Research Shows Mortgage Delinquencies Rise for Older Consumers

Blog: Enterprise Decision Management Blog

FICO research consistently shows that older consumers have higher FICO® Scores than their younger counterparts. But a recent report by the Mortgage Bankers Association (MBA) provides evidence that people become less reliable at making their mortgage payments as they age. Can both of these assertions be right?

To get to the bottom of this, FICO conducted fresh research on credit behavior trends by age. Our study revealed not only that mortgage delinquency rates rise for US consumers beyond a certain age, but that these delinquency increases were observable across other loan types.

Is this cause for concern? And was the MBA correct in their conclusion that declining memory and other cognitive skills are the main contributing factor? In this post, I’ll share our research findings and draw a few conclusions based on what we see in the data.

Delinquency Trends by Age

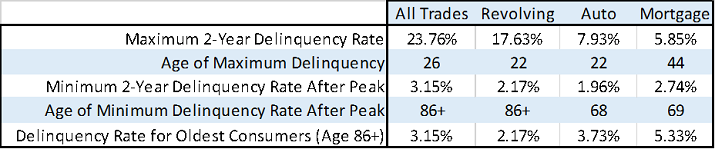

For this research, we examined payment behavior using credit bureau data as of January 2016. The following chart shows the serious delinquency rate by age over the prior two years for various credit products. The analysis is limited to consumers with activity during the period. Keep in mind that because of low counts, we grouped ages 86 or older at the group’s mean age of 92. (And as a reminder, the FICO® Score does not consider age in its score calculation.)

We see that 90+ delinquency rates for mortgages and other closed-end loans reach their lowest points for consumers in their late 60s or early 70s. Auto loans have their lowest delinquency rates when consumers are 68. The minimum delinquency rate for mortgages occurs at age 69. Conversely, delinquency rates for revolving trade lines (which include credit cards) decrease throughout consumers’ lives.

The following table summarizes the peaks and valleys of the previous chart:

For most loan types, the highest delinquency rates prior to those seen in later life occur when consumers are in their 20s and starting to take loans. Only mortgage delinquencies return to levels comparable to their peak at age 44. Delinquency rates do increase for older consumers for their auto loans, but those rates don’t approach the rates seen for consumers in their 20s.

Are These Findings Cause For Concern?

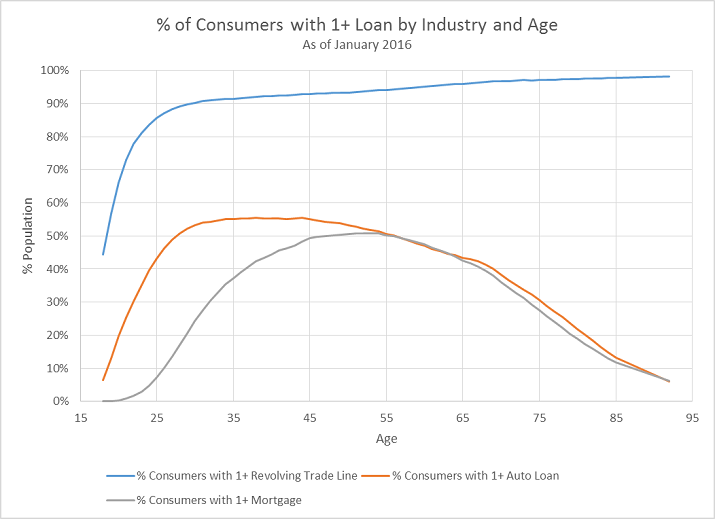

While delinquency rates do increase for older consumers, they represent a relatively small portion of the total debt tracked by the bureaus. As evidence, this chart breaks down US debt by age and loan type:

This analysis includes all consumers with at least one active trade. For a level comparison, we divided these consumers by age so that each of the five groups represents 20% of the bureau population.

Consumers aged 67 or older represent 20% of the bureau population, but they have only 11% of the total debt on the bureau – and only 11% of mortgage balances. Thus, while delinquency rates increase on this population, they have less total debt than younger Americans.

This data indicates consumers pay off their debt as they reach retirement age. In fact, when we dug deeper, we found that older Americans tend to close out their auto loans and mortgages, but keep at least one revolving trade, such as a credit card.

Because revolving delinquency rates decline continuously as consumers age, and because consumers tend to close their other loans, there is no surprise that FICO® Scores increase as consumers age, despite the fact that delinquency rates increase for some loan types.

Ultimately, our research shows that older Americans have less debt than younger consumers, and that the delinquency rate increases return to levels similar to or lower than those of young people just starting to establish a credit history. So while this trend is certainly something for lenders to keep on their radar, it’s not likely to play as important a role on delinquency rates as other factors such as US economic health.

Is Failing Memories the Cause?

As observed by the MBA, mortgage delinquency rates do increase for consumers past age 68. The MBA report suggested that these increases were due, in large part, to failing memories in older consumers. Of course, there’s nothing in the bureau data to either substantiate or contradict that assumption directly. But what we see in the data does suggest an alternate explanation.

Above, for instance, we showed how consumers pay off their closed-end loans as they get older. Much of the delinquency uptick is driven by a relatively small number of borrowers who still have sizeable mortgage and auto debts into their 70s and 80s. This suggests that some delinquencies may very well be due to a common occurrence in lending – those who have the resources pay off their loans over time, leaving only those more financially strapped consumers in the loan pool.

In addition, we showed how there were not similar increases in delinquency rates by age for revolving credit (e.g., credit cards), which is the predominant form of credit used by this age group. This contradicts the theory about ailing memories causing the rise in mortgage delinquencies. It’s hard to imagine that consumers would remember to pay their credit card but forget about their mortgage. Once again, financial health seems like a more likely reason.

No matter the cause, this – or any – delinquency increase is something we recommend lenders keep an eye on. To support those efforts, we’ll continue our periodic research on credit behavior trends by age and share key findings on this blog.

The post Research Shows Mortgage Delinquencies Rise for Older Consumers appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.