How Does Your Insurance Organisation Measure Up Digitally?

Blog: Kofax - Smart Process automation

Customers’ expectations and insurers’ challenges are difficult to reconcile. Customers want insurers to provide flexibility, functionality, convenience, and communication. They want their insurer to let them file a claim when and where they want and pre-fill their information when possible; avoid making them re-enter information or start over when switching channels, and provide updates on policy status in real time.

Insurers are largely failing to meet these expectations: many do not have the technology platforms to provide multi-channel service and rely on paper documents and data tracking, collection, and review, which is time-consuming and costly. Their channels and systems frequently don’t talk to each other. These inefficiencies make it virtually impossible to meet customer demands.

What is often missing is a well-reasoned strategy that takes into account the big-picture insights needed to truly transform their businesses end-to-end. Customisation is critical – there is no “right” way to proceed or a digital transformation “panacea” to reach. But in an era in which global entertainment platforms, such as Amazon or Hulu, are setting the bar for customer engagement, insurance carriers who don’t take the time to invest in a well-thought out digital strategy will not be able to compete with those that do.

The Why Factor — Recognising Market Disruptors

You know that digitising your operations brings benefits. Maybe your employees are talking about smarter ways to work and serve policyholders. Maybe you’ve been to a trade show and seen the latest technology to hit the market, but just haven’t taken the plunge. Or maybe you’ve taken steps in the right direction, but just aren’t quite where you want to be yet.

The “why” of digital transformation – and perhaps more importantly, the Why Now? – comes down to several shifting forces in the marketplace that are driving a digital disruption to business-as-usual for insurers, known as the four Cs: customers, competitors, costs, and compliance.

Customers—Customers aren’t simply comparing your pricing and coverage options to those of your competitors; they’re making buying decisions based on your ability to provide real-time service, respond to claim status inquiries, and enable them to request a quote or pay a bill on their preferred channel of choice, particularly mobile.

Competitors—Insurtech startups continue to be a disruptor. According to a recent survey from PwC¹ , 74% of insurers believe that some part of their business is at risk from Insurtech startups moving into their market.

Costs—High-volume activities such as onboarding, underwriting, claims processes and policy maintenance can be incredibly costly when combined with outdated manual or paper-based workflows. Manual effort translates into increased errors, greater redundancy in data and document verification, and the need for more full-time employees.

Compliance—Insurance regulations are complex and constantly changing, and legacy systems are often incapable of providing the visibility and document trails needed for reference in the event of an audit; this puts insurers at risk of fines for noncompliance.

If you still aren’t convinced, consider the recent Celent report that gathered data on consumer opinions of insurers’ ability to deliver a positive experience. The results were alarming: surveyed consumers ranked insurance companies slightly above companies without a website and the government in terms of delivering a great shopping or service experience.2

The How Factor — Developing Your Transformation Plan

While some insurers are still reluctant to full digital immersion, others are diving head-first into an unprecedented opportunity to expand their customer reach full digital immersion, others are diving head-first into an unprecedented opportunity to expand their customer reach — and market share — through what Accenture calls the “We Economy” of digital connectedness.

Think about where your organisation falls on this continuum. Are you reluctant to get started? Or have you already taken the plunge? Either way, it’s a good idea to give some thought to where you are and where you want to be. This is where developing a transformation plan comes into play:

- Map, prioritise and identify opportunities for digitisation — Your resources likely aren’t unlimited, so tackling multiple lines of business simultaneously might not be feasible. Focus on your core business functions within the insurance lifecycle, and prioritise those that will have the greatest potential impact on your results and/or your largest customer base, and help you keep pace or outrun the competition.

Processes to consider often consist of heavy manual data entry or redundant manual data extraction and document verification tasks (particularly when knowledge workers are taken away from more meaningful revenue-generating activities), as well as those involving a high percentage of exceptions requiring resolution.

- Assess digital maturity — You have to ask the tough questions and provide honest answers. Where is your organisation right now? Are you where you want to be? If not, what do you need to do to ensure you are operating efficiently and ready to truly serve your customers to their satisfaction and on their terms?

