Ultimate budget template for Google Sheets

Blog: Monday Project Management Blog

Failing to manage budgets effectively can lead to wasted time and resources, and it can even cause you to lose money in the long run. Luckily, using a budget template can help you track, monitor, and control your spending. You just have to know when and how to use it to make the most of it.

Whether you’re using a budget template on Google Sheets or customizing an existing template on a work management platform, knowing how to use a budget template effectively can make all the difference.

In this article, we’ll take you through the ins and outs of using a budget template and share some custom budget templates we created for Google Sheets.

CTA to get your template*

What is a budget template for Google Sheets?

A budget template provides you with a clear picture of your financial situation. It outlines all your budget details, showing your current balance, how much money is coming into the business, and how you’re spending it. While you can create your own budget planner, using a template like one for Google Sheets can help save you time and ensure you’re including all of the necessary information.

Typically speaking, a budget template includes the following information:

- Any variable or fixed costs — from rent to SaaS subscriptions to company credit cards

- Your cash flow

- Your revenue

- Your profit

- Any one-off costs

- Your losses

Over time, you’ll be able to track trends in your finances and forecast future spending.

Why use a budget template for Google Sheets?

Let’s take a look at some of the key benefits of using a budget template for Google Sheets:

- Visualize your entire budget in one place: No need to flick back and forth between different platforms. All your spending, ongoing costs, and allotted budget are saved in the same location.

- Track spending efficiently: Keep on top of your spending and make sure everything is in check. If you use a digital platform like Google Sheets, you can access this information from anywhere at any time. If things don’t look right, you can quickly put preventative measures in place.

- Highlight important data: Using an online budget template allows you to highlight the most important information. This is especially important if people other than you will also be accessing the budget.

- Share budget updates with key stakeholders: If you have external stakeholders that need to see your budgets, a digital budget is a great way to share that information. And if you use a collaborative platform like monday.com, you can share your budget with external users, and control their level of access. For example, you can limit them to viewing and commenting only. They can provide feedback directly on monday.com, allowing you to collaborate with them quickly and efficiently, with no risk of editing the data.

What are some examples of budget templates for Google Sheets?

Budgets come in different shapes and sizes depending on the use case — so let’s explore some examples of budget templates to give you an idea of how you can use them.

Default Google Sheets budget templates

Google Sheets has a few simple template options for budgeting, such as an annual budget template, a monthly budget template, and an expense report. But none of the default options are great for business use.

Why? Because they’re mostly designed for personal use, if you create a budget template for business use, you’ll need something with a little more detail. To make your life easier, we’ve created a couple of free templates for Google Sheets that are more usable for businesses like yours.

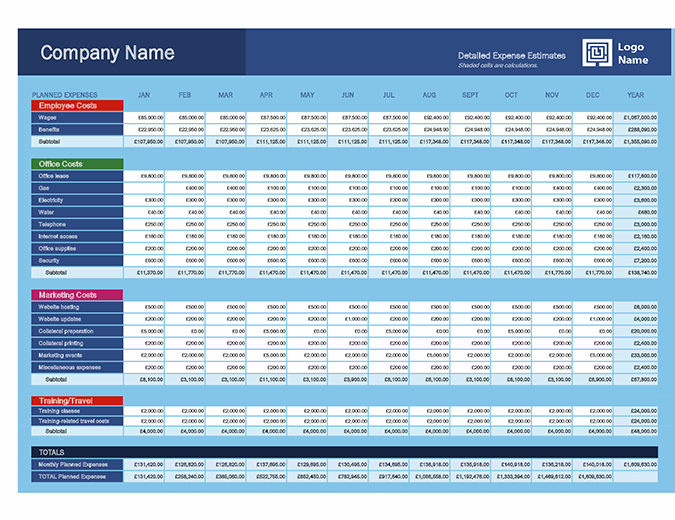

Annual budget template

With an annual business budget template, you’ll get a top-level overview of all your spending throughout the year. You’ll see your annual budget figures in one location, including expenses, income, revenue, and profit.

It includes a color-coded breakdown of expenses based on categories like marketing, office rent, payroll, and more.

