Truth Squad: Is a FICO Score 700 the Same as a VantageScore 700?

Blog: Enterprise Decision Management Blog

Securitization plays a key role in driving increased liquidity in the mortgage market, ensuring that banks can fund more loans, at lower cost. This in turn gives consumers greater access to affordable mortgages.

FICO Scores, of course, play an important role in the risk management and transparency that powers the secondary market. Now VantageScore is claiming that its score can be used instead in GSE underwriting (and by extension, securitization), as a one-to-one replacement for the FICO Score.

Could a clean swap-out work? It’s time to set the record straight.

Claim: A seamless mapping exists between FICO Score and VantageScore, one that will hold up over time.

Truth: The FICO Score and VantageScore, while sharing the same score range, do not share the same odds-to-score relationship, meaning the risk at a given score is different. The relationship between the two scores is not constant and any analysis that attempted to map the two via a fixed spread would not be reliable or accurate.

To see how important this is, a bit of background is necessary. The secondary market requires all of the participants to effectively model credit risk and prepayments. The FICO® Score is an important input into the default and prepay models, which form the core analysis in support of the To Be Announced (TBA) and credit risk transfer markets. The TBA phrase is used to describe forward mortgage backed securities (MBS) that are issued by Freddie Mac, Fannie Mae and Ginnie Mae. The term TBA is derived from the fact that the actual mortgage-backed security that will be delivered to fulfill a TBA trade is not designated at the time the trade is made.

This longstanding process works as long as loans with similar traits, including risk levels, are grouped together to form a pool that is fungible with other pools or mortgages. If the credit risk or prepay modeling is challenged or becomes uncertain in the TBA market, it would disrupt the secondary market. This disruption or lack of confidence will effectively result in a lower price for the securities and higher yields to account for the uncertainty. Higher yields mean restricting access to affordable mortgages for consumers.

The secondary market depends on stabililty, transparency and the ability to understand performance across a full market cycle. As the gold standard in credit-bureau-based credit risk assessment, FICO Scores play a critical role in the securitization of asset-backed securities such as auto loans, telco contracts and GSE-backed mortgages. FICO Scores are understood and trusted by investors as a key indicator of the default risk of a given pool of loans to be securitized, which informs how much the investor is willing to pay for that pool.

When a 700 Isn’t a 700

With their latest release, VantageScore finally capitulated to the ubiquity of FICO Scores as the gold standard in credit risk assessment, and adjusted their score to be on the same 300-850 score range as the FICO Score (prior VantageScore models were on a 501-990 scale). The fact that these scores are now on the same range, however, does not mean that these scores are the same — they’re not, and that means that the risk at a given score is different.

Put simply, a pool of consumers that receive a 700 FICO score have substantially different repayment risk than a pool of consumers that receive a 700 VantageScore.

Sound confusing? Of course it is. VantageScore is trying to make their score look interchangeable with the FICO Score, and in so doing is masking important differences that could result in poor lending and investment decisions.

In addition to the critical disconnect in the odds-to-score relationship between FICO and Vantage, there are other fundamental differences in the design blueprints of these two scores. Just to name a few:

- Differences in the minimum scoring criteria. As articulated in a prior Truth Squad entry, consumers with very sparse credit bureau files (e.g. the millions of credit files with no updates in the past 4 years) do not receive a FICO score, to ensure that scores are only delivered in cases where a robust and accurate assessment of the consumers’s creditworthiness can be provided. Obviously, there can be no mapping for those consumers who don’t have FICO Scores.

- Differences in the statistical techniques used to build the model. FICO uses a robust scorecard technology that has been refined and improved for over 25 years to build thousands of credit risk models around the globe. The power of this technology and our models has been tested through varying economic cycles, and has withstood the scrutiny of regulators, while also bringing tremendous value to tens of thousands of lenders.

- Differences in the treatment of key data elements in the credit file, such as 3rd party collection agency accounts. FICO Score 9 differentiates medical from non-medical collections, resulting in medical collections having less impact on the score than non-medical collections—commensurate with the credit risk they represent. VantageScore does not.