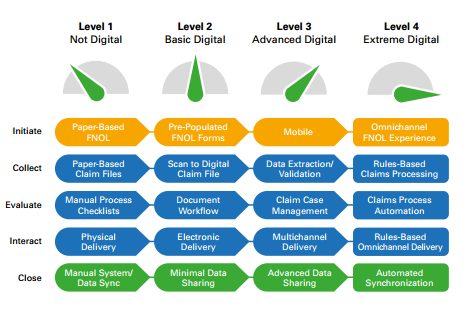

The process maturity model (see figure below) can help you assess the level of digital maturity across your organisation so you can determine which areas need improvement, and then prioritise the areas you want to digitise first as you move from manual and paper-based processes to a fully digital and paperless environment.

Try to evaluate from a customer-first perspective: Are your customers forced to initiate a claim via paper, or do you enable claim submission via the channel of their choice, including a self-service option? Are your employees mired in paper claims collection, or are these tasks automated? Are you putting your organisation at risk of errors and regulatory fines with cumbersome, inefficient workflows, or are you creating automated audit trails?

- Guide the redesign of business processes – Make sure you aren’t missing the big picture. It’s important to gain a wide perspective on your long-term automation needs across your business — don’t limit your focus to the front office. Evaluate the entire process from initial customer engagement all the way through policy maintenance and claims processing.

What results should you be looking for? When all is said and done, your customers should be able to enter less data and receive automated process confirmations and alerts. They should receive near real-time communication that allows for self-service and support from any channel they choose. Designing business insight into process improvement and compliance initiatives can also provide your company with the competitive advantage of being able to make better-informed business decisions, as well as ensure regulatory compliance.

Create “The Wow” Factor

Ultimately, digital transformation is about your customers — there’s a reason customers are listed first in the 4 Cs. This is where the wowing your customers pays off — through strategic investments in digitisation, many insurers are reporting tangible business benefits that include greater customer acquisition and retention, and new sales and cross-selling opportunities.

Consider Progressive Casualty Insurance, a U.S. carrier that was one of the first to launch a mobile photo quoting function. By 2013, nearly one in five of Progressive’s customers had their first interaction with the firm through a mobile device. When Progressive launched mobile photo quoting in one state alone, the company saw an 8% uplift in overall quoting activity.4

When it comes to driving efficiencies and reducing costs, less manual effort translates into reduced errors, less redundancy in data and document verification, and fewer full-time employees (FTE). The claims processing function at one global insurance company with more than 50 million customers was transformed through the deployment of a mobile engagement channel. Now, 70% of claims, data and documents are captured and submitted digitally. This not only improved the customer experience, settlement accuracy, and end-to-end claims process but also helped reduce costs associated with duplicate submissions—resulting in a projected return on investment in just 11 months.

Digital processing and automation also allow insurance providers to incorporate business rules and use data sources to ensure regulatory compliance, with greater visibility and audit trails for reference in the event of an audit. At the claims department of Ageas Insurance Limited, a team of 450 employees was processing more than 60,000 claims manually each week. Ageas integrated an automated process and content management system into their existing legacy system, which allowed documents to be scanned and captured digitally and linked to policyholders in just seconds. Now the claims process is fast, efficient, more transparent for policyholders and more secure. Plus, the improved productivity allowed Ageas to realise savings in operational expenses.

Take Your Next Step

No matter where your organisation is on the path to digital, one truth is constant: “Change is inevitable, and your technology solutions must be able to work together — not only for greater efficiency internally but more importantly, to deliver the best customer experiences.”importantly, to deliver the best customer experiences.”5

It’s time to insure your digital future. Ready to get started?Ready to get started?

Download your copy of “Insuring a Digital Future” for a complete guide to digitally transforming your insurance organisation.

Sources:

1 Opportunities await: How InsurTech is reshaping insurance, PwC, June 2016

2 Strategy in 20 Minutes: How to Be Decisive with Your Future, Celent, 2015Decisive with Your Future, Celent, 2015

3 Customer Loyalty in P&C Insurance: US Edition – Bain & Company

4 Make the Business Case for Mobile Insurance – Forrester Research Inc., July 2015

5 The Insurance CIO’s Guide to Building an Agile Communications Strategy – Oracle

Leave a Comment

You must be logged in to post a comment.