Top 5 Risk Analytics Posts: From Rising FICO Scores to Alt-Data

Blog: Enterprise Decision Management Blog

What were some of the most interesting risk analytics topics last year? Judging from the views on the FICO Blog, risk professionals are keenly interested in new ways to approach risk analytics.

Here were the top 5 posts of 2017 in the Risk & Compliance category:

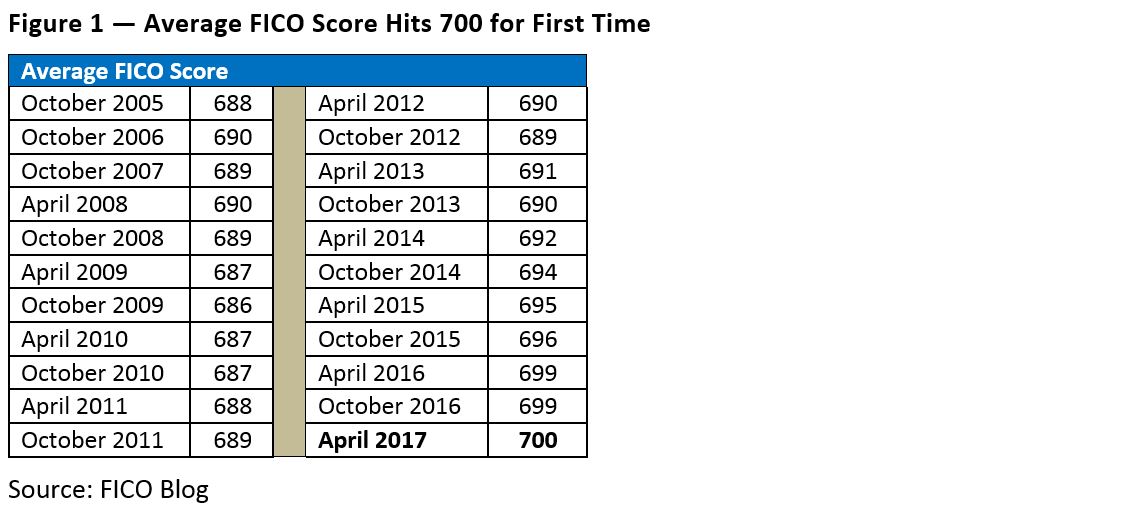

US Average FICO Score Hits 700: A Milestone for Consumers

Author Ethan Dornhelm explained, “We have pulled the latest FICO Score distribution information based on a snapshot of millions of US consumers’ credit data as of April 2017, and can report that consumer credit health and responsibility continue to be strong! For the first time since we’ve been tracking these stats, the average national FICO Score reached the 700 threshold — some 10 points above what it was just prior to the recession in October 2006.”

Millennials and Credit: Are We Missing the Real Story?

Andrew Jennings dug into data to explore whether we’re really seeing Millennials turn away from credit.

Andrew Jennings dug into data to explore whether we’re really seeing Millennials turn away from credit.

“Compared with 10 years ago, today’s 18-24 year olds have lower credit and store card balances, and while they have more auto loans, the value of these loans did not grow as much as inflation would suggest,” he wrote. “By contrast, growth in student loan debts outpaced inflation, being both greater in number as well as balances; this undoubtedly creates a drag on capacity for other forms of consumer credit.”

