Leveraging Alternative Data to Extend Credit to More Borrowers

Blog: Enterprise Decision Management Blog

You may have heard that alternative data holds great potential for expanding access to credit to more consumers to help them achieve their financial goals. Indeed, more data can enable credit score providers like FICO to provide a more complete snapshot of consumers’ credit behavior and potential risk. While FICO has been the leader in developing innovative ways to incorporate new and regulatory compliant alternative data into credit scores, there are still barriers to fully unlocking the potential of alternative data.

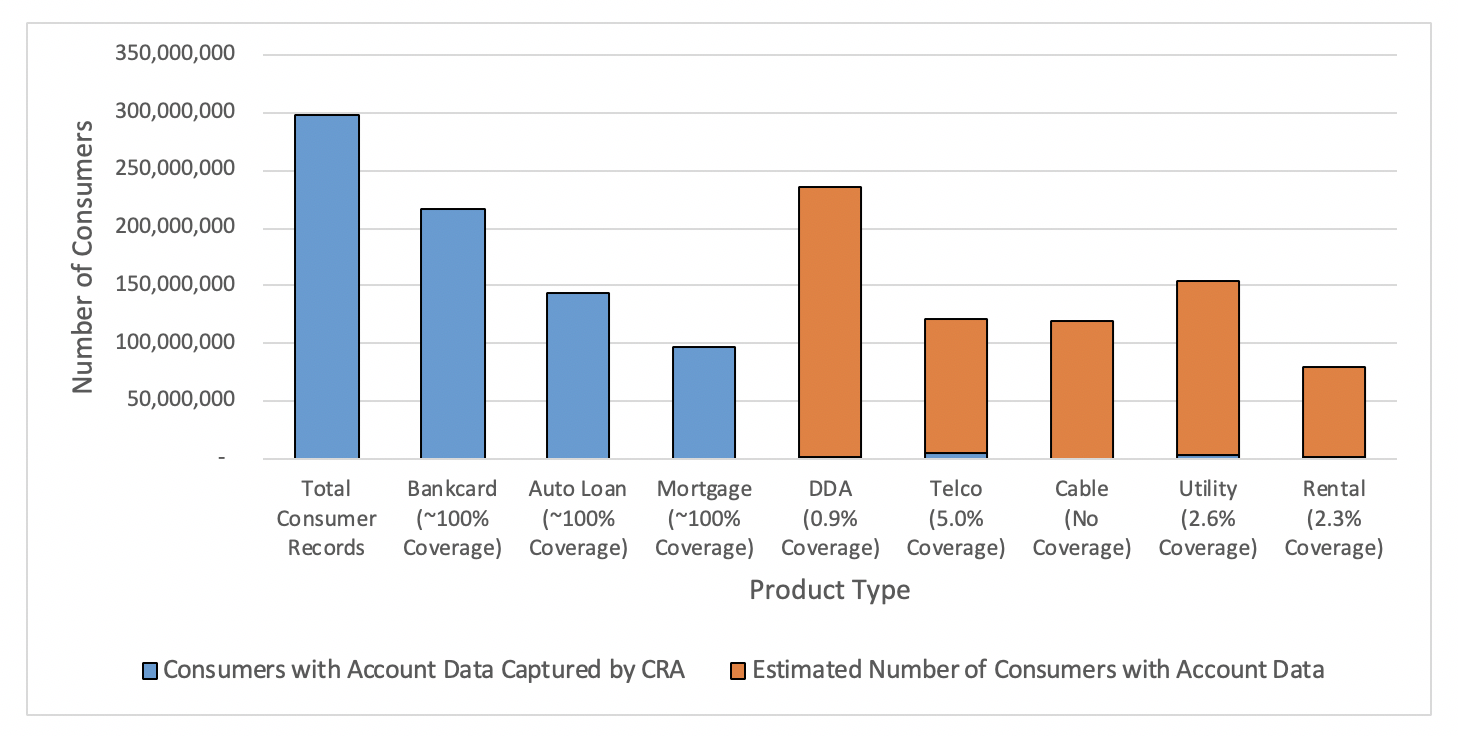

Due to the confusion around this issue, it’s important to be clear about what constitutes alternative data. In our view, for data to be considered “alternative data”, it means that the data is not part of the traditional consumer credit files maintained by the three largest credit bureaus (Equifax, Experian and TransUnion). The credit bureaus do maintain utility, cell phone and/or rental data and the FICO® Score has used this data for many years. The problem is that this type of data in traditional credit files is sparse, with utility data present for just 2.6 percent of consumers and cell phone bill data for just 5 percent of consumers. Instead, to reliably increase credit access, scoring must look beyond the traditional bureau files to include alternative data.

In the U.S., roughly 28 million consumers have insufficient data in their credit bureau file to meet the minimum criteria for calculating a FICO® Score (at least one credit account open for six months or more, and at least one accounted reported to the credit bureau within the past six months). Another 25 million consumers have no credit bureau file at all. But just because someone doesn’t have a FICO® Score, it doesn’t mean they’re not credit ready. Instead, innovative analytic firms such as FICO are investing in identifying new predictive and compliant data sources to build models that accurately assess if underserved borrowers are in a position to successfully take on a new credit obligation. Gathering and analyzing these new forms of data to build new credit scoring models allows lenders to make better decisions and extend credit to these consumers within their credit risk guidelines.

FICO is a longtime leader in incorporating available data into our credit scoring models. Telecommunications and utility data have been included in the FICO® Score formula since the first model was released in 1989, while rental data is incorporated into more recent models like FICO® Score 9. We’re also pioneering the use of new forms of data, alternative data: With FICO® Score XD, which takes into account positive and negative telecommunications and utilities data and public record information not available in traditional credit files, millions of U.S. consumers with sparse or no traditional credit files can now be scored reliably and have the opportunity to receive offers of credit.

