Persistent Debt – Moving from Compliance to Prevention

Blog: Enterprise Decision Management Blog

Following on from my previous post on persistent debt, here I’m tackling the topic of preventing customers from falling into persistent debt.

Issuers can contact their customers outside of the set stages, whether the consumer is in persistent debt or not, as account behaviour may indicate they are moving in that direction. Initially the focus may be on actions in the 28-35 month range, before moving to 19-26 and finally <18 months.

Cardholders may not even understand what persistent debt is. Issuers have opportunities to increase their customer base’s general understanding of this topic and process, rather than a communication being a shock at 18 months.

This would help to reduce the number falling into persistent debt and the potential anxiety it may cause. Along with general education campaigns, targeted approaches can be taken earlier in the process.

Early Contact

Contacting a customer at 12 months in persistent debt gives them 6 months to increase repayments or agree if extra payments are unaffordable. Appropriate action can be taken before they enter the formal process at 18 months. Changing behaviour earlier could be strategically vital.

Payment Reviews and Affordability

Payment reviews for all consumers paying less off their balance to ensure they are paying the right amount to keep them out of persistent debt is another option. Affordability checks will play a major role in determining whether payments can be increased and if so by how much, and whether this will take a customer out of persistent debt. This will result in a wider use of customer-level data from the bureaus. Robust affordability checks will also be important in identifying consumers who genuinely cannot afford to increase their payments versus those who can and are reluctant to do so, in order to obtain more favourable treatment, for example a lower interest rate. This can take place early in the consumer life cycle as a means of prevention.

The affordability checks to set the initial limit might consider the level of payment needed to prevent an account going into persistent debt. Minimum payments could shift from a low % and fixed small amount to a value that prevents persistent debt, based on the balance and interest rate, unless there is a 0% offer in place. This would avoid placing the consumer in the position of meeting the definition from the start. Consumer would experience more fluctuating payment amounts.

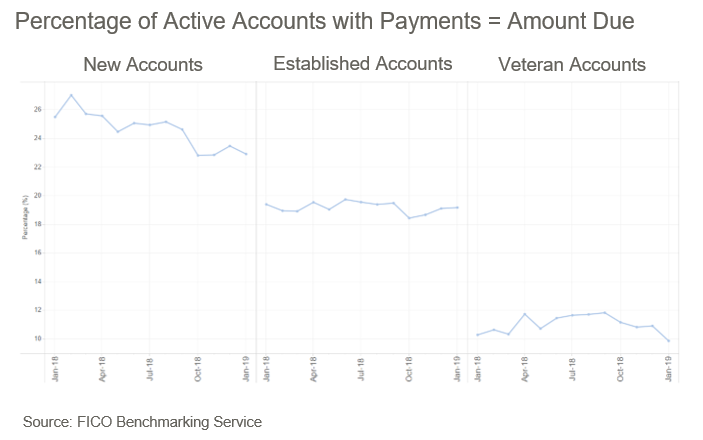

Since the regulations went live, we have seen a shift in the percentage of accounts paying the minimum amount — more people with <1 year on book are paying less than the minimum amount, and more people with 5+ years on book are paying more than the minimum amount but less than the full balance. A proportion of this decrease can be attributed to the rise in delinquency rates already commented on in other recent blogs. In Q4, 2019 once the regulations have been in place for at least a year, it will be interesting to see the impact on Industry payment trends.

A review of the percentage of accounts in persistent debt prior to the regulations being introduced and 6 months after may give an indication of how successful the original communication is, potentially leading to changes.

Limit Decreases and Freezes

Limit decreases to remove any unused credit may help to avoid future issues. Another option is to freeze proactive credit line increases for x months after a customer is in persistent debt, to prevent increased spend with a payment amount that will not support the extra credit, protecting the consumer and issuer.

Another argument in favour of prevention relates to forbearance on consumers who have not missed payments and how that sits with the interpretation of the IFRS 9 regulations. Should the definition of persistent debt be considered a deterioration of risk for the purposes of IFRS 9? If so, this is another reason to take preventative measures. This is likely to be determined more by the customer behaviour leading up to meeting the persistent debt definition, than purely driven by the fact they qualify for this program.

In my next post I’ll explore how you can move from prevention to competition.

The post Persistent Debt – Moving from Compliance to Prevention appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.