Real or a Red Herring? What Should Banks think of the Fintech Threat?

Blog: Enterprise Decision Management Blog

By now, you likely know the talking points by heart…

- Silicon Valley is coming

- Millennials hate banks, so much so that a majority would rather visit the dentist than listen to what banks are saying

- New fintech products—across a wide range of areas including lending, wealth management, and payments—are going to lead to the unbundling of the financial services industry

These talking points are deeply embedded in your brain because they are literally inescapable. If you have attended an industry conference, picked up a trade publication, or followed the conversation of the fintech intelligentsia on Twitter, you’ve been exposed to it.

It can be difficult to separate the facts from the hype. However, it is vital that we do so. The question of whether fintech poses a significant competitive threat to financial institutions’ customer relationships, especially with Millennials (consumers age 22-37) and Gen Z (consumers age 18-21), has enormous implications for all banks and credit unions.

It’s a complex question to answer and one that deserves more data-driven analysis and less hyperbole.

FICO recently conducted a survey of U.S. consumers regarding their financial services habits and preferences and we have a couple of data points to add to the discussion on whether the fintech threat is real or a red herring.

Red Herring: Consumers Hate Their Banks and Will Likely Move to Non-traditional Providers

Contrary to the common narrative, consumers don’t hate banks. 57% of survey respondents said that they were satisfied with their primary banking provider, compared to just 9% who said they were dissatisfied. In terms of net promoter scores (NPS), 54% of respondents identified themselves as promoters, compared to just 15% who identified themselves as detractors.

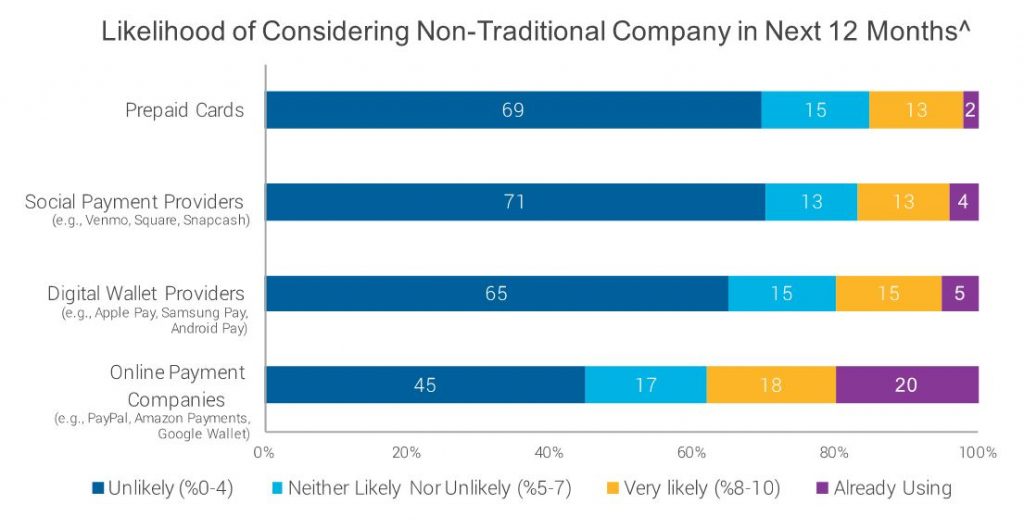

That satisfaction translates into an unfavorable competitive environment for non-traditional providers. When we asked consumers if they would consider using a non-traditional financial services provider in the next 12 months, a majority said that it was unlikely.

