Top 5 Collections Posts for 2018: NPL, DCAs and IFRS 9

Blog: Enterprise Decision Management Blog

How are regulations changing approaches to collections and recovery? Those discussions drove the most-viewed posts on the FICO Blog last year in the Collections & Recovery category.

Here are the top five posts from 2018.

How the Focus on NPL Is Changing Europe’s Debt Market

Bruce Curry wrote about the impact that regulators’ focus on non-performing loans (NPL) is having in multiple areas, including debt collection agencies. Here’s an excerpt:

One of the big changes we see as a result of the NPL activity is in the debt purchaser market, where some of the larger firms — such as B2 Holdings and Hoist — have grown rapidly, as banks look to shed unprofitable portfolios. Debt purchasers and debt collection agencies are consolidating, innovating and in some places become the preferred location for financially vulnerable customers. This is driven to a large degree by regulatory pressures on banks to reduce their NPL, and also by a new force: IFRS 9.

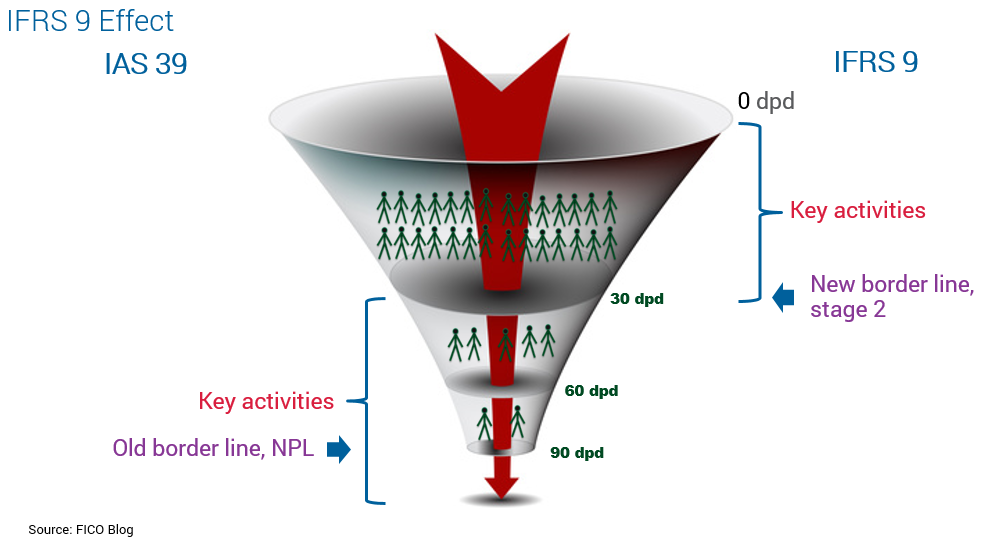

IFRS 9 accounting rules have effectively drawn a new border line for concern. Under previous regulation IAS 39, this border was at 90 days past due, when loans are classed as NPL. Under IFRS 9, this border has moved way up in the funnel, to 31 dpd, when customers (and all their accounts with the bank) move from Stage 1 to Stage 2 in terms of risk. At this point, the bank must increase impairment for the customer’s accounts from 12-month expected credit losses to lifetime expected credit losses. That’s a cliff-edge banks are naturally keen to avoid.

Collections Predictions 2019: SOP Won’t Cut It

In his last post of the year, Bruce Curry looked forward to 2019, discussing multiple trends including the rise of analytics in collections and recovery:

AI is here for a few and coming for many, but there will be many failures and many areas of wasted investment before appropriate AI is an off–the-shelf purchase. In the C&R space, a huge proportion of the industry still needs to develop a reasonable standard of analytic insight. My advice: Don’t get distracted by the word AI, unless you’re already pretty far along the analytics spectrum. You’ll see faster results from focusing on a good set of collection models and strategy optimization. (And for those that are close enough to it you’ll recognize that mathematical optimization in an adaptive control environment, and so actually is AI and machine learning!).

Not every organization will realize this off the bat, but those interested in achieving a true competitive collections competence will look to analytic models, decision engines and automated, omnichannel communications. Early adopters of highly sophisticated omnichannel systems will gain an advantage from their ability to serve pre-delinquent and disorganized payers at an extremely low cost, whilst achieving a better customer experience. (For many, many customers, collections is their experience of a lender.)

These omnichannel solutions are the target investment of many organizations that recognize the competitive disadvantage if they’re not in place. However, these platforms that provide the biggest change in customer treatment and performance for huge cohorts of customers only start to truly ”buzz” when they are deployed on a foundation of analytic optimization.

What Is Collection Treatment Optimization?

