Modeling Deposit Price Elasticity: What Is It All About?

Blog: Enterprise Decision Management Blog

Many top financial institutions have begun using predictive modelling and optimization to improve deposit pricing. This requires an understanding of customers’ deposit price elasticity — how sensitive are they to pricing changes, and what is the relationship between price and demand at the customer, segment and portfolio level?

I’m going to explore this topic in a series of posts, which should be useful both to deposit portfolio managers and analytics teams. To start with, let’s look at the basics.

Price elasticity is the study of responsiveness, and how the demand of a product changes with respect to price (and/or the price of competitors). Understanding deposit price elasticity, or having models that predict this, means you can quantify:

- Impact of a product’s price change on the deposit product

- How competitor price changes impact a deposit portfolio

- Impact of changing macro-economic conditions, such as a change in central bank lending rate

- How a product’s price change will impact the overall deposit portfolio, taking account of product cannibalization and source of funds

- How to maximize revenue from the deposit portfolio using optimization (more on this in a future blog).

A price elasticity model enables the product team to set deposit rates with a sound understanding of the expected performance from the rate strategy, and understand the complex nonlinear relationship between product rates and demand.

Deposit Pricing and Customer Behavior

Analytically understanding customer behavior is critical in establishing the deposit pricing strategy. A large number of potential characteristics can be considered in the development of models, such as:

- Product details relative to the whole market, or different competitor peer groups

- Product details relative to neighboring products

- Existing customer product holdings, including those reaching product maturity

- Macro-economic data

- Brand / market awareness

- Seasonality trends

- Indicator information (to take account of exceptional events)

The final model structure and characteristics are considered carefully to ensure robust relationships, across the suite of models. It is also critical to understand how the models interact and perform on data more recent than what was considered for the model development, as well as outside of historical price points. This helps gain buy-in from the product teams who are going to be using the models to set pricing.

Benefits seen from using price elasticity data driven models are:

- Deposit Portfolio Impact: To understand the impact of a pricing action on account applications, bookings and funding, taking account of competitor pricing, central bank rates, yield curve and how the pricing action impacts other products.

- Source of Funds: To predict the source of funds, which help determine if a pricing action is resulting in net new business or if the same deposits are being cannibalized from an older low-rate account to a new higher-rate account.

- Regulation: Not having statistically built models to make pricing decisions will be viewed as guesswork from subject matter experts. You need to be able to point internal auditors / regulators to a price elasticity model that has gone through the bank’s governance process.

A further benefit of developing price elasticity models is to make yourself more price-elastic, and review the deposit products you hold!

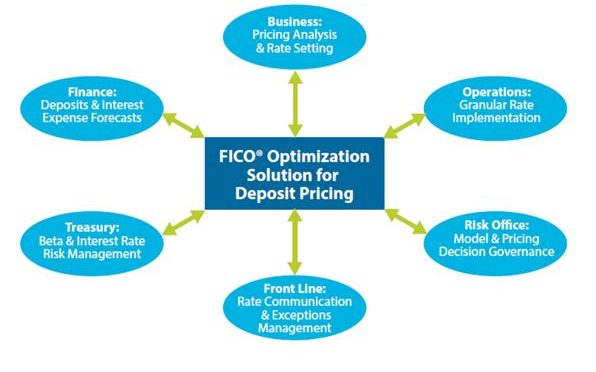

In my next post, you’ll learn about some of the challenges and requirements when building effective price elasticity models. I invite you also to find out more about FICO’s deposit price elasticity modelling and optimization.

The post Modeling Deposit Price Elasticity: What Is It All About? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.