Because of the amount of information it contains, it’s great for getting an overview of the bigger picture. But if you want something easier to digest, consider a monthly budget template.

CTA to download annual budget template for Google Sheets

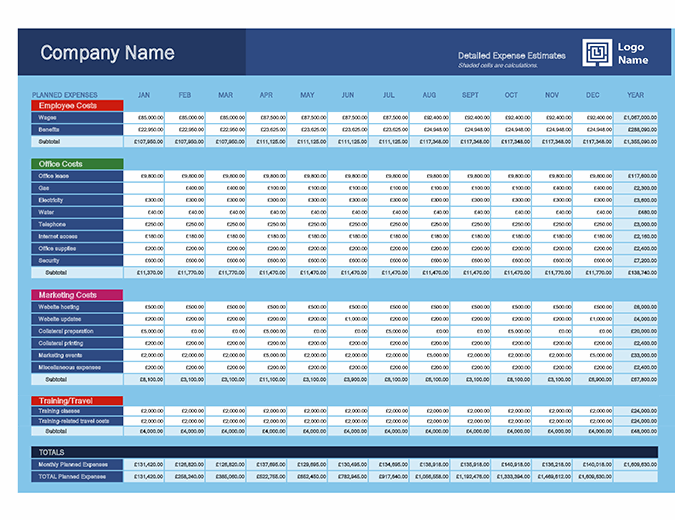

Monthly budget template

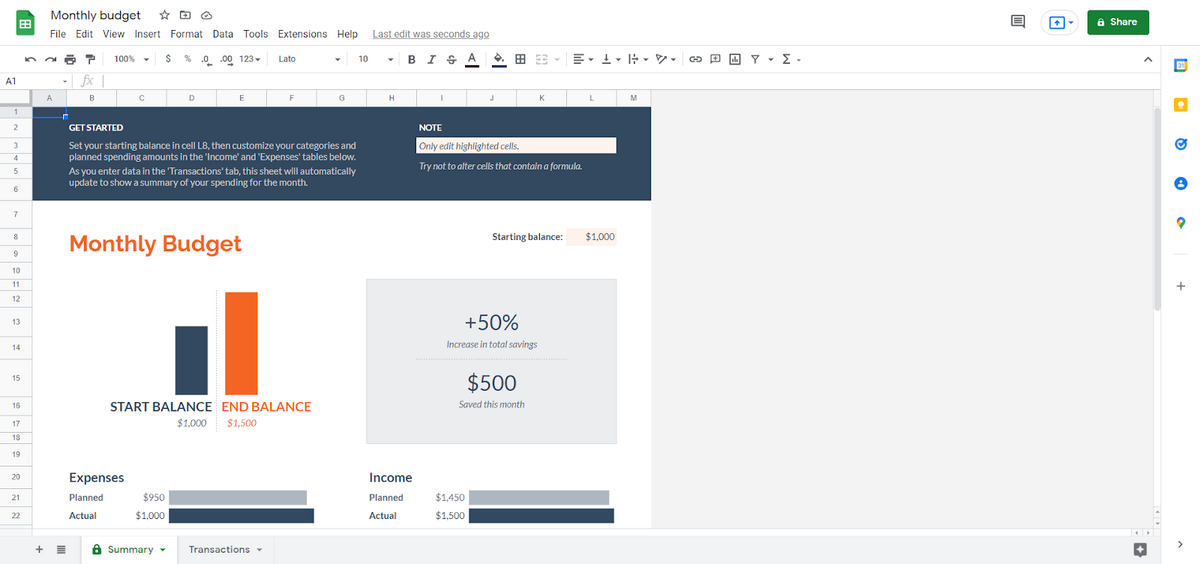

For personal finance, the monthly budget Google Sheet template isn’t a bad option. It outlines all your monthly expenses, your monthly income, your money savings, and your start/end balance.

But if you want something you can use for business purposes, you might need a template with a bit more detail. That’s where we can help.

A good monthly budget template allows you to track your monthly spending across the business. You can see all your outgoing costs and incoming revenue, categorize and color-code to track expenses, and make sure that you’re not overspending.