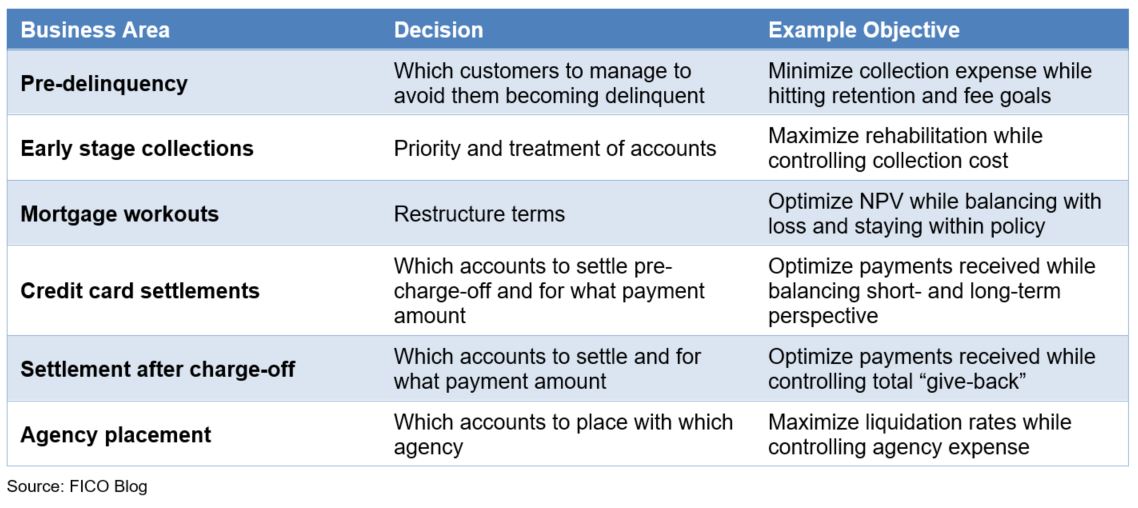

While many collectors are still getting on board with analytics, some of the most sophisticated are using mathematical optimization to decide who to treat, when and how. Ulrich Wiesner explored how optimization works in various areas of collection treatment.

Even if you have a decent strategy for segmenting customers and assigning actions, this will be complicated by workload issues.

Accounts enter in waves, so you won’t have the same inflow every day, and you need to spread work over the month. Credit cards are less of a problem — there are between 15 and 22 cycles spread over the month. But many loans or mortgage products only have payments once or twice a month, so all accounts become delinquent at once. You can’t call them all on the 15th.

Furthermore, you have to deal with the higher volume after vacations and holidays, where you will face higher delinquency rates. If you’re a mobile provider, you may sign a bunch of new contracts when a new iPhone is released, which can cause a wave of delinquencies with the next invoice. You also need to schedule around vacation time for collectors.

This is where collection treatment optimization really delivers benefits, because it works these capacity crunch constraints out for you. In a traditional environment, you can do ad hoc capacity management by manually overwriting your strategy, saying this week we won’t dial this campaign because we don’t have enough people to cover it. But this can negate the impact of a good strategy. With optimization, at the press of a button you can adapt your strategy to fit new constraints and capacity.

