is a leading Distributor strength. Similarly, two-thirds of InsurTech executives polled said the ability to address an essential market or customer need is a key strength of Distributors. Established insurers were in alignment with 57.7% agreeing that the ability to solve a vital market or customer need is a critical Distributor asset.

How Distributors stack up as partners

The recently published WITR 2018 analyzed various InsurTech firms regarding their potential partnership value for established insurers in short-to-medium term. In addition to Distributors, the report identified two other overarching InsurTech types: (1) Enablers that provide technical support to incumbents and other InsurTech firms, and (2) Full Carriers that provide end-to-end insurance offerings.

Based on their business and operating models, the Distributor InsurTech firms we identified in the report may be further categorized as:

- Marketplaces – Enable customers to compare plans from different insurance providers

- Personal Financial Assistants – One-stop apps to buy and manage all customer policies

- Digital Brokers – Platforms that allow customers to compare and purchase insurance policies

- B2B Digital Distributors – Provide comparison platforms for commercial insurance clients

- Value-Adding Intermediaries – Digital go-betweens that provide a more customized front office for customers.

As more consumers adopt digital channels and the popularity of platform models grows across industries, Distributor InsurTechs offer an increasingly compelling value proposition. They have a clear-cut impact on end-user experiences as they empower customers with information, choices, and potential price saving.

Distributors bolster the top and bottom lines of insurers by making it easier to cost-efficiently reach a broader range of potential customers; although price competition among carriers may also result. Online distribution models are easy to scale and, through APIs, can easily be integrated with insurers’ systems.

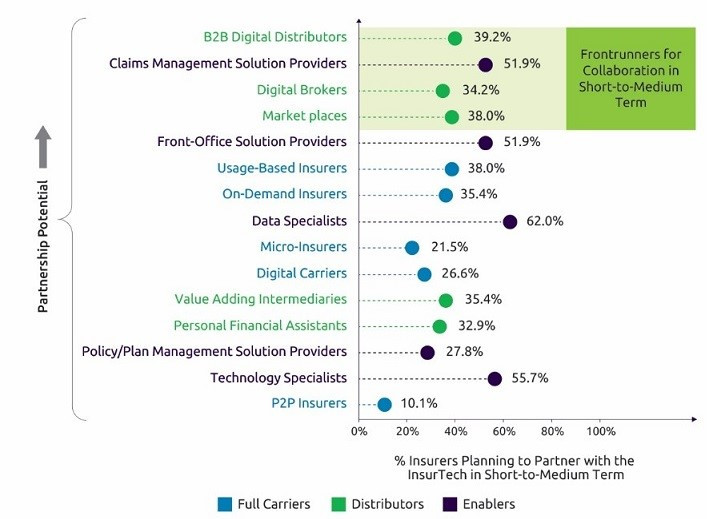

Among the pool of InsurTechs with which established insurers are most likely to collaborate in the short-to-medium term, most Distributors are among the frontrunners (Figure 1). Personal Financial Assistants and Value-Adding Intermediaries fell slightly behind in partnership appeal due to slower initial adoption and greater complexity of their models.

Figure1: InsurTech partnership potentiala and insurers’ preferences for short-to-medium-term partnerships, 2018

a: Individual InsurTech types were assessed on their partnership potential over the short-to-medium term based on a weighted average of ratings along short-to-medium-term assessment factors that were determined based on input from insurers, InsurTechs, and extensive secondary research. InsurTech types with an overall score above a defined level were identified as frontrunners.

