Digital IDs help banks reduce compliance burdens, become more efficient, and less error-prone

Blog: Capgemini CTO Blog

Banks have struggled with compliance-related initiatives such as know-your-customer (KYC) and anti-money laundering (AML). Verifying a person’s identity and their associations with firms, assets, and other individuals can be cumbersome, expensive, and error-prone. However, advanced solutions such as biometrics mean banks can now create and maintain digital ID solutions that benefit customers, the financial services industry, and potentially other industries.

Banks have always been susceptible to fraud, and as digitization becomes more pervasive, cybersecurity risk has become another security challenge. Cyber breaches may result in reputational loss as well as financial loss (direct and through fines, penalties, loss of potential business, etc.).

Banks have tried to safeguard themselves and customers by beefing up scrutiny of individuals and their associations, but the process is time-consuming, operationally burdensome, expensive, inefficient, and prone to errors.

Enhanced security procedures reduce fraud risk but burden customers with repetitive requests to prove their identity, and longer turnaround times – not a boon for customer experience. On top of these challenges, regulators are demanding operational and transactional transparency.

Defining identity

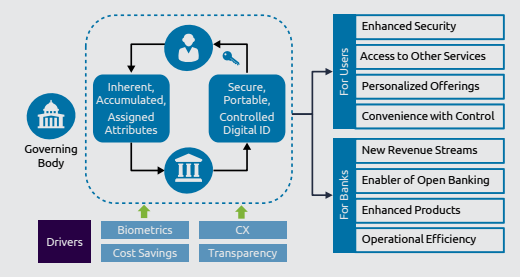

The identity of a person, entity, or asset is used to establish transaction authenticity and is based on descriptive attributes categorized as “inherent” (intrinsic and not defined by relationships to others), “inherited” (gathered or developed over time), and “assigned” (changeable and reflecting relationships with others). Banks, governments, and businesses are now creating digital ID systems and databases built on these attributes to create unique digital identities for individuals, firms, and assets.

For example, the Indian government’s biometrics-based identification system Aadhaar features a 12-digit individual identification number issued to Indian citizens.[1] Issued and managed by the Unique Identification Authority of India (UIDAI), an Aadhaar Card verifies citizens’ details including biometric and demographic data. Aadhaar can be used as a single identification document. Banks, financial institutions, and telecom companies use it for KYC verification and to maintain profiles.

However, in order to be broadly beneficial, digital IDs must be usable across banks and other industries. Portability will necessitate collaboration among banks to create common standards. While banks must ensure that digital IDs are secure, customers will undoubtedly want to retain control of their IDs and decide where to share the information.

Though several approaches can be used to build these systems, biometrics-based solutions (fingerprint, iris, vein, face, voice) can help banks create and maintain a credible identity system. Blockchain-based identification solutions also add immutability and decentralization benefits.

Digital IDs benefit both banks and users

Source: Capgemini Financial Services Analysis, 2017

Some banks are building solutions that go beyond authentication to cover the full transaction value chain, including intermediaries and regulators. In Canada, several major banks, including Bank of Montreal, CIBC, Royal Bank of Canada, Scotiabank, and TD Bank, are building a digital tool that will allow customers to self-identify in a digital world.[2] Similarly, BBVA, Capital One, Deutsche Bank, and USAA have started digital ID projects.[3] Penetration of digital identity systems such as e-ID is very high in the Nordic countries, where these initiatives started early.[4]

Industry’s move towards open banking may further accelerate the adoption of digital IDs. Trustworthy and secure access to identification information for individuals and entities will enhance efficiency, convenience, and cost savings, and provide better risk management for banks and other entities. Regulatory technical standards such as EU’s revised Payment Services Directive (PSD2) can strengthen the security and, in turn, the adoption of digital IDs.

Who benefits?

Digital IDs can help banks reduce the burden of already stretched compliance functions, making them more efficient, less error-prone, and more economical. Moreover, digital identification can minimize fraud through better verification of entities and individuals. It can also aid individuals who do not have a traditional form of identification such as a driver’s license or a passport.

Frictionless banking services have been proven to significantly improve customer experience. Therefore, banks can generate new revenues through Identity-as-a-Service offerings[5] or by acting as an identity broker that provides digital authentication and verification services to third parties.

Although digital identification is appealing, because it helps banks as well as benefiting customers and businesses, concerns around interoperability and default liability still exist. Banks will have to work collaboratively to encourage broader adoption, acceptability, and standardization to drive the full potential of digital IDs.

[1] Unique Identification Authority of India (UIDAI) website, https://uidai.gov.in/your-aadhaar/about-aadhaar/feature-of-aadhaar.html

[2] Tearsheet, “Canadian banks are building a digital identity tool,” Tanaya Macheel, March 20, 2017, http://www.tearsheet.co/data/canadian-banks-are-building-a-digital-identity-tool

[3] American Banker, “Banks can profit from digital ID movement,” Bryan Yurcan, May 17, 2017, https://www.americanbanker.com/news/banks-can-profit-from-digital-id-movement-even-if-they-dont-control-it

[4] World e-ID and Cyber Security, “Nordic Digital Identification – A Survey,” accessed on Sep 25, 2018, https://www.worlde-idandcybersecurity.com/session/nordic-digital-identification-a-survey

[5] https://www.capgemini.com/service/new-ways-to-control-secure-your-assets/cybersecurity-services/capgeminis-idaas-identity-as-a-service/

Leave a Comment

You must be logged in to post a comment.