Modeling Deposit Price Elasticity: Where’s the Value?

Blog: Enterprise Decision Management Blog

The ability to model deposit price elasticity is becoming a core component of deposit portfolio management. In my previous posts on this topic, I discussed:

- How deposit price elasticity models provide the product team with a tool to accurately forecast the expected performance from any given rate strategy and understand the complex nonlinear relationship between product rates and demand.

- The data and analytic requirements for building such models.

- The particulars of model structure and how characteristics need to be considered carefully to balance a statistically rigorous approach with the ability to explain results to stakeholders.

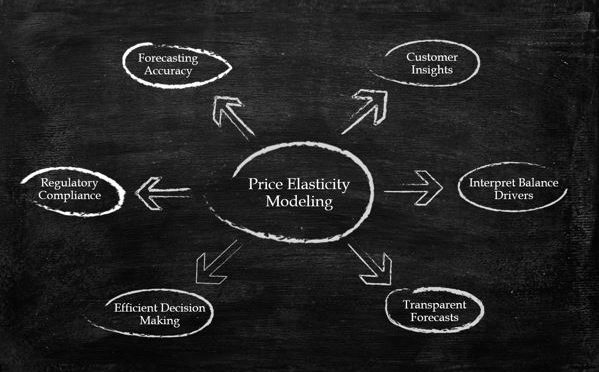

This post focuses on benefits once models have been completed and are in use. What should you expect to gain from deposit price elasticity models and what can you do with them to maximize benefit to the business?

The main function of a deposit pricing team is to forecast the future performance of their portfolio and a substantial amount of time is spent answering questions such as: How much new money will this rate bring in? How will this cannibalize my more profitable back book? What is the impact of the new rate on my portfolio P&L? What if the market changes rates?

Scientifically derived deposit price elasticity models streamline the answering of these and other questions. Moreover, as the core of a deposit forecasting solution, these models improve the accuracy, efficiency and accountability of the entire pricing process.

Accuracy

Price elasticity models are not affected by qualitative bias and provide a level of accuracy not achievable by gut instinct alone. Rather than focusing on individual products, the modeling suite should have the ability to create simulations of the entire portfolio, incorporating balance movements into and out of the bank as well as the effect price changes have on other products and the resulting impact on the bottom line. Simulations of future behavior should have the ability to predict the impact of price changes and allow the user to flex assumptions around competitor pricing, changes to the macroeconomic environment and internal profit assumptions.

Using this approach we achieve a better understanding of customer behaviors and the associated sensitivities of the bank’s liquidity as a whole. The best system of models tracks the impact of price changes so that previous decisions can be reviewed, appraised and the results fed back into the model calibration. This closed-loop process ensures models are continuously learning and adapting to changing market sentiment.

Efficiency

Another significant benefit of pricing analytics is that they accelerate the decision making process. Pricing managers can rapidly generate a number of different scenarios to study alternative pricing strategies, changes in competitor pricing assumptions or wider market factors. Providing the business with appropriate forecasting levers allows them to focus their expertise on pricing. Generation of evidence to justify pricing decisions becomes an automated process and this makes it possible to quickly iterate towards a pricing strategy that achieves the desired portfolio outcome.

Accountability

When recommendations are based on transparent model drivers, conversations with internal stakeholders or senior management become easier as forecasted balances can be directly related back to internal or external modeling factors. The demonstrable action-effect behavior of pricing models also extends beyond the organization as they facilitate conversations with regulators.

In recent times, the regulatory burden on bank executives has grown such that transparency of the underlying pricing models is paramount. Pricing decisions must be explainable and the inputs and assumptions that sit behind them thoroughly documented. An ideal price-elasticity solution provides transparency to the underlying models, automates much of this governance process and provides an auditable structure for the entire pricing process.

Towards Optimization & Beyond

As I have discussed, price elasticity models that predict flows into, out of and between products are key to gaining a full understanding of a deposits portfolio. They serve as part of a broader analytic infrastructure underpinned by a strong data management system and a highly skilled analytic workforce. Ultimately, they empower the pricing team to make better decisions that are more accurate, quickly identified, and easily explained. These improved, data-driven processes have myriad benefits for everyone from the pricing analyst through senior management, partner stakeholders such as treasury, finance, marketing, and even external auditors.

However, the full value of a deposits portfolio can only be completely unlocked through the application of optimization, which is the final frontier in the construction of a comprehensive pricing solution. Full price optimization has the ability to discover revenue where a simple forecasting tool cannot. It optimally trades off balances and revenue across every product in the portfolio and finds the most efficient path to achieving the desired business outcome.

In my next post, I’ll discuss price optimization in more detail and how it can directly generate value to the deposits business.

The post Modeling Deposit Price Elasticity: Where’s the Value? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.