When back-office operations don’t align with front-end experience

Blog: Capgemini CTO Blog

In today’s unpredictable environment, IT investment can be your secret weapon.

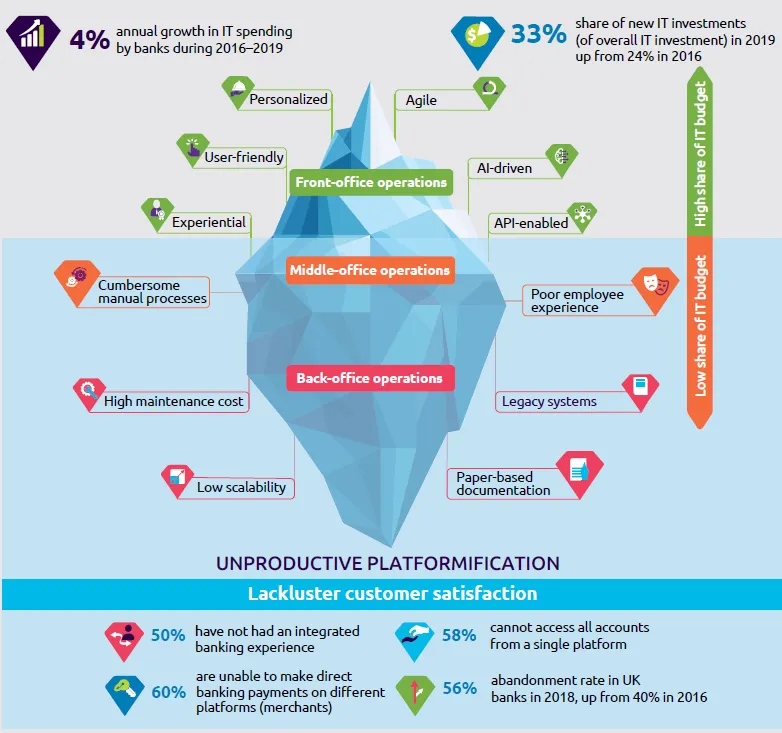

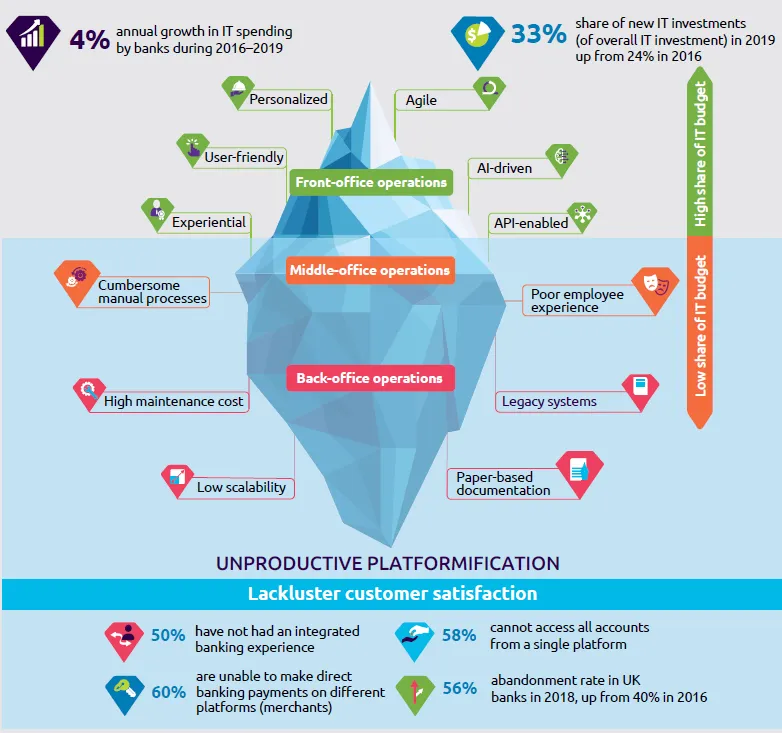

With financial services (FS) spending more on IT as a percentage of revenue than all other business sectors, IT investment can be a strategic enabler for the digital, personalized, user-friendly, and experiential banking, highly demanded by the consumer looking for superior last-mile customer experience (CX).

