Making Debt Restructures Work When Interest Rates Rise

Blog: Enterprise Decision Management Blog

Debt restructures are an important tool to address financial hardship. The toolkit can include measures such as arrears capitalisation, term extension, interest reduction or even a haircut on the outstanding balance. When applied appropriately, a restructure serves both the debtor and the creditor. From a debtor perspective, the instalments become more affordable. From a creditor perspective, the reduced instalment amounts increase the likelihood of the payments to happen, and hence increase the Net Present Value of the loan. Applied correctly, restructures ensure a right outcome for all.

Many organizations struggle with the idea of compromising on the contractual payment terms. Concerns include the risk involved, “rewarding” customers who don’t perform, and “giving up” money that is contractually owed. However, the realistic alternative to a restructure frequently is not that the customer sticks to the original agreement, but that the customer defaults, is charged off and that only a low percentage of the balance is recovered. Not having an appropriate restructuring toolkit can hence be expensive.

By contrast, a well-governed restructuring framework increases the value of the restructured loans by increasing the likelihood that the new payment schedule is actually affordable and met by the debtor, even if compromising on contractual terms. To address the risk of over-restructuring, evidence should be sought for the customer’s financial hardship, and the available income of the debtor should be thoroughly assessed.

Additional challenges arise in markets with increasing interest rates, as many organisations impose policy restrictions that virtually prevent reasonable debt restructures. A policy rule we frequently see in such markets is that the restructured loan needs to be re-written with the current interest rate, which can be much higher than the original interest rate of the loan. This can defeat the purpose of the restructure — to reduce the monthly financial burden of the customer. It is specifically the case for medium- to long-term products such as mortgages and auto loans, where the interest part of the instalment dominates amortization during the majority of the lifecycle of the loan.

Asking for More Can Be Expensive

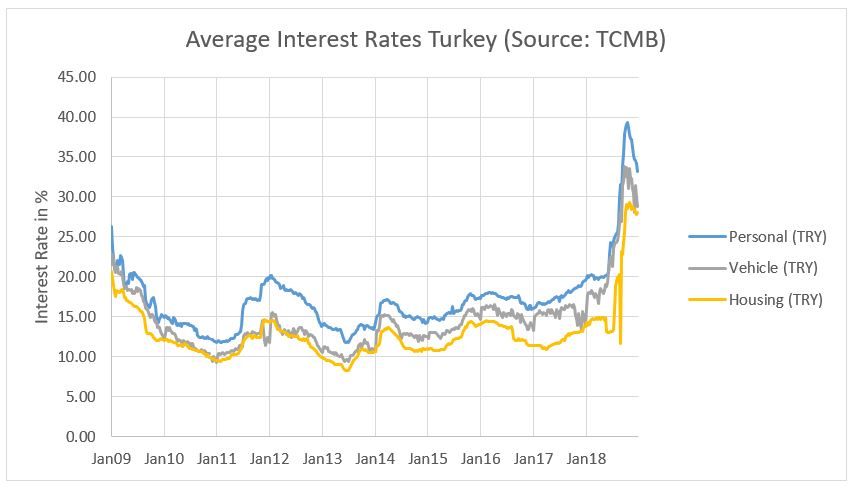

As an example, mortgage interest rates in Turkey have been between 10 and 15% during most of the past 10 years, but on the back of the devaluation of the Turkish Lira recently they shot up to 25% and more.

A customer who took up a 10-year mortgage at 12% will have initially spent 70% of the instalment on interest. By the time the interest portion of the instalment is down to 50%, the customer will be more than 50 months into the contract. This means that in a period when interest rates have doubled, every customer who is into the mortgage for less than 50 months will need to spend the previous instalment amount or more just on interest, if the current interest rates are applied.

This defeats the purpose of the restructure and consequently prevents the creditor from increasing the likelihood of the payments. In a market with increasing interest rates, creditors insisting on applying current interest rates effectively remove debt restructures from their collections toolkit, which is likely to result in higher default rates and more losses.

Using Analytics to Solve the Problem

Analytics can help to shape appropriate restructuring tools even in difficult market conditions. By modelling the likelihood of a re-default of a restructured account depending on the restructure terms, we are able to quantify the financial impact of a restructure.

Mathematical optimization can help to develop an optimal restructure strategy, considering the goals and constraints of an organization. Analytics and optimisation can also help to reduce the risk of unsuccessful debt restructures, which fail within the first couple of months and therefore do not address the risk situation effectively. Finally, optimization provides a tool to simulate performance of a restructured portfolio under given constraints, and helps to shape restructure solutions and policy rules that really create value.

The post Making Debt Restructures Work When Interest Rates Rise appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.