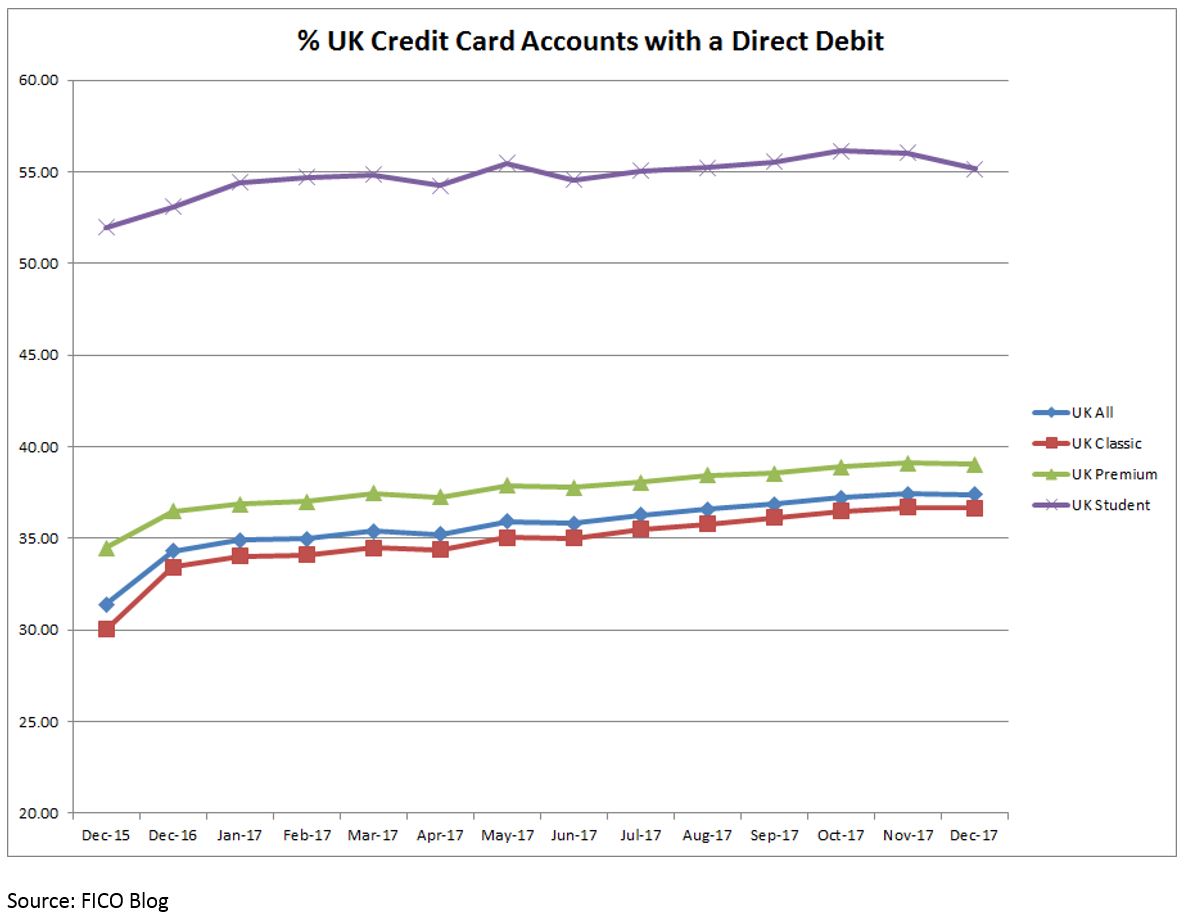

How Direct Debits Can Help with Persistent Debt and IFRS 9

In the UK, the FCA has focused on persistent debt and challenged lenders to help consumers out of it. Stacey West discussed how Direct Debits can help.

After discussions with Bacs, the organisation behind Direct Debit in the UK, it became clear that flexibility in both payment date and frequency can have a significant impact on take-up rates. Offering consumers the option to choose a date, or dates, which suit them best – perhaps to coincide with payday – can have a positive effect. Given the rise of the ‘gig economy’ and the number of people being paid weekly, considering a move away from just a monthly frequency for Direct Debit collection is also worth looking at to encourage more people to opt to pay this way. Find out more about how to promote Direct Debit at www.bacs.co.uk/marketingdirectdebit.

It’s also worth addressing another potential misconception, which is that only minimum or full payments can be taken through Direct Debit. In fact, any % or amount is available — this flexibility could be very useful relating to these two initiatives. Some issuers make it easier than others to change to a more flexible payment structure and this is expected to expand. It would also help with demonstrating to the regulators that customers are being treated fairly.

Increased Direct Debits may result in a loss of revenue for issuers, but this loss may be far outweighed by the cost of provisioning for stage 2 or for the actions required in a persistent debt situation. This trade-off may help issuers build a business case for incentivising Direct Debit usage.

Managing Pre-Delinquency Under IFRS 9 & Persistent Debt

Another approach to persistent debt is helping borrowers before they fall behind on payments. Stacey West discussed ways to do this, which will also help lenders avoid higher provisions under IFRS 9.

There are a host of metrics an issuer could use when trying to detect the accounts that are most likely to fall into financial difficulties, including more trend-focused data, transactional data and bureau information, with the latter providing a wider customer view. If accounts fall into the pre-delinquency subpopulation, reviewing their other products held is also key — issuers need to be aware of the potential knock-on effect for other business lines and the broader relationship.

Example metrics include the following, although the full list FICO recommends is more extensive:

- Change in % payments to balance over 3 or 6 months to determine if payment amounts are decreasing.

- Reaching highest balance levels.

- Overlimit for the first time or first time in X months.

- First use of cash or increase in usage.

- Recent limit decrease.

- Recent bounced/late payments.

- Recent direct debit cancellation.

- Sudden use of card after period of inactivity.

- < 18 months in persistent debt.

The chosen predictive metrics need constant review as they will vary in line with any economic changes.

Consistency with other account management treatment needs to be considered to prevent sending mixed messages and confusing the customer. For example, you don’t want to offer an increase or allow overlimit spending while also making contact relating to potential problems.

Follow this blog in 2019 for more insights into collections and recovery challenges.

The post Top 5 Collections Posts for 2018: NPL, DCAs and IFRS 9 appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.