The Evolution Of Global In-House Centers

Blog: NASSCOM Official Blog

GICs make the move from cost savers to innovation partners

With revenue projected to reach $350 billion by 2025 for India alone, global in-house centers (GICs) are in many ways the future of global business. Their evolution over the past two decades shows that multinational companies (MNCs) have come to rely heavily on GICs, particularly in India, and not just for outsourced business functions with an eye on cost savings. Having proved that the model can deliver sustained growth and value over time, GICs offer the potential for partnerships based on shared organizational goals and a level of innovation that uniquely benefits the parent organization. Several enterprises have built competences and moved up the value chain to set up Global Centers of Excellence in India.

Driven by exponential digital trends, MNCs first looked to developing countries like India, China, Malaysia, Thailand, Philippines, Mexico, and Brazil in the 1990s to outsource their business functions with sustainable global growth and cost savings in mind. Soon after, MNCs realized the need for more control over quality, so they moved from outsourcing to offshoring and opened GICs, which were first known as “captives.” These companies set up offshore centers (in-house centers) in developing countries to perform designated tasks for the parent organization with a direct hold over work quality, productivity, and efficiency. GICs enabled companies to leverage the benefits of cost savings accompanied by improved productivity and high-quality service.

As demand for MNC-owned in-house centers surged, global companies started to explore cost-effective destinations. ASEAN countries experienced meteoric growth and India underwent an economic liberalization, and thus large corporations began to consider places farther afield. MNCs turned to South and Southeast Asia, along with the Asia-Pacific region, to set up their GICs. Parts of Latin America also saw the arrival of GICs, based on the availability of economic and skilled labor.

Evolution of GICs in India

GICs have proved invaluable in their ability to transform and adapt their functionality while finding new and innovative ways to effectively support their parent companies.

Because of this, the GIC landscape has expanded exponentially across the globe. In India, GICs have undoubtedly metamorphosed in the past two decades. India is currently home to more than 1,200 GICs employing close to 1 million people. According to Nasscom, these GICs generated revenues of about $28.3 billion in the last financial year alone. With growing digitization and the augmented role that technology now plays, GICs are set to make an even bigger impact in the coming years.

“GICs in India have come a long way since first setting up in the country over 20 years ago as pure voice-support centers. Parent companies have recognized the quality and potential of Indian talent and scaled up the scope of services done out of India,” says Madhavi Lall, Managing Director and head of HR at Deutsche Bank India.

“Global organizations are either setting up or scaling up their presence to leverage the top-quality talent here in driving cutting-edge technologies and highly sophisticated operations support for their global businesses.”

From the beginning, GICs were intended as a means to boost cost savings. But with the rise of the disruptive technological ecosystem, perceptions of the way that GICs conventionally operate are starting to change. Companies are becoming aware of the shifting tide and understand the need to innovate for viable growth on the global market.

MNCs have singled out India as the hotspot for quality work that is delivered economically. GICs are mushrooming in India, and the number is increasing each year. With more GICs opening in India, the avenue of growth toward employment and financial independence is broadening. GICs in India have been on a hiring spree as they steadily spread their operations across the verticals and create innumerable opportunities.

From Cost Centers to Innovation Hubs

GICs have seen a remarkable transformation in the past few years in India from being cost arbitration centers to quality centers to innovation centers. The bulk of GICs’ efforts were previously centered around executing mundane and repetitive back-office processes as efficiently and cost-effectively as possible. But over time and as businesses matured, the minds behind GICs begun to explore ways to evolve their strategy and operating model and remain relevant to the parent organization.

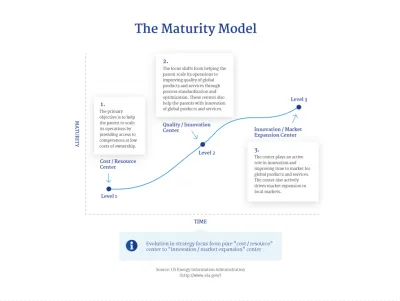

Figure 1 – Cost Center to Innovation Center

GICs steadily evolve into centers of excellence by leveraging their end-to-end process expertise and deep domain knowledge to take complete ownership of operational excellence. With the advent of disruptive digital technologies, increasing complexity, and new opportunities at hand, GICs are rising to the challenge.

“Shared Service Centers or GICs are increasingly becoming a part of the core strategy for their parent group/HQ,” according to Sunil Shah, Global Head of Société Générale’s solution centers in India and Romania and CEO of Société Générale Global Solution Centre.

“GICs are impacting critical value chains by transforming, building a depth of talent, and innovating via new delivery models to generate high business value.”

