Managing Persistent Debt, Static Delinquency and IFRS 9

Blog: Enterprise Decision Management Blog

Following last week’s posts about static delinquencies and other delinquency trends, I have had several conversations that lead me to wonder how holistically we are looking to solve some of the more challenging credit management issues. Here are my concerns.

Firstly, I have just seen the damage a collections shop that is not ready for IFRS 9 can experience. This has thrown the organisation concerned into a spin as they grapple with impairment increases resulting from an inability to stem the bucket 1 roll rate, and the subsequent roll to 3+.

I believe part of the challenge faced here may involve the way organisations are dealing with the gauntlet thrown down by UK regulators around persistent debt. It has been clear for some time that pre-delinquent strategies will help reduce collection losses. Clearly, the UK regulator felt organisations were not doing enough and prescribed what should be done on card customers who qualified as persistent debtors.

When we look at how card issuers are dealing with three key factors — the performance of delinquent credit card portfolios, the actions on the persistent debt cohort and the operating model adjustment to mitigate against unnecessary impact of IFRS 9 — what is interesting is what we don’t see. We don’t see much clear, holistic change in action. In far too many organisations, we see disjointed approaches that are not making life easier for the creditor, their customer or the regulator.

Let’s look at each of these three issues in turn.

Static Delinquencies

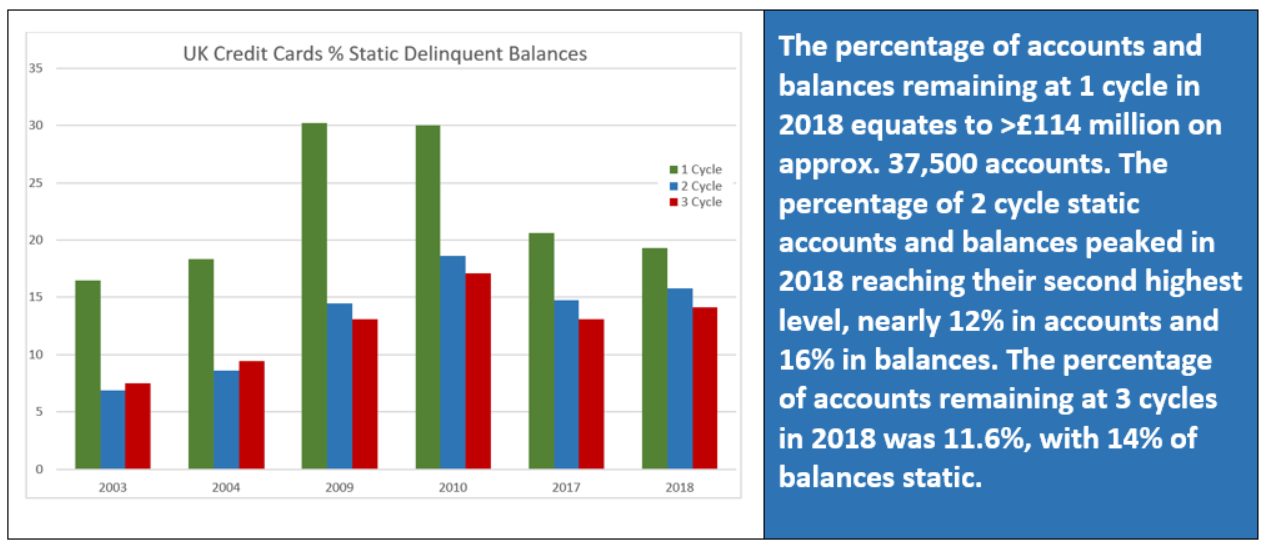

Last week, my colleague Stacey West wrote about trends in static delinquent balances. Here’s some of that data:

Reducing static delinquency has, for too long, been a missed opportunity for many. How can it still be ignored by card issuers dealing with persistent debt and IFRS 9?

Persistent Debt

Why am I mentioning this topic in relation to static delinquency? Because in the past many organisations could identify who was credit-stressed, but what the creditor did about it drove customers into collections. Some of the proposed approaches on how to treat persistent debt customers are likely to do likewise.

There are estimates that the new rules on treatment of persistent debt will save qualifying borrowers between £310 million and £1.3 billion a year. Or put another way, they will cost the credit card industry that much — plus more, given that issuers also have the operational cost and the impairment on those consumers it pushes into collections.

With that in mind, surely the customers sat static in the delinquent portfolio eroding balance-sheet value further must be worth targeting, and not just once they get into collections. Many institutions have worked through identifying the profile of persistent debt customers at 18 months and then working out how to identify and manage down those with a high propensity to be still in persistent debt at 36 months.

What we don’t see is widespread evidence of systematic ‘in production’ policy, analytics, decision and process.