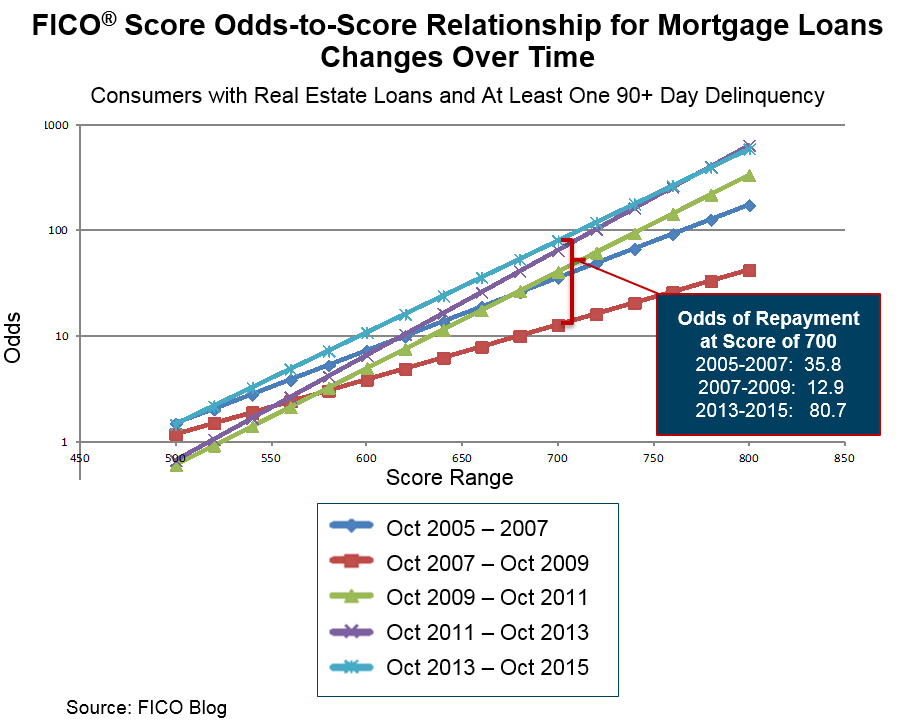

The relationship between FICO score and default risk varies across credit products, with credit cards, auto loans, and mortgages all exhibiting different repayment rates at a given score band. The relationship between FICO score and mortgage default risk is more complex than other common credit products such as credit cards or auto loans, and varies substantially through different phases of the economic cycle and across geographic regions. As shown below, the odds of satisfactory mortgage repayment for consumers with a FICO score of 700 jumped more than 6-fold in six years: from ~13:1 (13 satisfactory payers for every 1 payer seriously delinquent on their loan) during the worst of the mortgage crisis to 81:1 during more recent post-recession times.

Given the fundamental differences in model design between FICO Scores and VantageScore, the through-the-cycle shift in the odds-to-score relationship will vary across these two models. So while one could theoretically purchase a massive data set from the CRAs to create a look-up table that would be valid for one moment in time, who is going to maintain this table, how and at what cost?

Can You Trust These Scores?

There’s one more inconvenient truth about the score mapping fantasy. There are millions of consumers who lack sufficient credit bureau information to drive generation of a reliable and robust FICO score. For these FICO unscorable consumers, any global mapping between FICO Score and VantageScore would not be trustworthy.

Previously, we’ve noted the lack of reliability in the odds-to-score relationship observed on the FICO unscorable population, when scored via a “research score” that, like the VantageScore utilizes just what sparse information is available on these consumers’ credit reports. For example, we found that a score of 640 based on a “stale file” (a credit file without an update in the past 21 months) exhibits repayment behavior more in-line with a 590 score among the traditionally scorable population—an odds misalignment of about 50 points.

Other segments of the unscorable population are likely to be similarly volatile. What this means is that even if a mapping could be created between VantageScore and FICO Score that would hold for only one moment in time, that mapping wouldn’t hold for the FICO unscorable segment. There would almost certainly be much more variance within this VantageScore segment as well, since it would include credit reports with full data and those with hardly any data.

This could result in loans booked with VantageScore on this population being viewed as “undesirable” by investors due to the lack of a reliable mapping to default risk. At minimum, this would require separate mappings to be defined for these subsegments of the FICO unscorable population, with an even greater urgency for frequent monitoring and updating of the mapping.

Conclusion: The risk level will be different for FICO Scores and VantageScores in the same range, and mapping that difference reliably will be difficult if not impossible.

Interested in learning more? See our other posts in the Truth Squad series:

Truth Squad: Does VantageScore Use Alternative Data?

Truth Squad: Will Weaker Scoring Criteria Create a Mortgage Surge?

Truth Squad: Will Looser Scoring Standards Help Millions More Americans Get Mortgages?

The post Truth Squad: Is a FICO Score 700 the Same as a VantageScore 700? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.