Real: Fintech is Gaining Ground in Certain Areas

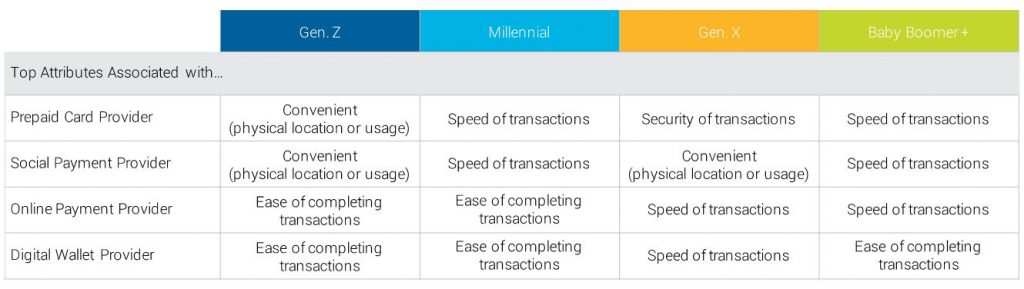

On the other hand, it does appear that non-traditional providers are gaining some ground on banks and credit unions. When we asked consumers to rate non-traditional providers on a range of attributes, the same few kept coming up at the top of the list.

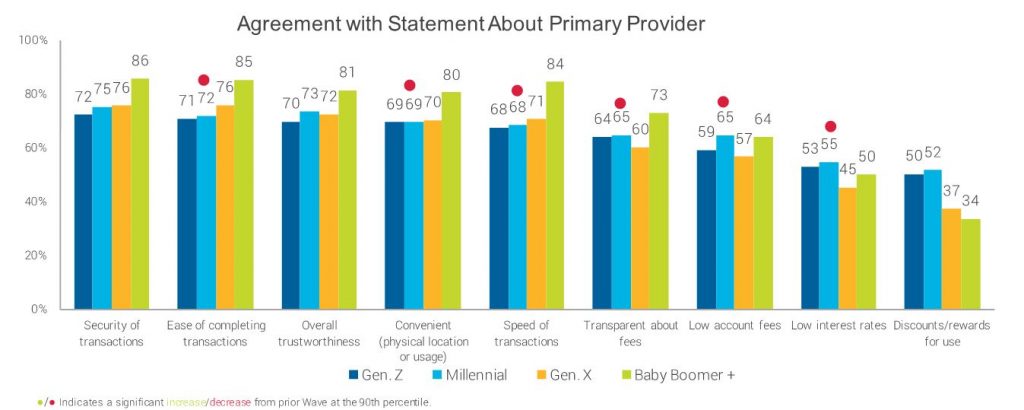

These attributes—convenience, transaction speed, and ease of completing transactions—are the same ones that Millennials have begun to rate their primary banking providers lower on in our most recent survey.

Red Herring: Trust and Security is a Huge Advantage

However, as shown in the graph above, banks and credit unions maintain a huge advantage in the areas of transaction security and overall trustworthiness. In fact, 79% of consumers (across all age segments) rated their primary banking provider as “good” or “excellent” for security of transactions compared to 38% for non-traditional providers. For overall trustworthiness, the gap is even bigger—78% for primary banking providers and 36% for non-traditional providers.

Real: Debt Management is a Weak Spot for Banks

An area that we have already seen non-traditional providers gain some traction, especially with younger consumers, is in the online lending space. Specifically, online lending focused on helping consumers refinance their debt (which is the niche that the major players—Lending Club, Prosper, SoFi—have built their businesses around).

According to our data, this shouldn’t come as a surprise. When we asked consumers if they were concerned about the amount of debt they have and if they were interested in getting help managing it, we found that Millennials and Gen Z consumers were more likely to say yes to both questions.

These findings suggest that banks and credit unions can and should do more to help these consumers get their debts under control (even at the risk of losing a little short-term revenue). This is particularly true when you consider that consumers who told us they were concerned about the amount of debt they have were also significantly more open to the idea of working with a non-traditional financial services provider.

Threats & Opportunities

So is the fintech threat real or a red herring? As with most things, the answer is complicated. Non-traditional providers may, one day, disrupt a significant portion of the business conducted by traditional financial institutions. However, according to FICO’s 2017 U.S. Consumer Banking survey, that day isn’t right around the corner. Banks and credit unions would be well served to focus on the threats and opportunities that are in front of them now.

FICO recently presented an American Banker webinar that tackled this topic, using our 2017 survey data, in much more detail. An on-demand recording of the webinar is available for you to view and, of course, I would love to hear your views in the comments section below.

The post Real or a Red Herring? What Should Banks think of the Fintech Threat? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.