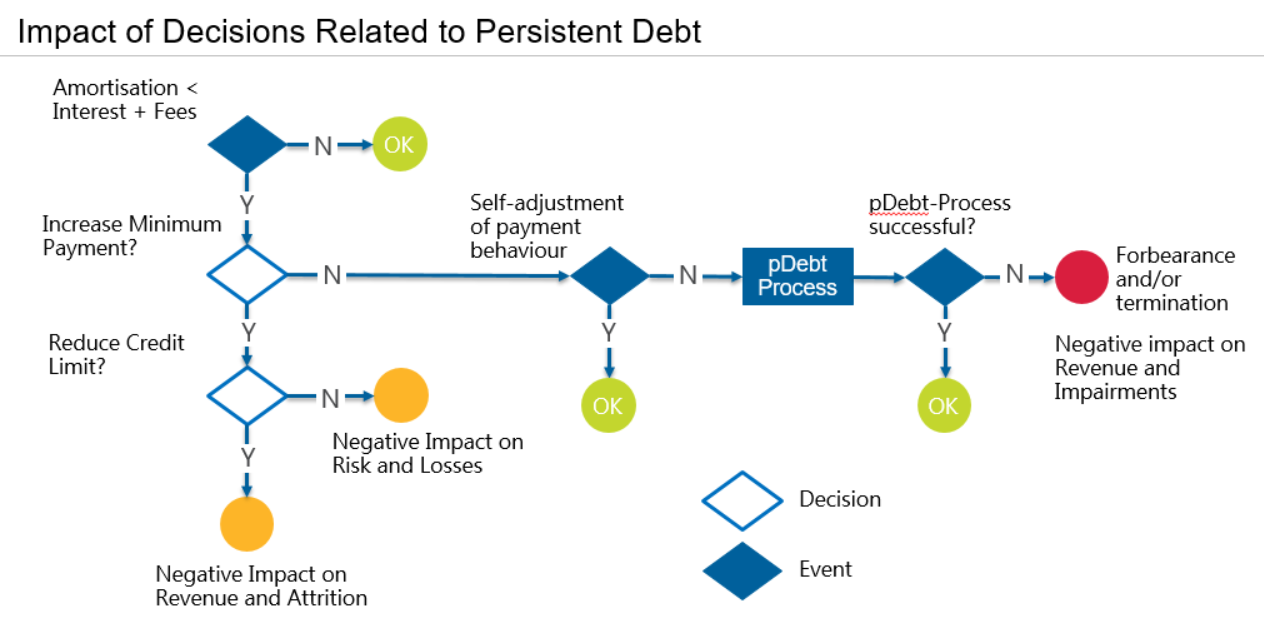

At a recent FICO meeting, colleagues and I walked through what we did not see and mapped what we felt would be needed for any organisation, in the UK or out, that was truly looking to understand and effectively manage its pre-delinquent, credit-stressed and high-cost-of-credit customers. The decision tree below seems appropriate.

