Banks are leveraging data analytics to transform customer journeys

Blog: Capgemini CTO Blog

Historically, banks almost singularly focused on products and sales. Customer service and experience took a backseat. However, today the situation is changing significantly.

Broad acceptance of digital and mobile technologies has exposed banking customers to exceptional services and seamless customer experiences from providers in other industries. BigTechs are affecting the expectations of banking customers as well.[1]

BigTechs use all available data sources to understand their customers’ needs. Then, based on these insights, they build a holistic view of each customer to enable personalized, relevant interactions that give shoppers what they like most when they need it.

Technology has changed how customers interact across every industry so that all lifestyle activities now leave a digital footprint. It is no surprise, therefore, that banks are adopting digitalization to provide quicker service resolution, competitive pricing, and easy-to-use website/mobile apps.

However, few banks have embraced the holistic approach of BigTechs to leverage data for keener customer insights. Instead, banks address customer pain points at various touchpoints, which can create a disjointed experience and a less-than-seamless journey.

Striving for a frictionless and personalized customer journey

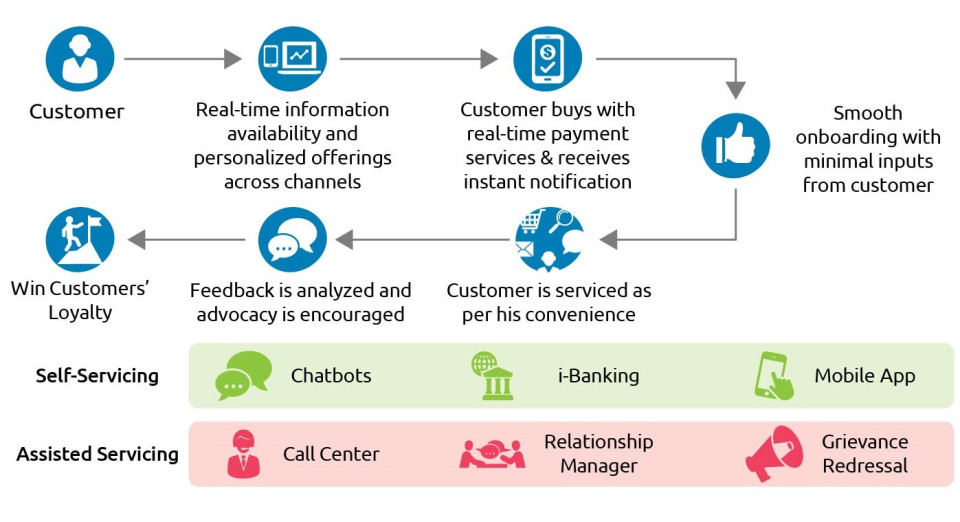

A customer journey includes a set of sequential activities that occur during a transaction. For instance, when seeking a loan, a customer will go through informational phases covering quotes, purchasing, onboarding, and service. The customer’s journey may cross all channels from mobile apps, through web interfaces, and even though more traditional mediums such as a call center.

Banks are in a position of strength based on the vast customer data they accumulate through historical transactions – and they can access a full view of each customer’s financial life and lifestyle preferences by leveraging this data. With the increased adoption of digital channels, and social media as new sources, there has never been a better time for banks to take a 360-degree view of their customers’ lives and offer a segment-of-one customer experience – the right offer at the right time.

The growing role of analytics

Analytics have evolved measurably over the past few years. While most banks already use analytics to some extent, their approach is not always holistic. Practical use of data analytics can help firms to more fully understand their customers’ preferences and needs to deliver customized and personalized products.

Real-time analytics also help to reduce drop-out rates because decision making is quick, and customers are not kept guessing or waiting. Moreover, analytics-based optimal pricing and next-best offer services can attract new customers. Better customer monitoring will support cross-selling and up-selling the right products to maximize the customer’s lifetime value.

A strategy that puts data to holistic, not-fragmented use is critical to ensuring superior experience throughout the customer journey. Banks can leverage their unique view of customers’ life stages and lifestyles to proactively reach out with relevant and personalized products that serve specific, timely needs.

For example, to better understand customer behavior, Lloyds Banking Group in the UK began working with Google in early 2016, to offer requirements-based, real-time solutions to consumers. Lloyds tested Google’s big data platform technologies and analytics on non-personal behavioral data using a secure Lloyds’ account on the Google Cloud platform.[2]

Readily available product and service information, prompt customer support, and instant approvals can safeguard customer satisfaction, resulting in fewer drop-offs and increased sales. What’s more, analytics can minimize customer effort during onboarding through features such as pre-filled forms. Banks can predefine rules and criteria to enable straight-through processing by leveraging analytics.

Banks and users benefit from digital IDs

Source: Capgemini Financial Services Analysis, 2017

Generally speaking, analytics can strengthen the customer-bank bond during customer service interactions, and self-service quality dashboards and reporting tools offer peace of mind because customers know they have 24/7 access to their latest information.

Analytics can be an asset when it comes to running relevant customer loyalty programs and allowing firms to act as a true financial advisor, which can both enable sales and enhance customer trust. Similarly, analytics use can support the gathering and assessment of customer feedback to improve service and show customers that their voice matters.

Personalized and relevant services will help banks to realize the lifetime value of a customer. Through analytics, banks can devise customized services that not only improve customer experience and drive up-sales and cross-sales but also make customers feel valued and distinguished.

As banks move from traditional face-to-face customer relationships to digital relationships, this ability becomes even more crucial. Smoother customer journeys during sales, servicing, and problem resolution will help banks realize the maximum lifetime value of their customers. Banks should work to ensure that all functions work in tandem with a unified view of the customer’s status to provide a consistent customer experience across all lifecycle stages.

Find out more in Top-10 Trends in Retail Banking 2018, a report from Capgemini Financial Services or connect with me here.

# # #

[1] The term BigTech encompasses tech giants such as Google, Apple, Facebook, Amazon, Microsoft, and Alibaba (sometimes referred to as GAFAMA).

[2] BankingTech.com, “Lloyds launches digital analytics innovation team,” Antony Peyton, March 4, 2016 https://www.bankingtech.com/2016/03/lloyds-teams-with-google-for-digital-analytics-innovation

Leave a Comment

You must be logged in to post a comment.