CTA to download monthly budget template for Google Sheets

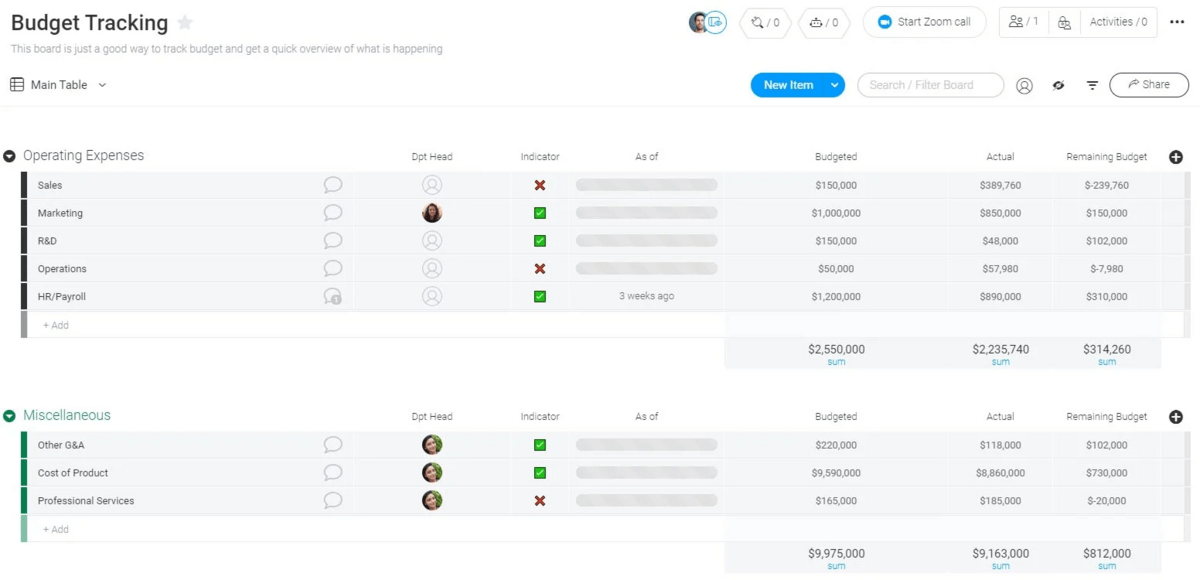

Budget tracking template

A budget tracking template helps you get better control of your finances. It shows you how much you’re spending in relation to your budget, making it easier to keep your spending in check.

Depending on the template you use, you can break your budgets down into different departments. For example, you can track all operational expenses against your operations budget.

This gives you a deeper insight into where your spending is going and how you can best allocate your resources across the business.

