Survey: When it Comes to Credit Scores, Consumers are Confused

Blog: Enterprise Decision Management Blog

Every day consumers across America make important financial decisions, such as buying a first home. They monitor their credit score and, if necessary, take steps to improve it so that when they finally find the perfect place, they can be confident they’ll get approved for a mortgage. But often, instead of qualifying for a loan, they’re shocked to find that they are denied. Why? Because, unbeknownst to them, the “credit score” they had been viewing online was not a FICO® Score.

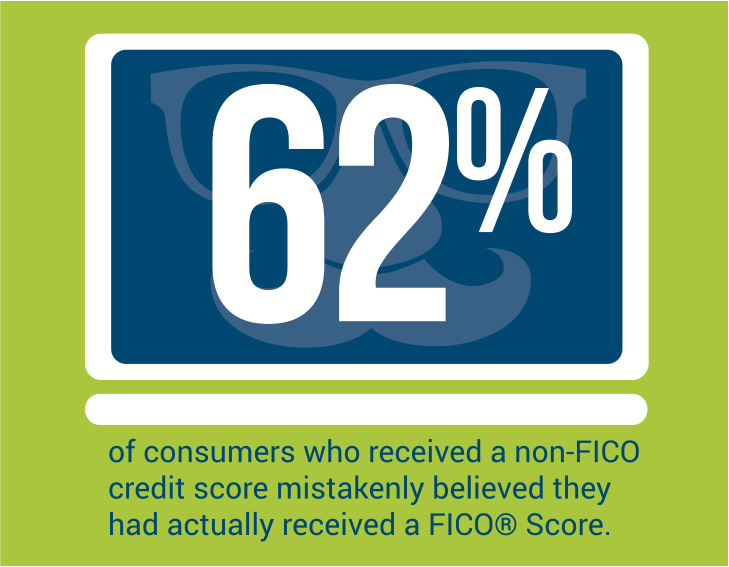

In fact, more than 60 percent of consumers mistakenly believe the non-FICO credit scores they obtain from online sites are actually FICO® Scores, according to new research conducted by independent research firm, BAV Consulting. The findings below show that many consumers are mistaken about the nature of the credit scores provided to them and, therefore, about their own creditworthiness.

The mathematical formulas used by each scoring company are unique and create credit scores for the same consumers that are often significantly different from their FICO® Scores – sometimes 100 points or more. With such large score differences, not understanding that the credit score obtained isn’t a FICO® Score can cause consumers to over- or underestimate how a lender will view them. The graphic below shows how this confusion can negatively impact a person’s financial health and well-being.

We launched the FICO® Score Open Access Program to help educate consumers about credit scores and to give them regular access to and feedback on the same FICO® Scores used by their lenders for credit decisions. The program has proven to also help banks, credit unions and other lenders better serve and engage their customers. In a recent post we announced that more than 100 million consumer accounts are eligible to get FICO® Scores for free. Yet, a great deal of confusion persists among consumers engaging in websites offering them their “credit score.”

To that end, we’ve created a new website to increase awareness and provide clarity to consumers. By visiting www.ficoscore.com, consumers will get access to valuable financial education information designed to help them understand how to manage their credit health and address areas of continued confusion. They’ll also see a list of authorized FICO® Score providers, so they can be sure they are receiving actual FICO® Scores, if that’s what they are seeking.

Consumer empowerment and financial capability start with transparency. We’re doing what we can, and hope others in our industry will do the same.

The post Survey: When it Comes to Credit Scores, Consumers are Confused appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.