As data, technology, and compliance complexity grow, it is encouraging to see banks seizing the opportunity to transform their business models – and remain relevant – within a post-pandemic economy and amid escalating customer expectations. However, layering new models on top of legacy infrastructure creates complicated and interlocked processes that are difficult to automate. Have you heard about the spaghetti IT syndrome?

Though front-end, customer-facing systems have been an IT modernization priority, RoI, in terms of improved CX, has been somewhat lackluster. In fact, half of bank customers surveyed as part of the World FinTech Report 2020 said their primary firm does not offer an integrated experience, which makes it impossible to access all their accounts from a single platform. In short, customers say bank services are not up to speed with the WOW factor they have come to expect from non-traditional players.

So, why aren’t banks’ CX improvement efforts paying off? The answer might be in the bare-bones attention firms have given to their middle and back-office operations. These ignored, behind-the-scenes processes are chilling the positive impact of front-end investments.

Legacy systems, paper-based documentation, and cumbersome manual processes clog the digital ecosystems that banks are diligently creating. Banks may support 300 to 800 middle and back-office processes, many of which are complex and span different siloed business units, slowing down the entire IT system.

When back-office operations don’t align with front-end functions, mobile apps or website interfaces must assume sole responsibility for driving customer experience. The reality is that superior CX depends on an end-to-end value chain and interconnected platforms. This includes everything from well-timed customer engagement and convenient onboarding (in the branch, online or via mobile phone) to no-surprises middle and back-office operations such as eKYC, digital contracts and signatures, as well as loan or credit approval, and underwriting.

Front-office operations are the tip of the customer experience iceberg

Collaboration by design offers a path to transformation

Undoubtedly, the alignment of the middle and back-offices with the front end can be an arduous journey. Although legacy infrastructure upgrades or overhaul are necessary, phased implementation can be a prudent approach for banks concerned about business continuity. Sure, transformative initiatives can be handled in-house – yet another addition to the long laundry list of ongoing IT updates. Or, banks can collaborate with FinTechs that specialize in the design of agile, user-friendly technology and modern, open, and evolutive platforms.

Collaboration by design is an efficient, three-step approach to upgrading high-impact middle and back-end operations.

- Identify: First, assess current processes through data-centric mapping to detect how efficiency bottlenecks tie in with customer experience.

- Prioritize: Then review the overall business strategy and the expected outcomes from process improvements.

- What does success look like? The point is to identify and prioritize processes with the highest impact on customer experience, operational excellence, and profitability.

- An immediate focus on low-hanging-fruit upgrades can help to kick start the transformation initiative.

- Collaborate: Finally, boost CX by partnering productively with qualified FinTechs with capabilities in data management and cost rationalization.

- An example of a successful partnership is the one formed in late 2018 between JP Morgan Chase and unicorn Plaid. Chase sought to leverage Plaid’s APIs so customers could quickly push their bank data to outside apps and manage their finances while simultaneously allowing them to control how the data was accessed and used.

- And in late 2019, New Jersey-based Investors Bank partnered with ODX, a subsidiary of digital lender OnDeck, to utilize the FinTech’s digital loan origination platform and offer small business quick access to credit. The collaboration allows the bank’s small business clients to complete an online application in minutes using their desktop or mobile devices, and, if approved, to receive funding in as little as one business day.

Transformation through collaboration with mature FinTechs (scaleups) can boost bank productivity and reduce time to market. Relationships between FinTechs and banks were once competitive, but time and today’s new normal now make them a synergistic imperative. FS players can no longer go it alone. To ensure survival and maintain profits during the unpredictable times ahead, partnership is the golden ticket.

Questions, comments? Reach out to me on Twitter or LinkedIn.