Persistent Debt Regulation and Advanced Analytics

Blog: Enterprise Decision Management Blog

The Financial Conduct Authority of the United Kingdom (FCA) has recently introduced new rules to avoid long-term indebtedness of credit card holders. As per this regulation, a cardholder is in persistent debt if payments against interest, fees and charges exceed amortisation payments over an 18-month period. The 18-month period is reset if the card balance falls below £200.

Persistent debt is a situation that tends to occur with customers who choose to make minimum payments only. With typical monthly interest rates between 1.5% and 2.5% (18% to 30% p.a.), a monthly minimum payment of 2.5% will systematically lead to a persistent debt situation. Some high-interest products even lead to persistent debt situations when more than the minimum payment is made.

While it seems to be the aim of the FCA to ensure that amortisation exceeds interest and fees, the persistent debt regulation surprisingly does not regulate minimum payments to exceed the interest rate by a factor of two. Instead, the policy requires card issuers to take a number of escalating steps, informing the customer after 18 and 27 months of persistent debt, and eventually going through a forbearance process before month 36, which might include actions like card closure and interest waivers.

My colleague Stacey West has recently blogged about some of the operational implications of the persistent debt regulation. Today, we will look at this topic from a decision analytics perspective.

Decision Options

For new accounts, card issuers can avoid the challenges arising from persistent debt entirely by setting the contractual minimum payment rate at least to double the value of the monthly interest rate. For products which accrue substantial fees, these might need to be considered for the minimum payment as well. In general, affordability checks will need to assess if customers can make sufficient payments avoid a persistent debt situation.

For existing customers, increasing the minimum payment can prevent persistent debt situations, but requires additional considerations. Customers making average payments in excess of the minimum payment and customers at low to medium utilisation levels might easily be able to meet higher minimum payment requirements. However, customers at high utilisation levels with low to minimal payment to balance ratios might not be able to make larger payments – whether or not an issuer increases the minimum payment terms, or the customer is implicitly required to increase payment levels to get out of the persistent debt situation. This also suggests that, for customers who do not have the financial capacity to stay out of a persistent debt situation, the credit limit provided might be too high considering the new regulation.

