Modelling Deposit Price Elasticity: Challenges and Approach

Blog: Enterprise Decision Management Blog

This is the third in a series of blogs on deposit pricing, focusing on price elasticity modelling approaches and challenges.

The goal of any deposit price optimization solution is to make data-driven pricing decisions to manage portfolio balances and trade these off against the associated costs. These solutions should allow a pricing manager to prepare and run what-if analyses to assess the impact of pricing strategies, competitor price actions or movements in central bank base rates.

Fundamental to these solutions are price-elasticity models that capture and predict customer behavior as a response to pricing and other non-price factors. In this blog, we discuss the challenges and solution approaches for the development of robust price-elasticity models.

Price Response Signal

Price sensitivity can be measured with regards to product rate, market ranking, competitor rates or even interest paid to other products in the portfolio. The modelling challenge is not only to measure price sensitivity accurately, but to capture as much richness in pricing behavior as possible, e.g., variations in price sensitivity across different segments.

For example, ultra-low bank base rates have become the new normal in the US and Europe and it can be a challenge to isolate the price signal. There may be limited price variation in the modelling period or else one-time shocks caused by the presence of non-price related factors (such as Brexit) that drive balance flows. Previous experience of price sensitivity models across different markets, interest rate environments and transformation of price-related variables provides an anchor to avoid misdiagnosis of the price signal.

Cannibalization

In order to truly understand the impact of pricing decisions, the flows between individual products and segments must be understood. This allows the prediction of the balance distribution by product and requires a tried and tested process for inferring balance flows. Understanding and predicting balance flows across products in turn allows pricing managers to assess the impact of cannibalization on pricing decisions and overall portfolio revenue.

Data Availability & Granularity

One of the biggest challenges for the development of price sensitivity models is data availability. The development of overly complex models with insufficient data results in the often-cited adage of garbage-in, garbage-out, so it is important to ensure that the modelling approach is appropriate to the data available.

Finer granularity, where more modelling segments are used, introduces richer pricing behavior and allows greater insights into pricing decisions. This must be balanced with the need for sufficient deposits within each segment to ensure a statistically significant price signal can be measured.

Another consideration concerns the model resolution: An established deposit portfolio with relatively stable balances might only re-price a few times a year and a monthly granularity is sufficient. On the other hand, a smaller bank that needs to make shorter-term funding decisions might buy balances through the introduction of market-leading rates. This type of pricing action typically occurs more frequently and would therefore need a weekly granularity.

Modelling Methodologies

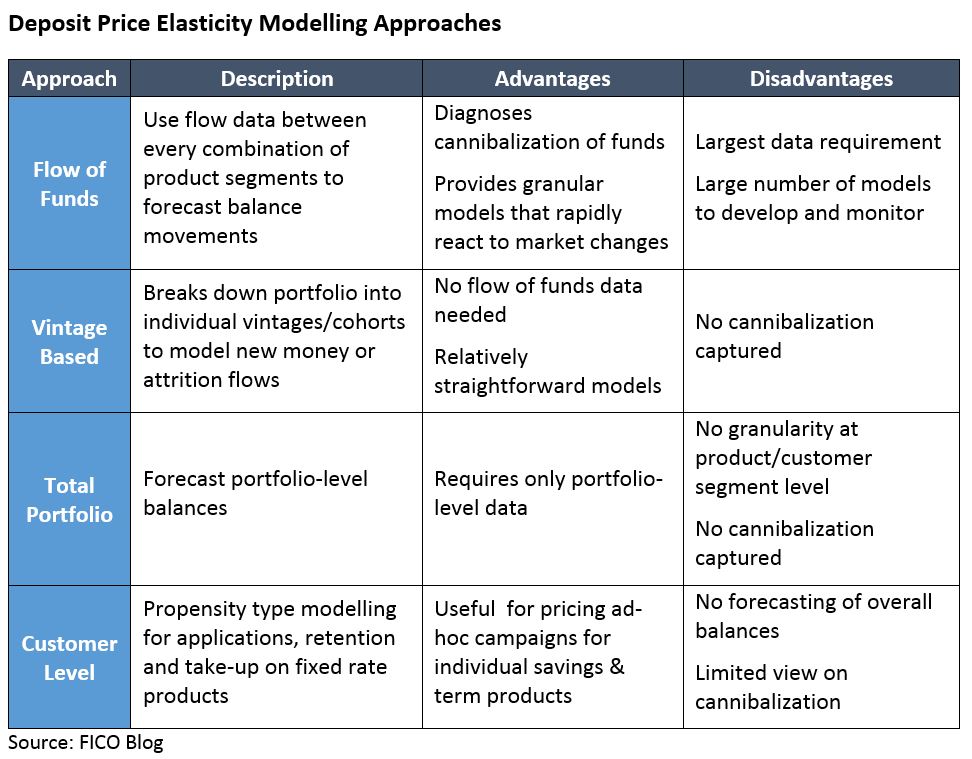

Depending on a bank’s objectives and the availability of data, there are a number of modelling approaches that might be considered.

Model Management

It is vitally important that all stakeholders from the pricing analyst to senior management have confidence in pricing models. The best way to achieve this is to ensure full transparency of the models, methodology and the factors that drive predictions.

With a full understanding of model drivers, the business can justify why particular pricing decisions are made to internal stakeholders and also answer any challenges posed by external regulators that a “black box” solution could not.

An ongoing model management process should monitor model performance against established accuracy thresholds to guide model recalibration and redevelopment. This ensures that models respond to changes in the market and provides a mechanism whereby the impact of recent pricing decisions feed back into the price sensitivity models.

Conclusion

In order to develop deposit price sensitivity models, careful consideration is needed to evaluate an organization’s requirements and mitigate some of the challenges discussed here. The deployment of such models offers substantial improvements on approaches that rely exclusively on expert judgment. It allows banks to more effectively manage their deposit portfolio, better understand their customer behavior and preferences, and identify new revenue opportunities. It is also a critical component on the journey towards full price optimization where banks derive all the benefits that data driven models have to offer.

The post Modelling Deposit Price Elasticity: Challenges and Approach appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.