Source: Capgemini Financial Services Analysis, 2018; WITR 2018 Executive Interviews

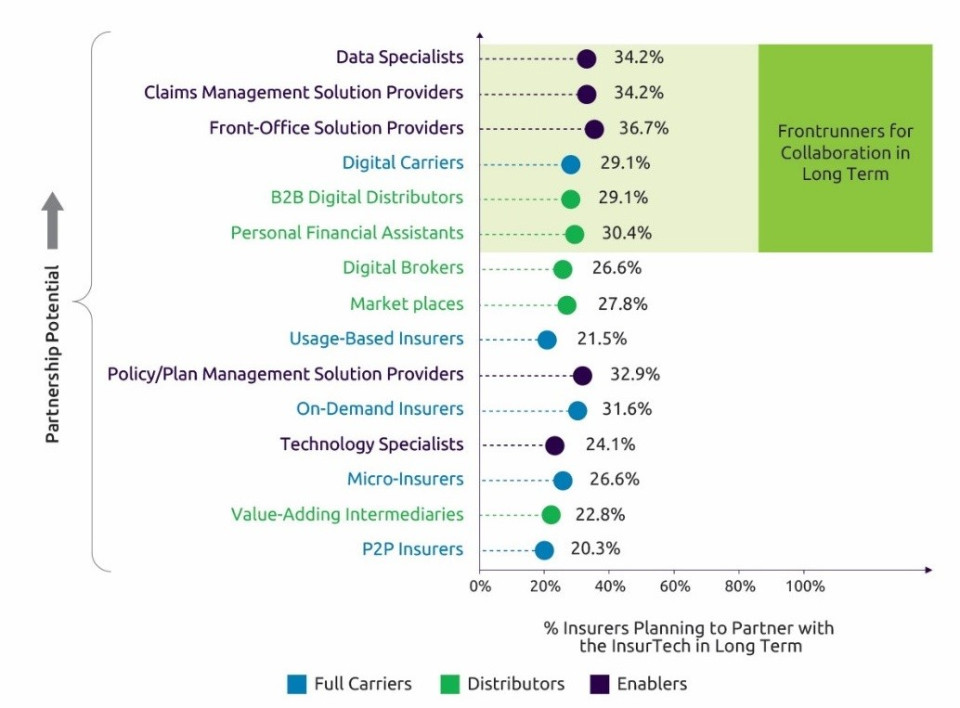

To identify InsurTech frontrunners for long-term collaboration, we assessed their business models for sustainability. Except for Value-Adding Intermediaries, all Distributor InsurTechs showed high potential for market adoption and the ability to sustain profitability and scalability.

Among Value-Adding Intermediaries, abilities to maintain profitability and scalability and to withstand regulatory constraints were model dependent. In terms of ecosystem capabilities, all Distributors scored high because of their knack for creating neutral platforms, which may be critical components of future ecosystems. Without a neutral platform, it will be difficult for insurers to replicate their models, which would raise barriers to entry and make partnership even more important.

While Distributors led the way among short- to medium-term frontrunners, only two models emerged as long-term frontrunners: Personal Financial Assistants and B2B Digital Distributors (Figure 2). Why? While it’s true that Marketplaces and Digital Brokers are essential for near-term partnership, they may gradually be replaced by the Personal Financial Assistant model, which has a one-stop policy management benefit for customers.

Figure 2: InsurTech partnership potentiala and insurers’ preferences for long-term partnerships, 2018

a: Individual InsurTech types were assessed on their long-term partnership potential based on a weighted average of ratings along long-term assessment factors that were determined based on input from insurers, InsurTechs, and extensive secondary research. InsurTech types with an overall score above a defined level were then identified as frontrunners.

Source: Capgemini Financial Services Analysis, 2018; WITR 2018 Executive Interviews

Digital Distributors are on track to become significant partners for incumbent insurers in one form or another thanks to their robust, sustainable models, and their growing footing in the front office as online platforms become more and more popular. The insurance industry is moving toward a digitally integrated ecosystem where specialized players in different parts of the insurance value chain work together to deliver seamless and convenient customer experience. As incumbents prepare strategies to maximize emerging ecosystem opportunities, collaboration with Distributor InsurTechs will be a critical aspect of building a strong ecosystem position.

To learn more on the subject, feel free to reach out to me on social media.

Leave a Comment

You must be logged in to post a comment.