The Story Behind Europe’s €1.8 Billion Card Fraud Problem

Blog: Enterprise Decision Management Blog

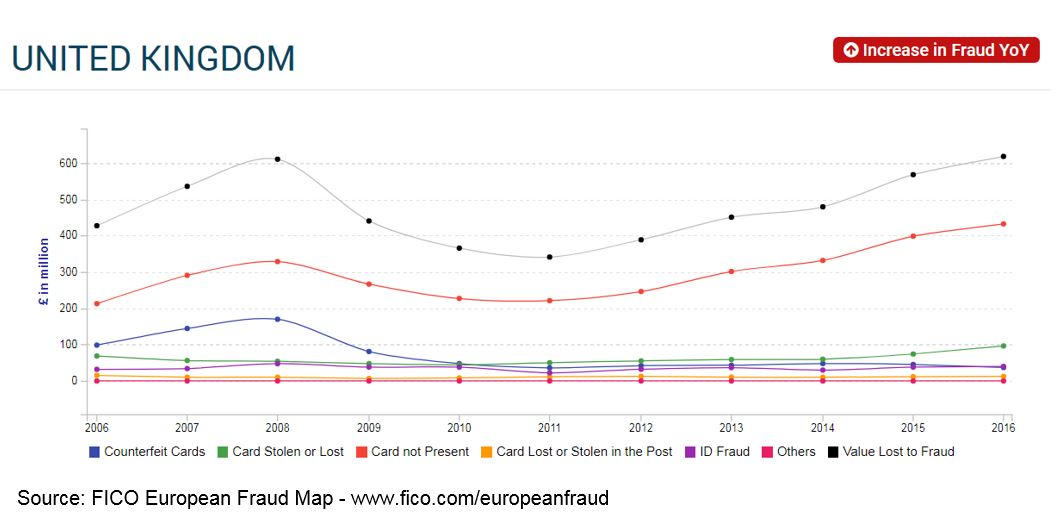

FICO has just released an interactive infographic on European card fraud trends since 2006, showing that card fraud in the 19 countries studied has hit a new high of €1.8 billion. In the UK, card fraud also a hit a new high in 2016, £618 million, though the rise was less than the rise from 2014 to 2015.

To understand what these numbers mean — and what issuers need to do now — it’s important to know how got here. That’s why our map tracks the data back to 2006.

Why is 2006 so important? That was the year of ‘love my PIN day on Valentine’s day’ in the UK, as the liability shift between magnetic stripe and chip & PIN technology had been put in place during 2005. So chip & PIN was officially rolled out across Europe and executives expected to see the benefits of that investment in technology at point of sale.

What we actually saw was a migration in fraud attacks away from face-to-face transactions to card-not-present (CNP) and cross-border fraud, where magnetic stripe technology was still accepted and carried no liability shift. In the US, this liability shift didn’t take place in 2015, 10 years after Europe, and criminals used this as an opportunity to skim cards and use counterfeit ones in the US.

UK fraud would continue to rise to a peak of £610 million in 2008, when banks introduced a tough-on-fraud stance to get this back under control. Fraud detection dials were turned up using real-time analytic detection, principally FICO® Falcon® Fraud Manager and its AI-based analytics. Over the next year, £170 million of fraud was prevented and this trend would continue to the bottom of the trend trough in 2011.

CNP Fraud Takes Over

CNP fraud had reached £328 million in 2008 and represented 53% of the total fraud losses in the UK. To put this CNP trend into context, 10 years earlier in 1998 it was £13.6 million and just 10% of the fraud losses. By 2011 banks using real-time detection and advanced analytics banks had reduced this to £220 million, but there was an underlying trend in genuine spending that could not be ignored.

Digital e-commerce spending was £45 billion in 2008 but by 2016 it had reached £248 billion. That trend was the perfect place for criminals to focus their attention. By 2013, UK CNP losses had just breached the previous high of 2008 at £331 million by £3 million, which means that some clever ‘real-time’ detection and prevention analytics capability had kept the lid on the fraud attacks.

Our latest map shows that CNP fraud reached £432 million in 2016 in the UK, and digital e-commerce is estimated to be £309 million of that figure. Digital now represents 50% of the total fraud losses at £618 million and confirms the challenge that UK banks need to get to grips with.

AI Breakthroughs for Fighting Fraud

Many European countries, including the UK, are seeing CNP fraud at 70% plus of their losses. FICO and these banks are focused on using new advances in machine learning to cut into these losses, but allowing consumers to spend where and when they want. No small challenge but it’s doable!

Introducing more behaviour analytics such as FICO’s patented behavior-sorted lists and customer behavior archetypes has enabled FICO to separate more subtle changes in genuine behaviours from fraud attacks trying to fly under banks’ analytic radar.

There is no silver bullet, which is why we’re working on multiple fronts, introducing:

- Better CNP analytic models that focus on digital e-commerce

- Analytics that rate a transaction’s risk in part based on identifying the device and IP address as the consumer’s norm

- Mobile analytics that check a consumer’s mobile behaviors

- Archetype analytics that tap into the rich source of mobile context such as advanced geolocation, feeding that information into real-time fraud detection on Falcon

You can learn more about how AI and machine learning technologies are advancing fraud detection in our white paper, Using Advanced Analytics to Stop Fraud. Also, check out the blog posts by Scott Zoldi on the FICO Blog and Twitter @ScottZoldi.

The post The Story Behind Europe’s €1.8 Billion Card Fraud Problem appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.