Using AI and Machine Learning to Improve AML

Blog: Enterprise Decision Management Blog

When the sheer computing power of AI meets the transactional complexity of AML, good things happen. I recently had an opportunity to talk about this at the annual Edinburgh Credit Scoring and Control conference. This is a topic I am quite passionate about, as I firmly believe that eliminating the scourge of money laundering could make the world a significantly better place to live.

Money laundering is the process of creating the appearance that illicit funds obtained through illegal activity originated from legitimate sources. It is responsible for fueling narcotics, human trafficking and terrorism. According to the United Nations Office on Drugs and Crime, the estimated amount of money laundered globally in one year is as much as 5% of global GDP, or $2 trillion. This is almost the size of the UK’s annual GDP.

To tackle this menace, regulators have slapped fines on banks who fail to stop money laundering. The fines have increased 500-fold in a span of a decade and now amount to nearly $10 billion per year.

Finding a Needle in a Haystack

It’s not that banks haven’t put in controls to tackle this menace. Each bank has dedicated large teams whose sole purpose is to monitor financial and non-financial transactions and identify and create suspicious activity reports, or SARs. They rely on a Know-Your-Customer process, and use gaggles of transaction rules to identify SARs. These processes go through rigorous scrutiny to ascertain that banks are in compliance with the regulators guidance around monitoring practice.

But there is a growing awareness that rules alone are often not sufficient to detect money laundering cases, and regulators have started pressuring the banks to adopt sophisticated analytics in their workflows. This is not surprising, as rules-based systems typically generate large amounts of false positives, resulting in thousands of false leads to be investigated. Further, rules reflect past expert knowledge but may not surface sophisticated new money laundering schemes designed to circumvent the rules in place.

My talk focused on the use of machine learning for combating money laundering. We have built these analytics using FICO’s battle-proven and patented advanced artificial intelligence systems. We’ve combined our practical, operationalized machine learning expertise — gained over the past 25 years using AI to protect about two-thirds of the world’s payment card transactions — with the power of our FICO TONBELLER Anti-Financial Crime Solutions. This allows us to focus on injecting new machine learning into world-class AML detection methodologies.

Soft-Clustering Behavioral Misalignment Score

One of the capabilities that I discussed was the soft-clustering behavioral misalignment score. Here’s what that jam-packed phrase means.