The Maturity Index: Assessing the Transformation

In collaboration with Deloitte and the Indian School of Business (ISB), Nasscom devised the concept of a maturity index model for global in-house centers to benchmark their performance. The maturity index tracks the evolution of GICs from cost center to innovation center and substantiates the performance for each maturity level. This model helps to identify areas to emphasize for potential investment that would yield optimal results in each step of the GICs’ maturity model in India.

“The maturity index of a global in-house center is influenced by dimensions like geography, industry, regulations, and business strategy of the group,” says Rashika Malhotra, Chief of Staff for the Office of the CEO at Société Générale Global Solution Centre India.

“These dimensions define the culture, and in turn, the ownership imparted to the GIC. [The] maturity index of a GIC can consider four key attributes: exploring [the] internal and external innovation ecosystem to solve business problems, developing new capabilities and delivery models, developing talent proactively, and delivering top-line and bottom-line value.”

According to the maturity index model, cost centers, quality centers, and innovation centers are characterized by different strategies, capabilities, and performance. Cost centers are entirely focused on reducing the costs of ownership of offshored business functions. They provide access to competences not available in-house and thus enable the GICs’ scaling of operations.

Figure 2 – Maturity Model

In addition to minimizing the costs of ownership of offshored tasks, quality centers produce higher-quality results than cost centers through standardized and optimized processes. While providing similar gains in terms of reduced costs, innovation centers drive modernization in products and services for their parent company’s global market, and in some cases, for expansion on the local market. Innovation centers require higher levels of autonomy than cost and quality centers in strategic decision making for a greater performance output.

The aim of GICs is to reach the top level of the value chain and be an equal strategic and innovation partner of the parent organization. The maturity index model helps GICs understand where they stand with respect to their peers and their parent organization’s business objectives. But in order to fully gauge the path forward, it is important to identify the factors and roadblocks that will influence GICs’ transformation.

Digital Disruption Tests the Resilience of Businesses

The technology industry is continuously changing, and this constant flux impacts the global market as innovative new technologies and models affect the value of existing products and services. Digital disruption is no longer just a concept, and companies are already experiencing its ramifications. Emerging technologies such as automation, big data analytics, machine learning, and blockchain coupled with various business models are redefining the way organizations operate and compete.

Since GICs operate in an environment where technology-driven change is accelerating, it is crucial for GICs in India to adapt. With the advent of technologies like cognitive automation, artificial intelligence (AI), and natural language processing (NLP), a lot of jobs are expected to become automated in the not-so-distant future. This causes far-ranging disruptions to the way that GICs function. Robotic process automation, AI, and NLP enable machines to perform certain tasks far more efficiently than humans. For instance, tasks such as customer relationship management requests and document reviews can be completed far more quickly and effectively by machines. This has an impact on human resources, too.

Emerging technologies are already impacting functions like finance, HR, procurement, and IT for which GICs have been typically offering support for decades. Companies must learn to embrace the disruption and identify newer opportunities and areas that could put them in the tactical path of the parent organization before becoming redundant.

As businesses across the globe undergo digital transformation, the role of technology becomes increasingly central to their overall operations and growth strategies. However, these technologies can also help boost the accuracy and productivity of employees, enabling them to contribute more rather than being burdened with low-end repetitive tasks that are tedious and unfulfilling. For instance, a survey conducted by OnePoll and commissioned by Automation Anywhere in the United Kingdom found that data entry is the ‘most hated’ of tasks and workers waste more than 40% of their day on manual data tasks. Therefore, GICs need robust and comprehensive reskilling programs to train their employees in emerging domains such as AI, big data, and robotics.

Even though the digital disruption has made some jobs redundant, such challenging times call for a remodeling of processes. Exploiting the digital disruption to their advantage and exploring the opportunities spurred by it will help GICs play a key role in driving their parent companies’ overall strategic direction.

Startups and GICs: A Win-Win Partnership

India is in the top five leading countries in the world for tech startups, and startups in the country are aggressively venturing into the newest technologies. Collaborating with startups in India would be a good move for GICs to drive the innovation agenda and stay abreast of the latest technology on the market.

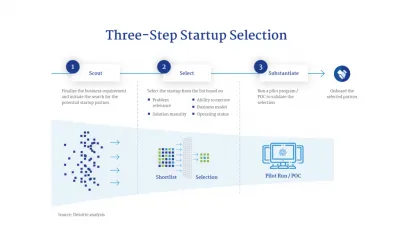

In turn, startups can use GICs as a medium to leverage a parent organization’s scale, domain expertise, and access to subject matter experts, as well as accelerate their operations to create a more refined, market-ready product. By choosing the right startup as their partner, the GIC and the startup could create a win-win situation. The challenge, therefore, would be to navigate the more than 7,500 startups in India and identify the right partner. Market scouting and accelerator and incubator programs are some of the tools GICs can use to find the right startup partner.

