6 Minutes to Customer Onboarding Success

Blog: Kofax - Smart Process automation

As banks continue to struggle with onboarding new customers, a section of the KYC (Know Your Customer) guidelines comes to mind:  Onboarding is your crucial, first customer touch point. When you make customer onboarding the best possible experience for your customer, you set the stage for successful engagement and the chance to grow your brand. But many roadblocks can derail the onboarding process, including compliance issues, siloed business functions, error-prone processes, time delays and lack of technology. When your potential customers encounter these roadblocks, they often decide to take their business elsewhere—and you miss a valuable opportunity for new business.

Onboarding is your crucial, first customer touch point. When you make customer onboarding the best possible experience for your customer, you set the stage for successful engagement and the chance to grow your brand. But many roadblocks can derail the onboarding process, including compliance issues, siloed business functions, error-prone processes, time delays and lack of technology. When your potential customers encounter these roadblocks, they often decide to take their business elsewhere—and you miss a valuable opportunity for new business.

What if you could transform the way you onboard your customers?

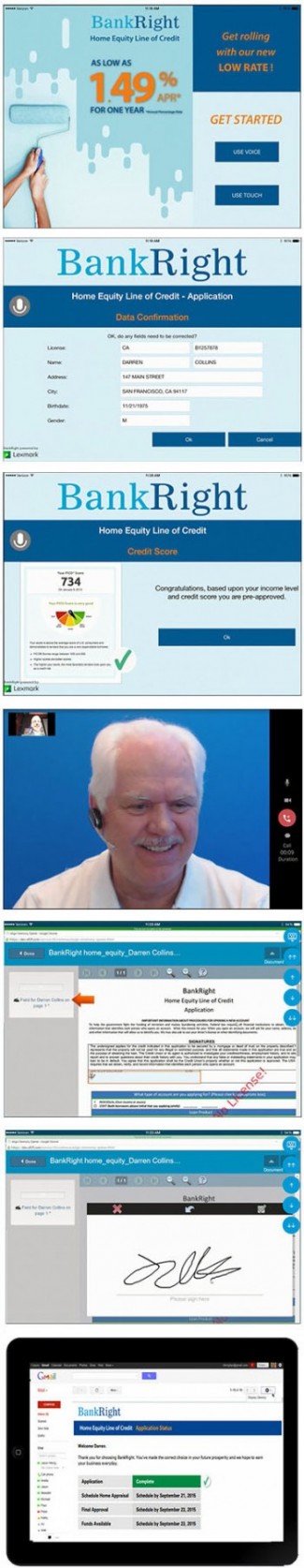

What if you could reduce process complexity, enhance customer experience, shorten the process and reduce customer attrition rates–all in the time it takes you to order a latte? The following example details the process for a home equity loan, but you can apply this technology to new employee onboarding, as well as new account openings and enrollments. In the example, BankRight, a fictitious financial services organisation, is expanding their services with a new, fast, seamless loan application process. This new, streamlined process can reduce your customer attrition rates while providing your organisation with a greater share of wallet.

Step 1: Using the voice-driven application form.

Browsing through a news website, I saw an advertisement for home equity loans. I had some bad experiences with lenders in the past, sometimes waiting up to 45 days for loan approval. It’s not hard to understand why nearly 40% of applicants drop out during the approval process. But, I’ve heard about BankRight and how their loan application process is fast, easy and smart, so I decide to give them a chance. The first thing I notice is that I can drive the application process with my voice.

The BankRight web page prompts me to show my driver’s license. The system then automatically reads my license, captures the photos and data from it, and inserts this information into my on-line application form. I’m then asked to confirm if the data populating my application form is correct, which it is.

Step 2: Completing the qualifying questionnaire.

Next I’m asked a short list of questions, including the dollar amount I wish to borrow, what my home is worth, what I owe on my home, and my social security number. I’m then shown the terms and conditions.

Step 3: Agreeing to terms and conditions and viewing my credit score and loan pre-approval.

I agree to the terms and conditions verbally, and in just a few seconds I’m shown my credit score and pre-approval for the loan. I’m ready to speak to a live agent. What you don’t see here is the parallel processing of regulatory requirements such as AML, KYC, credit due diligence, credit risk and limits. By completing these reviews upfront, at the point of origination, you can control potential exception costs later in the process.

Step 4: Completing the digital signing process.

As I speak with the live agent, I provide my email address and begin the digital signing process (which is recorded and now stored as an object on my digital customer record). I digitally sign on screen, touch to confirm my signature and then touch the Done button.

Step 5: Confirmation of loan approval and scheduling an appraisal.

Within mere moments, I check my email and receive loan document confirmation along with next steps to schedule an appraisal.

And it took only about six minutes to complete the process.

Six minutes, how was this possible?

The secret is in the technology behind this onboarding process, which includes:

- Mobile capture and automatic data extraction

- Voice recognition software

- Real-time integration with a credit bureau

- Income verification providers

- A live video session for the digital signature ceremony

- Personalised communications back to me, the customer

In today’s highly competitive economy, finding key areas to differentiate your financial organisation is critical. More customers are taking the “if you can’t make it easy for me, another bank will” approach. Onboarding represents your first official interaction with the customer, so making it smooth and efficient establishes a standard for successful engagement in the future. And, it creates the opportunity to expand services and grow your financial brand with very happy customers.

Watch this demonstration to see just how simple customer onboarding can be.

Interested in keeping up with the latest innovations in financial and banking technologies? Be sure to register for Finovate 2016.

Leave a Comment

You must be logged in to post a comment.