The promise of these new data sources points to the primary barrier to incorporating telecommunications, utility and rental payment data into broad based credit scoring models: the limited availability of that data in traditional credit bureau files. In the U.S., 92 percent of consumers have cell phones, but just 5 percent of consumers have telco data in their traditional credit bureau files. The story is similar for rental payments: of the roughly 80 million U.S. adults who live in rental housing, just 1.8 million (2.3 percent) have a rental trade line reported in their traditional credit file.

For these types of accounts, furnishing the data to the credit bureaus is voluntary and comes with significant responsibilities and hurdles. Thus, the best way to truly increase the use of alternative data is to make sure that the data is accessible to third-party analytic firms, like FICO, to assure a competitive market. Incorporating new forms of data into a credit score also requires that the data be accessible, a good predictor of credit behavior and compliant with all laws governing consumer credit evaluation. For newer forms of data, FICO uses a six-point test to determine whether the data is worthy of inclusion in a FICO® Score model.

To be more inclusive and meet the demand for greater access to credit for worthy consumers, FICO is making considerable investments in exploring new data sets and model development, including through the use of checking, savings or money market account data contributed by consumers to enhance the predictiveness of their score based on proven indicators of sound financial behavior. Note that demand deposit account (DDA) data such as this is estimated to exist for nearly 250 million Americans, but is found in less than 1 percent of traditional credit bureau files. Our testing has found that as many as 15 million U.S. consumers without sufficient credit history to generate a FICO® Score can now be scored reliably through the use of this DDA data.

Alternative data holds tremendous potential to responsibly expand access to credit. But it’s not simply a matter of flipping a switch and having readily available data suddenly incorporated into a credit score. Considerable resources go into establishing a reliable supply of consumer behavior data and ensuring the data is compliant, accurate, unbiased and predictive of credit risk. Introducing new data has a real impact on a consumer’s credit profile, so we must diligently test the new data’s impact on credit scoring models.

As the independent standard in credit scoring, FICO has been a longtime leader in leveraging innovations in scoring to responsibly expand access to credit, and we will continue to advocate for solutions that both help more Americans responsibly access credit and preserve the safety and soundness of our lending system.

The post Leveraging Alternative Data to Extend Credit to More Borrowers appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.