Marketing budget template

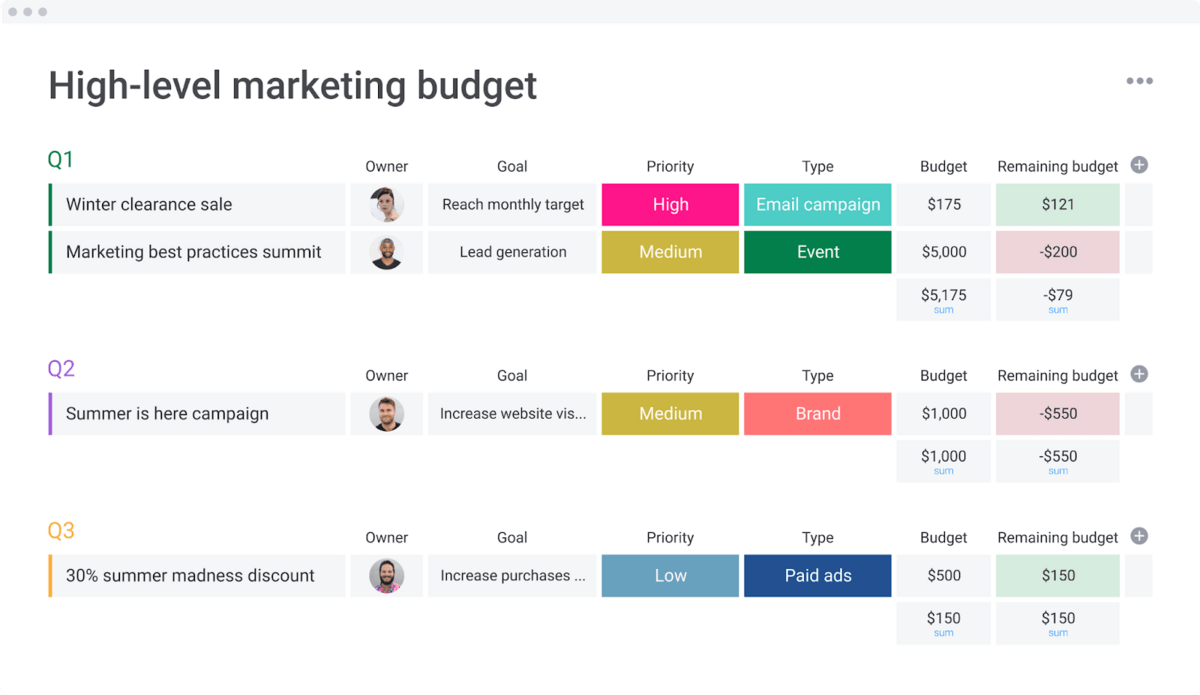

Track your marketing costs and budget allocation with a marketing budget template. With this template, you can align your marketing efforts with quarterly and yearly spending goals.

And if you use monday.com’s marketing budget template, you can integrate with ad platforms like Facebook Ads to track your spending in real time and instantly see if you’re over or under budget. As a result, you can make fast and informed decisions about your marketing efforts to maximize resources and reduce overspending.

Income and expense template

Keep up to date on payments coming in and going out of your business with an income and expense template. With this template, you can better manage your cash flow and be proactive with your finances.

monday.com’s budget template for Google Sheets

When it comes to managing your budget with monday.com, you’re in good hands. Our platform is able to integrate with Google Sheets through Zapier or our low-code software, so you can use a budget template right in monday.com.

On top of that, there are many benefits that come with using our customizable template.

Our intuitive budget template lets you track expenses, highlight important data, and analyze your spending habits.

You can also easily customize the template to suit your business’s unique needs. Add custom columns and labels, create custom automations, assign payments to a specific budget category, and even integrate with external platforms to track costs in real time.

As a Work OS, monday.com helps teams manage their entire workflow — not just budgets. Optimize not just your company’s spending, but also your processes and habits — start collaborating with your team as efficiently as possible, and maximize your company’s productivity.

[Image of monday.com’s budget template]

Let’s take a look at the benefits of using monday.com’s budget template in more detail:

- Simple to use: You don’t need any accounting experience to manage your budget with monday.com. Our intuitive and user-friendly interface makes it easy for teams to get stuck in straight away. All you have to do is select our ready-made template, input your financial information, and start managing your budget.

- View key financial information: Create custom dashboards to view all your key financial information in one location. Add widgets, graphs, tables, and whatever else you need to visualize your planned and actual spending.