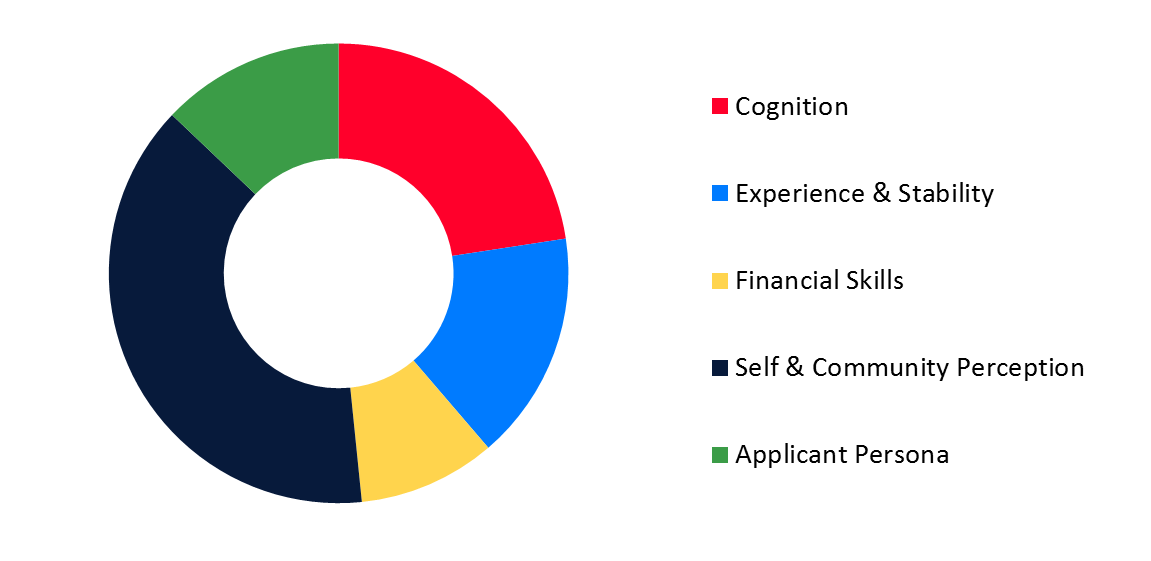

A New Way to Score Credit Risk – Psychometric Assessments

Can you score people who don’t have a credit history using their responses to a questionnaire? Yes, and psychometric risk analytics could expand credit in markets worldwide.

Explained author Campbell Scott, “The scoring methodology was developed by EFL Global and marketed by FICO as part of our FICO Financial Inclusion Initiative, designed to open up credit markets around the world to a larger number of unbanked and underserved consumers. The EFL credit risk score is created through a dynamic behavioral design and psychometric assessment that analyzes character traits with a proven relationship to credit risk. It’s an ideal approach for applicants who do not have a credit history and therefore cannot be scored using traditional methods.” He shared the characteristics scored by EFL:

2017 Banking Regulatory Predictions—Brace for a Sea Change

Daniel Nestel’s predictions for 2017 involved the Congressional Review Act, cybersecurity legislation, disparate impact and TCPA relief. About the latter, he wrote, “The Federal Communications Commission has not provided much relief for those seeking legal clarity when using modern technology to communicate important non-telemarketing messages to customers’ mobile phones (e.g., fraud alerts) in accordance with the 1991 Telephone Consumer Protection Act (TCPA). Under Chairman Tom Wheeler’s leadership, FCC actions have been widely criticized as further chilling the use of text and automated messaging preferred by many consumers. However, change is on its way with the departure of Wheeler on January 20, 2017, the eventual confirmation of two new FCC commissioners and a much-anticipated decision by the DC Circuit on the industry’s appeal of the FCC’s most recent TCPA guidelines.”

Read the full post and see Daniel’s most recent post on this topic, “What’s Happening While We Wait for TCPA Reform?”

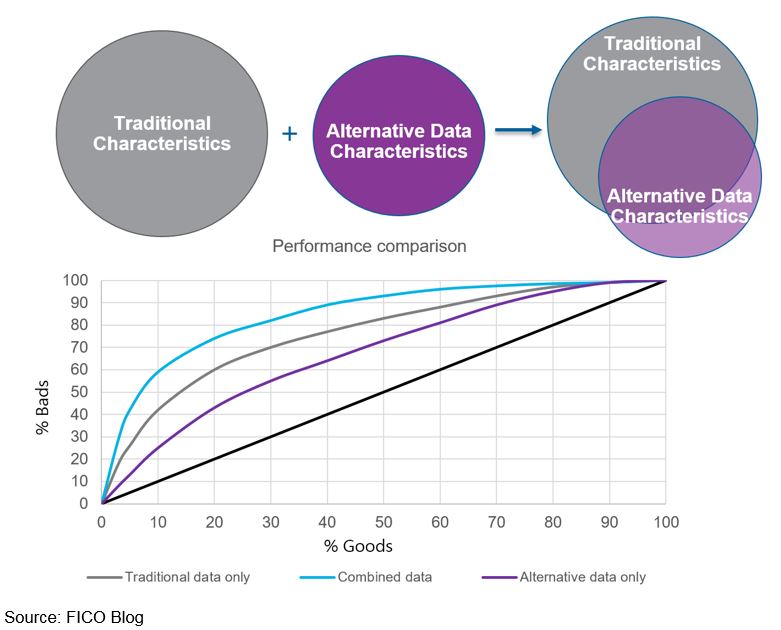

Using Alternative Data in Credit Risk Modelling

This was one of the hot topics from our EMEA risk management forum in 2017, where Manish Gandhi presented an overview of what people are doing with transaction data, telecom data, social profile data, clickstream data, audio / text data and more. He also shared a chart from a project FICO did for a personal loans origination portfolio.

“The traditional credit characteristics captured more value than the alternative data characteristics (with the alternative data capturing about 60% of the predictive power), and there was a high degree of overlap between the two. However, by combining the traditional and alternative data characteristics (and understanding the overlap so as not to over-weigh certain variables’ contribution), we were able to produce a more powerful model.”

Follow this blog for our 2018 insights into risk analytics and regulatory compliance.

The post Top 5 Risk Analytics Posts: From Rising FICO Scores to Alt-Data appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.