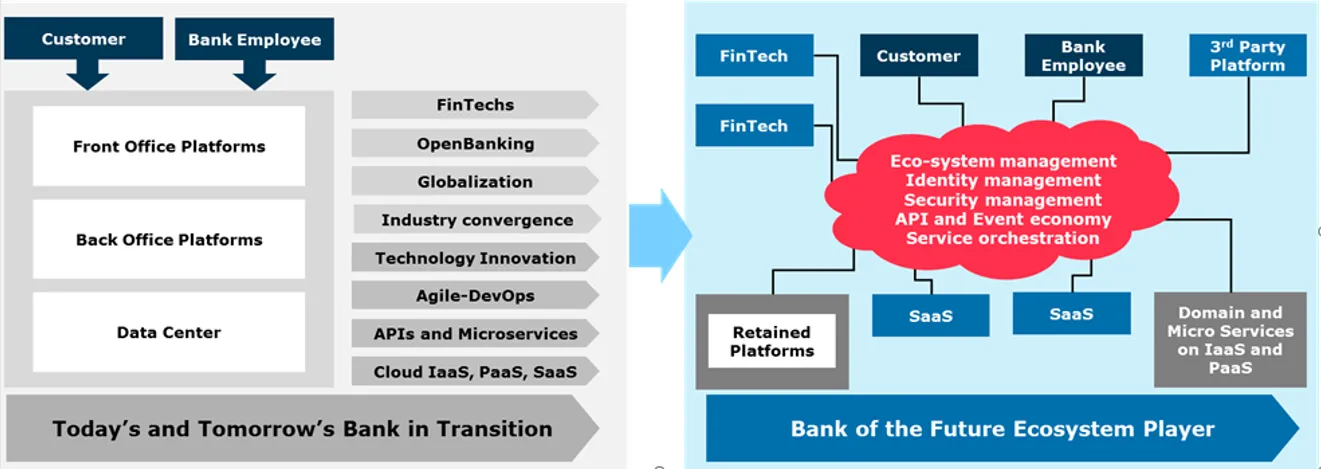

Why Core Banking Transformation?

Blog: Capgemini CTO Blog

Salma Qureshi, Consultant, Capgemini FS│SBU

I help our clients understand and adapt to the challenges they face through innovative architectured solutions while being compliant with latest regulations such as GDPR and PSD2. I hold a Master degree in E-Business Management from the University of Warwick – WMG.