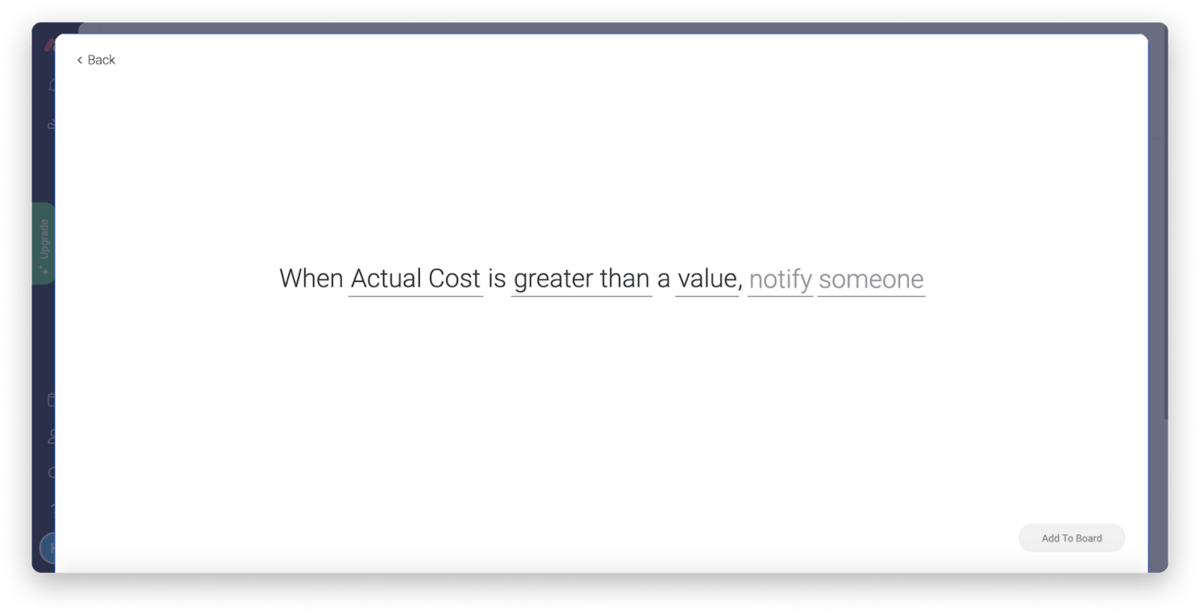

- Receive notifications: Custom-made automations make it easy to set up alerts to let you know when payment is due, overdue, or if you’re overspending.

- Track spending in real time: Whether you’re working from home, on the road, or in the office, access your spending performance in real time and from any location.

CTA to get the template

Tips & tricks for successfully executing the budgeting process

Effectively managing budgets is easier said than done. To proactively manage your budget and keep track of your spending, take a look at these best practices.

Prioritize your spending

Being able to prioritize where to allocate your budget and resources makes sure that your project runs as smoothly and efficiently as possible. To effectively prioritize your spending, make a list of outgoing cash flow. Highlight the essential payments and figure out the total amount. Once you’ve got a handle on the essential payments and how much they’ll cost, you can prioritize these costs.

They’re non-negotiable, so take these payments into account before spending in other areas. If you use monday.com’s template, you’ll be able to flag these payments in the template, so they’re easy to spot.

Automate parts of the process

Automation can help you streamline the entire budget management process. For example, you can:

- Set due-date reminders: With automation, you can create reminders to prompt you before payments are due.

- Create dependencies: Automatically assign tasks and deadlines with automated dependencies.

- Streamline recurring or mundane tasks: Automations reduce the necessity to complete repetitive, administrative tasks.

Ultimately, all of these automations save you valuable time. Overall, you’ll spend less time checking due dates and making payments and more time managing your budget proactively.

Use a work management platform for real-time access to your expenses

Get real-time access to your budget spending with a work management platform like monday.com.

CTA to get your template

FAQs about budget templates for Google Sheets

Here, we’ll answer some commonly-asked questions about budget templates for Google Sheets to put your queries to rest.

What is a budget plan?

A budget plan — sometimes called a spending plan — outlines how your budget will be spent. It helps you figure out if you have the budget to do what needs to be done, and how your budget should be spent to reach your goals.

It’ll also show you if you don’t have the funds you need to complete certain tasks. As a result, you can reassess your spending before you get to the stage where you’ve overspent.

Is there a budget template in Google Sheets?

Yes, there is an annual budget template designed for personal use. There’s also a single-month budget template and an expense report template included by default. To create a comprehensive budget for your business, you can use our custom templates instead.

The templates can be tweaked, but they’re not as interactive and user-friendly as templates in monday.com’s work management platform.

How do I make a budget spreadsheet?

How to make a budget spreadsheet varies from business to business, so there’s no set formula. However, most budget spreadsheets include the following information:

- Revenue

- Expenses

- Profit

- Loss

- All outgoing costs — including rent, bills, salary, memberships

If you want to use Google Sheets, you can choose one of the ready-made templates. If you’d prefer to use an interactive budget template, take a look at monday.com.

Customized banner CTA*

The post Ultimate budget template for Google Sheets appeared first on monday.com Blog.

Leave a Comment

You must be logged in to post a comment.