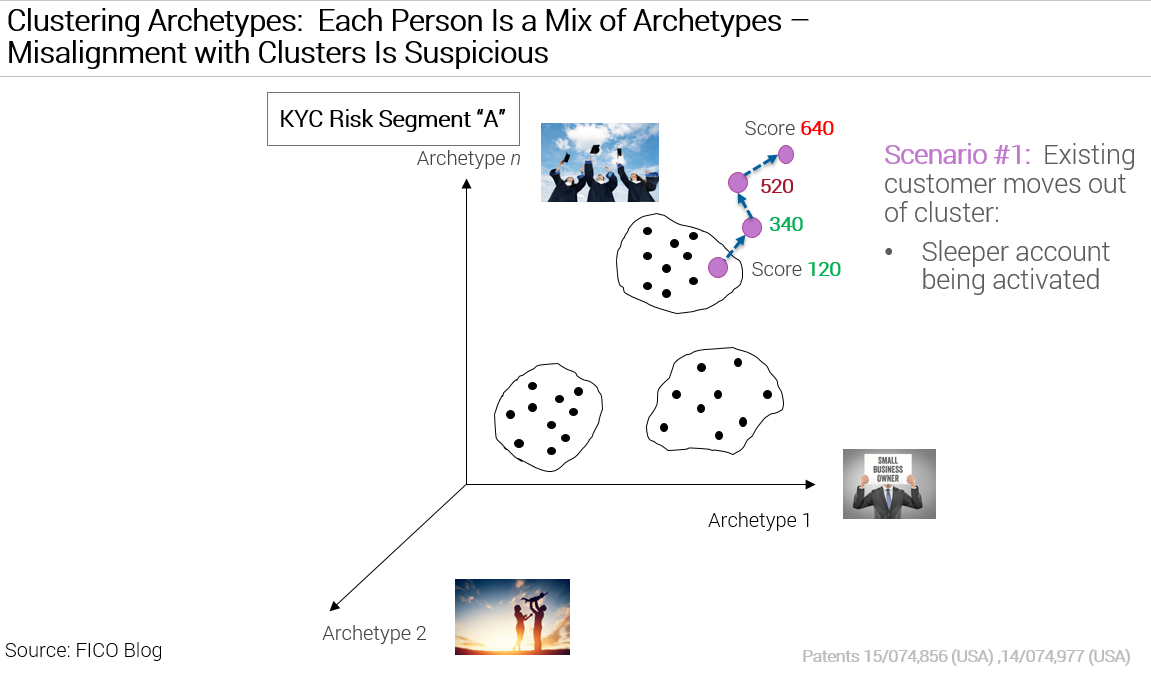

Instead of using hard segmentation of customers based on the KYC data or sequence of behavior patterns, we use collaborative profiling based on soft clustering. We use collaborative profiling, an unsupervised Bayesian learning technique, to analyze customers’ banking transactions in aggregate and generates “archetypes” of customer behavior. Each customer is then represented as a mixture of these archetypes (rather than as a single archetype) and these archetypes are adjusted in real-time with the financial and non-financial activities of the customer.

Customers with similar archetype distribution are clustered together in peer groups. Different clusters have different risk, and customers that are not within any cluster are suspicious. Further, these behavioral soft-clusters allow precision in determining if a customer’s behavior starts deviating from what’s usual for their behavioral peer group. This deviation informs the soft clustering misalignment score, which can be used to prioritize alert-based cases or drive entirely new SAR events undetected by traditional KYC and rule-based systems.

Auto-Encoders for Unsupervised Anomaly Scoring

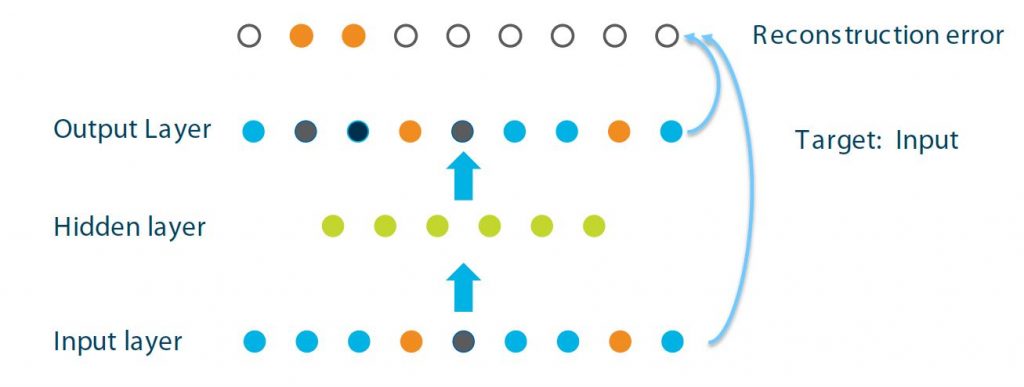

We augment the Soft Clustering Misalignment score with another powerful machine learning capability called auto-encoders. These are powerful deep neural networks that are trained to compress transaction data, and reconstruct data with minimal error. In doing so, auto-encoders learn the key latent factors representing the expected legitimate data/feature distribution.

When we process a new record through such an auto-encoder, the reconstruction error is computed. The lower the reconstruction error, the better the record conforms to the expected normal transaction behavior and distribution. Conversely, a large reconstruction error provides a very powerful way to identify behaviors not seen before or rarely seen in past historical data.

This is essentially a powerful magnet to surface needles in the haystack. We train these auto-encoders on soft clustering collaborative profiling archetypes and behavioral profile variables of the customers. When the auto-encoder finds a customer with large reconstruction error, it flags it with a high score. Such high-score cases are anomalous and corresponding SARs are generated, allowing subtle behaviors to be surfaced from the masses of transactions daily in the bank.

AI Is the Future of AML

It was quite satisfying to be able to talk about our sophisticated machine learning and AI-driven analytics for identifying SARs going beyond what transaction monitoring, rules-based systems can do. The response to the talk was overwhelmingly positive. The audience were quite enthused by the technologies that I described. This is a good sign for the future of AI in AML!

You can find a PDF of my presentation here, or download our white paper on the application of AI to AML. And I encourage you to follow me on Twitter @ScottZoldi.

The post Using AI and Machine Learning to Improve AML appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.