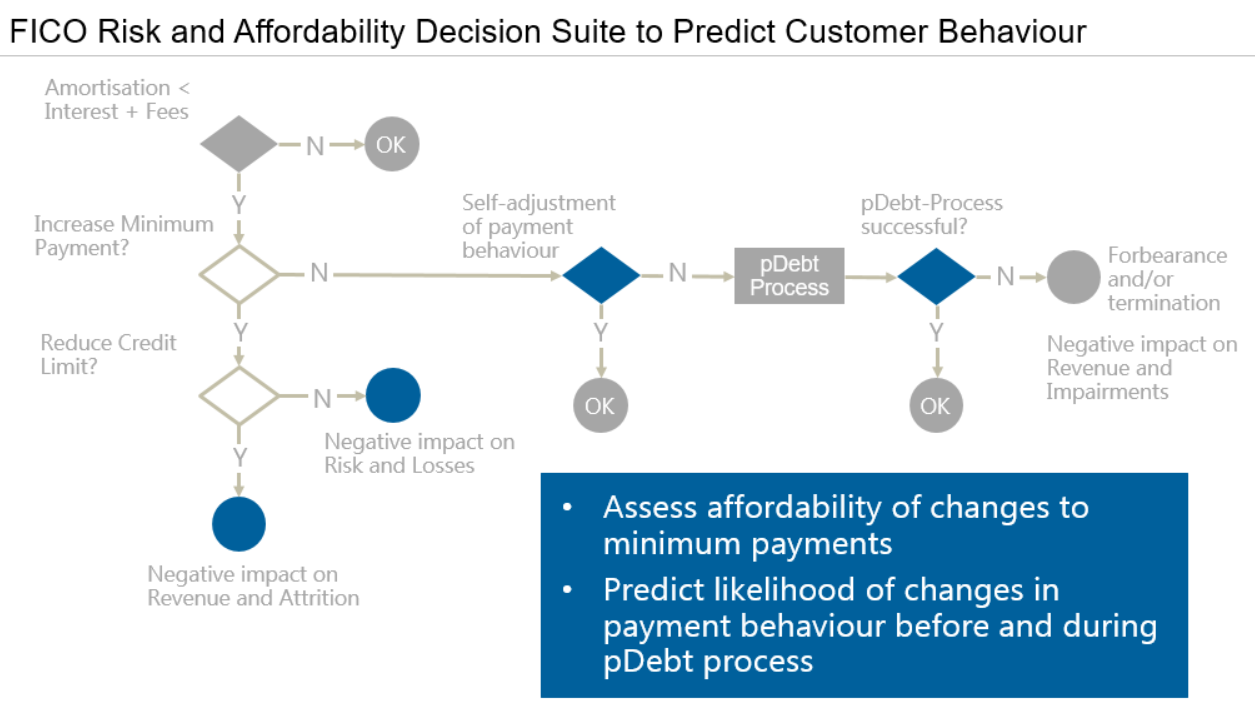

When there is a clear executable process that can be triggered at any point in the customer lifecycle, then you can truly comply and compete. In order to do that, your process must include sound predictions of customer behaviour. For example, it could include the FICO Risk and Affordability Decision Suite.

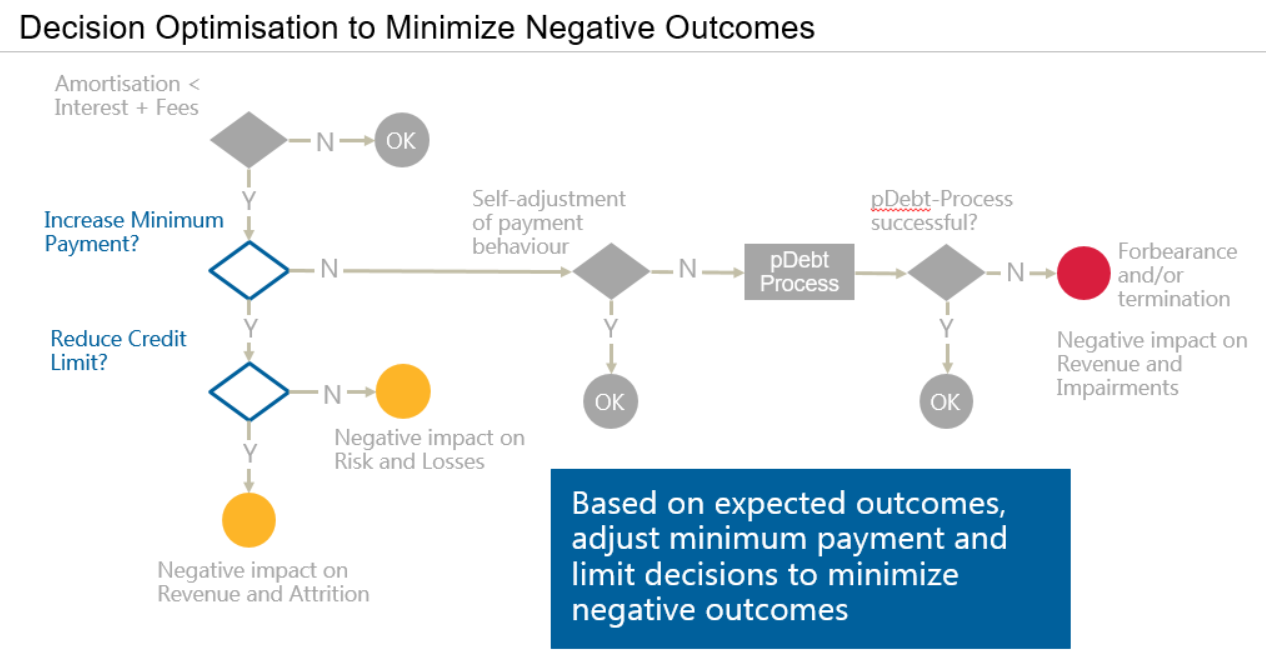

Once there is robust predictability of customer behaviour, you can get a clear line of sight on the commercial impacts of treatments, which can be achieved with optimisation.

Once commercial implications are known, then strategic decisions can be made for both the customer and the portfolio.

So, whilst a raft of proven capabilities exist across the analytics and technology spectrum to determine and execute the most appropriate treatment, we haven’t yet seen these analytics deployed in many of the EMEA countries. Until we do, I expect to see high static rates in early collections, impairment increasing to levels that threaten product profitability, struggling collections operations — and, no doubt, an increasingly prescriptive regulator.

IFRS 9

IFRS 9 does not allow any tolerance for those not totally on top of avoidable losses. Whether true loss or through impairment, organisations need to really push their data science teams to address the customer in the round and provide those in collections and recovery with forensic-level insight on how customers arriving in collections need to be managed and what the outcomes are likely to be. Anything less and organisations face a risk of haemorrhaging customers and losses.

Those organisations where Finance, Risk, IT and Operations are collaboratively joining the dots of multiple challenges, and working through how to put the required solutions into production, will soon see a clear competitive advantage.

If you’re not there yet, it’s time to move faster. Merger and acquisition activity will increase over the next couple of years, and organisations need to decide if they want to be an acquirer or an attractive target.

The post Managing Persistent Debt, Static Delinquency and IFRS 9 appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.