“Static Delinquency” Trends Show Opportunity for UK Issuers

Blog: Enterprise Decision Management Blog

Following on from evaluating the roll rate results, I’m going to look at new FICO data on UK cards and static delinquency levels, accounts remaining at the same level of delinquency. Whilst payment plans can influence results, there are fewer issuers holding delinquency levels for these accounts than in the past.

There are several good reasons to target static accounts:

- The ability to make multiple payments despite missing previous ones means consumers should be lower risk. Issuers could gradually transition them into an in-order status by taking extra payments or multiple smaller payments, affordability metrics allowing.

- Reducing delinquency levels.

- Improving customer experience, especially in relation to their credit status at the bureaus.

- Treating customer fairly by minimising the collections contact designed for standard collections accounts, potential reducing any associated stress.

- Demonstrating knowing your customer by having more targeted conversations specific to their situation.

- Freeing collections resources to concentrate on more complex accounts.

- Reducing the costs of collections actions by implementing a more appropriate strategic approach on this segment that would stop the same actions taking place over potentially many months.

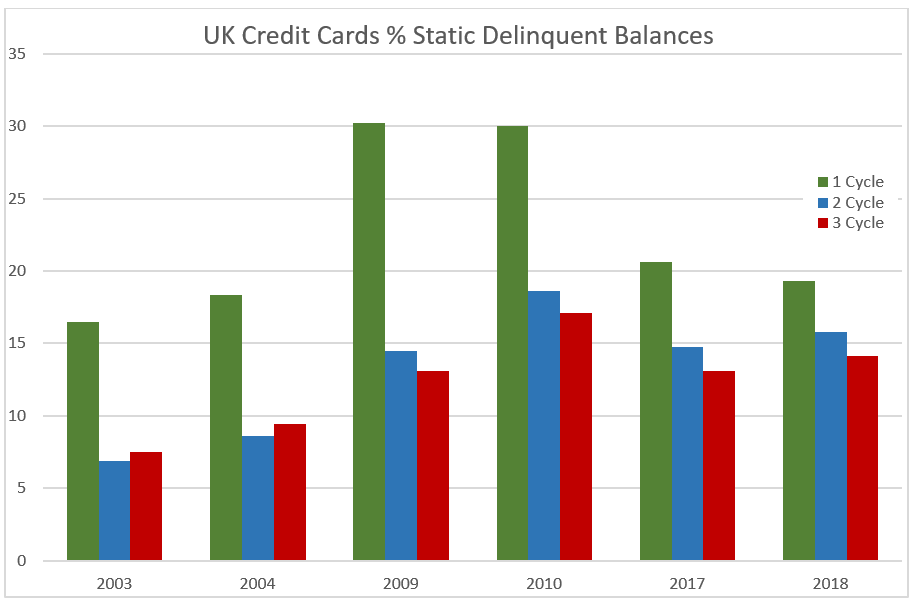

Using 11 issuers’ data from November 2017 and 2018, we calculated industry averages. Historical results from 2003, 2004, 2009 and 2010 were included for comparison purposes.

Static Delinquency Trends

The percentage of accounts and balances remaining at 1 cycle in 2018 were on a par with the 2004 results, with a peak in 2009. This equates to >£114 million on approx. 37,500 accounts, so reducing these levels can have a noticeable positive impact on results with potentially a minimal impact on the collections team.

The percentage of 2 cycle static accounts and balances peaked in 2010 and in 2018 reached their second highest level, nearly 12% in accounts and 16% in balances. The percentage of 3 cycle static accounts and balances also peaked in 2010. The percentage of accounts remaining at 3 cycles in 2018 was 11.6%, with 14% of balances static.

Despite volumes and values being lower at 2+ cycles, there is still benefit to gain by treating these accounts separately to normal collections processes. Looking at the risk levels of these accounts compared to normal 2 and 3 cycle consumers should highlight that these are lower risk.

Potentially targeting static delinquency accounts that have remained at the same level for a sustained period could form the basis for a champion/challenger test to determine if there is merit in rolling this approach out to the whole book. Debt restructure optimisation could also be an option. Next week, we’ll explore some strategies in a post.

To learn more about our cards benchmarking service, or FICO’s new Risk Benchmarking Service which forms part of the Fair Isaac Advisors P&L Insight Service, please contact me at staceywest@fico.com.

The post “Static Delinquency” Trends Show Opportunity for UK Issuers appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.