Top 5 Analytics Posts: Explainable AI and Machine Learning

Blog: Enterprise Decision Management Blog

As artificial intelligence applications exploded last year, our blog posts on AI and machine learning drew thousands of readers. Indeed, taken together, they explored many aspects of Explainable AI and its applications, particularly in the area of credit risk.

Here were the top 5 posts of 2017 in the Analytics & Optimization category:

How to Build Credit Risk Models Using AI and Machine Learning

FICO’s chief analytics officer, Dr. Scott Zoldi, wrote a post that has already become the third most-read post ever on the blog. In this post, he discusses some of the special circumstances around using AI and machine learning to assess credit risk, a highly regulated field.

“Years of market experience have validated our approach, which is very different than the ‘move fast and break things’ brashness we see from some AI start-ups in the originations space,” Dr. Zoldi wrote. “They’re focused on using many types of alternative data, such as information gleaned from social media, to deduce credit risk.

“Innovation is great, but you don’t want to naively throw in a lot of new data sources ––many of which may not be permissible in credit decision-making, and might be easily manipulated (like social media data) –– into an AI model that comes up with a score that may not be explainable. Why not? First of all, lenders in many markets do need to be able to explain how a customer was scored. Second, you don’t really understand what relationships are being learned from this data, and if these relationships really matter. By contrast, FICO analyzes new data sets along five lines to see if they will add value to credit risk scoring.”

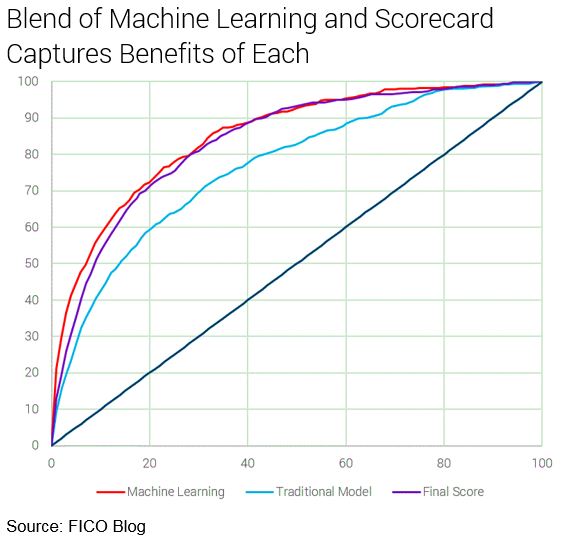

Combining Machine Learning with Credit Risk Scorecards

Following Dr. Zoldi’s post above, Shafi Rahman of FICO’s R&D team drilled into a specific example of mixing traditional credit scoring methods with machine learning. He discussed the application of a FICO tool called Scorecardizer.

“Scorecardizer recodes the patterns and insights discovered using machine learning or AI and turns them into a set of scorecards,” Rahman wrote. “The tool tries to match the score distribution generated by a machine learning algorithm like TEM, instead of relying on the WoE approach that we discussed earlier. So instead of providing good and bad data points and directly computing the WoE, the score distribution in each bin derived from the machine learning model ends up providing an estimate of WoE. Significantly, the final model is almost as predictive as the machine learning model.”

Explainable AI Breaks Out of the Black Box

Dr. Scott Zoldi returned to the theme of Explainable AI with a post on various ways to explain AI when used in a risk or regulatory context. These include:

- Scoring algorithms that inject noise and score additional data points around an actual data record being computed, to observe what features are driving the score in that part of decision phase space.

- Models that are built to express interpretability on top of inputs of the AI model. Examples here include And-Or Graphs (AOG) that try to associate concepts in deterministic subsets of input values, such that if the deterministic set is expressed, it could provide evidence-based ranking of how the AI reached its decision.

- Models that change the entire form of the AI to make the latent features exposable. This approach allows reasons to be driven into the latent features (learned features) internal to the model. With this approach, we are going to rethink how to design an AI model from the ground up, with the view that we will need to explain latent features that drive outcomes.

The Future of Analytics: The Revolution Will Be Unstructured

Dr. Osvaldo Driollet discussed his work analyzing unstructured data such as text, and presented the benefits of text analytics, including:

- Discovery through machine learning: “Machine learning methods can determine what textual data is about and classify it for further analysis. These methods can discover customer characteristics and transform them into structured numerical inputs that, in turn, can be used in predictive models and traditional analytic algorithms.”

- Handling complexity: “The potential value of text analysis is often increased by combining text of different types from multiple sources. Such a comprehensive approach may reveal complex, subtle customer behavior patterns not evident in smaller, more homogeneous document sets.”

- Facilitating engineering, deployment, management and regulatory compliance: “While text and the process of analyzing it can be quite complex, the results need to be simple to understand and use. Today we can bring new insights from text analysis into predictive scorecards, for example, maintaining all the advantages they provide.”

4 Analytic Predictions for 2017 – From Killer Devices to AI Hype

Our first analytics post of the year contained Dr. Zoldi’s predictions for analytics in 2017. These were:

- Security/IoT: Is your video cam no longer your friend? “I predict that in 2017 our personal lives, as well as infrastructure, will be brought down by the devices we design to make things easier.”

- Enterprises: Lax cyber security? You’re about to be found out. “I predict that we will see big advances in how enterprise security scoring is adopted as an important risk assessment tool. Another critical area will be in vendor management, particularly to continually monitor vendors’ cyber security postures.”

- Who’s scoring you now? “I believe that businesses and individuals will be getting scored much more in 2017. These will allow us to measure the complex data-filled world around us and boil down the risks we accept in those with whom we interact and do business. For our part, we have recently announced a Safe Driving Score.”

- Will the AI hype cycle crash? “I think that we are just at the beginning of the golden age of analytics, in which the value and contributions of AI, machine learning and deep learning will only grow as we accept and incorporate these tools into our businesses.”

Follow this blog for our 2018 insights into AI, machine learning, optimization and other applications of advanced analytics.

The post Top 5 Analytics Posts: Explainable AI and Machine Learning appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.