Daniel Arancibia, Managing Director at Falabella Technology India, says his company has a startup mindset in the way they think and work. “Falabella is a company that has evolved over the last 130 years. Though we have a deep-rooted legacy, Falabella has … an open culture, from the way our office is designed to the non-hierarchical and transparent way in which we operate,” he says.

“We have a razor-sharp focus on innovation; we encourage our employees to roll up their sleeves and get creative, and we proactively seek partnerships with startups in retail and finance to accelerate our innovation agenda. And the foundation of it all is our culture that fosters an environment of learning and collaborating. Our values, outlook, people, and customer-centric approach keep us relevant in today’s disruptive world.”

Figure 3 – Three-Step Startup Selection

Indian GICs Hereafter: Milestones to Aim For

Digital disruption and the startup ecosystem combined with the already established advantages of low-cost, efficient resources and the availability of talent are unquestionably major advantages for India. India faces close competition from China, though, which has the highest number of GICs.

But, unlike China, which is focused mainly on its local market, India’s focus on global initiatives has made it a favorite destination for international players. An intercontinental mindset, proactive thinkers, and cutting-edge engineering capabilities are some of the other reasons why India is a top choice. India also has an edge over other countries like China due to factors such as widespread proficiency in English, cultural adaptability, and an alignment with MNC culture.

“In future, the success of GICs in India will depend on the ability of leadership to further build two Cs: culture and capability,” says Madhavi Lall of Deutsche Bank India. “A culture that is professional, international, adaptive, and seamless across geographies. And capability that will need to be at a competitive cost and superior to what is available anywhere else in the world.”

In order to develop and grow in future, there are a few areas GICs need to focus on:

- Enhancing capabilities, leadership quality, and the existing talent pool: Building the right leadership and mindset should be one of the priorities for GICs while expanding. GICs need to invest in next-generation business leaders for high performance output. With the growing complexity of the business function, it becomes imperative to have a strong leader with domain expertise to manage the business through challenges and support the enterprise’s strategic objectives. Regular training and mentorship programs would help teams upskill themselves and stay informed, creating a future-ready, competent talent pool.

- Invigorating an innovative work culture: The culture of an organization plays a pivotal role in deciding its sustainability. In a world driven by digitization, creating an innovative work culture is imperative. Employees and leadership should be motivated to embrace ever-changing technologies with a high level of collaboration across the firm, thus maintaining an equilibrium with the parent organization. An employee-centric work culture, flexibility in approach, and a ready-to-learn attitude are attributes that can help GICs with employee retention and thus scale up a GIC’s performance.

- Ensuring business ownership and accountability: Autonomy in business planning and strategic decision results in a better outcome. Taking ownership of key enterprise priorities, including market-sensing and customer-facing core functions that bring measurable improvements to enterprise profitability. Migrating through the market to create products and services catering to local demands unfolds a greater avenue for GICs.

- IT, automation, and data analytics: GICs should prioritize adopting the latest technologies from A.I. to data analytics to generate a sustainable competitive advantage for the enterprise in their function. The likes of process excellence and automation, IT security, and business intelligence are core functions that GICs need to deliver on. Responding to the current market needs, GICs should invest in creating better ERP software, automation processes, and cybersecurity firewalls.

From shifting their focus from being mere cost savers, GIC establishments continue to evolve in terms of strategy and innovation. However, in order to achieve sustained growth and deliver value over time, GICs need to invest heavily in building a feasible workforce structure, investment-friendly government policies, productivity measures, and operational models. Numerous GICs have already demonstrated their ability to adapt and innovate to meet larger organizational goals, and organizations can enable and empower GICs by creating special roles, technical leadership programs, and strong HQ sponsorship. The future is made for GICs, so long as GICs take the right strategic and innovative steps toward it.

About the Authors:

Sripad K N Rao is a Managing Partner for Stanton Chase’s offices in Bangalore, Mumbai, and New Delhi. He has over 19 years’ experience in executive search consulting and is the Regional Vice President for the Asia-Pacific region. He heads the firm’s Technology Practice Group across India and the region as well as the Private Equity and Industrial practice groups for India.

Ashwini Prakash is a Managing Partner for Stanton Chase’s India offices. She has over 18 years’ experience in executive search consulting and specializes in the consumer products, retail, life sciences, and healthcare sectors. She is a Certified Assessment Consultant (Psychometric Assessments) and a Certified Organisation Culture Expert.

Veena Pandey heads the editorial and content function for the Stanton Chase India office. She has an extensive background in both qualitative and quantitative research.

The post The Evolution Of Global In-House Centers appeared first on NASSCOM Community |The Official Community of Indian IT Industry.