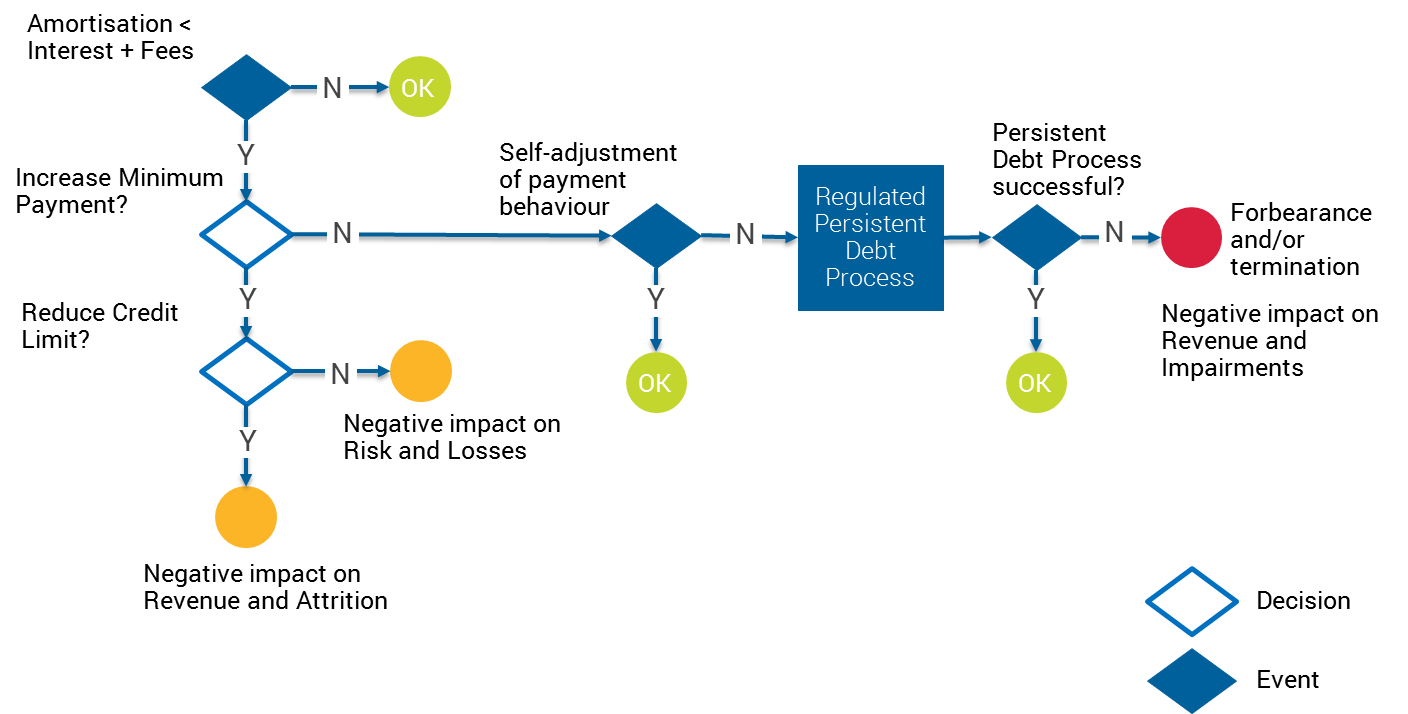

Persistent Debt Decision Tree Example

For customers who typically make minimum payments only, this gets us to the following decision options:

- Leave the minimum payment as it is and hope that the customer’s payment behaviour changes later or can be influenced by the mandatory persistent debt process. If unsuccessful, this might lead to forbearance measures, card closure or write-offs.

- Increase the minimum payment to a level that prevents persistent debt situations. However, this might drive customers with insufficient financial capacity into arrears, eventually leading to account termination and write-off.

- Decrease credit limit to a level where an increased minimum payment remains affordable for the customer even at high utilisation. However, this might negatively impact interest revenue and could trigger attrition if the customer wants to maintain the credit line or feels inappropriately treated.

When deciding whether to modify minimum payment and credit limit, the financial impact of the respective outcomes should be considered. If this decision is made at account level rather than at portfolio level, more appropriate decisions can be made, and unnecessary financial impact can be avoided.

How Analytics Can Help

Analytics can help to predict the probabilities of the respective alternative outcomes. For example, analytic models can predict the probability of a customer moving into the regulatory milestones at 18, 27 and 36 months, and hence can help to identify customers who should be contacted ahead of reaching these trigger points.

Analytics can also help to predict how customers are going to react to modified minimum payments and modified credit limits, and how such changes are going to impact revenue, attrition and delinquency levels. In that context, FICO’s Risk and Affordability Decision Suite can help issuers understand the financial capacity of customers, and hence their ability to make payments that get them out of the persistent debt situation.

Decision optimisation can help to balance the draw backs of the alternative outcomes, including revenue impact, losses and attrition. Combining multiple action-effect models into a decision framework, optimisation can simulate portfolio performance in alternative scenarios, and prescribe a treatment strategy that maximises or minimizes a given objective (such as profitability) under chosen constraints (such as attrition goals, revenue targets and operational capacity).

For example, decision optimisation can identify which customers should be subject to modified minimum payment and credit limits. Optimisation can also help to identify which customers in persistent debt should be contacted ahead of the regulatory milestones. In both cases, optimisation would help to understand the financial dynamics and trade-offs between revenue, losses and attrition.

When addressing persistent debt, don’t just look at it as an operational challenge. Treat it as a decision problem and gear up your analytic tools to address it.

The post Persistent Debt Regulation and Advanced Analytics appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.