Insurers around the globe are prioritizing hyper-personalization

Blog: Capgemini CTO Blog

Lately, I have been seeing many businesses accelerate their efforts from personalization to hyper-personalization to keep up with consumers’ head-spinning adoption of everything digital. Firms that took their time to understand the millennial mindset are redefining and consolidating their digital strategies as tech-savvy characteristics initially assigned to the under-age-40 crowd now span generations, genders, and geographies.

Customer preferences are evolving

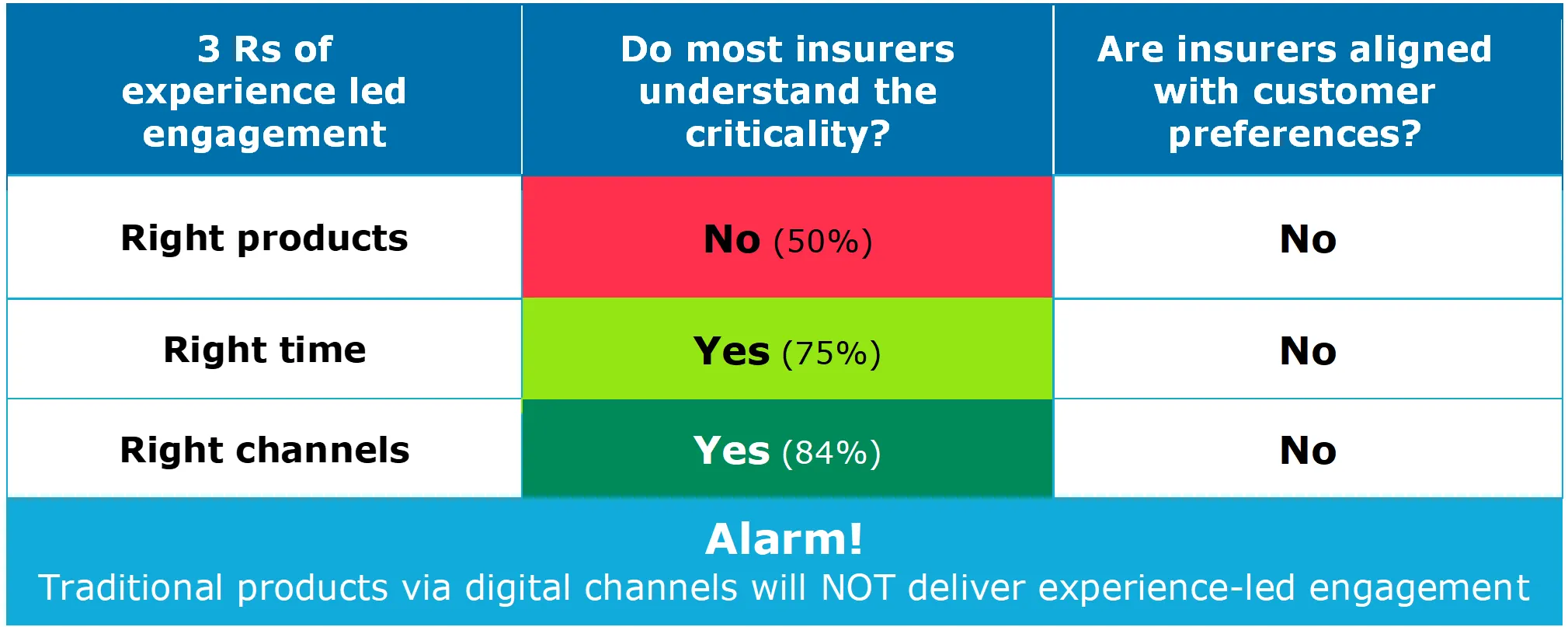

And when it comes to the insurance industry, today’s priority is a well-defined hyper-personalization strategy that focuses on the 3 Rs of experience-led engagement ‒ delivering the Right products, at the Right time through the Right channels.

Hyper-personalization has taken center stage as policyholders expect customized offerings/services from insurers through the channel of their choice and at an appropriate time. Some insurers received a wake-up call from a World Insurance Report 2020 survey that identified a significant gap in customer expectations and insurer offerings.

The survey shines a light on insurers’ perception of policyholder experience versus actual CX, which links to service and customized and relevant product offerings. More than half of the insurers we surveyed said they did not understand why product relevance was critical for customers.

The 3 Rs gap in customer expectations versus insurer offerings

I believe it’s time for traditional insurers to revisit their strategy and consider an agile ecosystem that includes third-party service providers, partners, brokers, agents, and InsurTechs. But where to start?

Let’s begin by reviewing the multi-pronged fundamentals of engagement:

Delivering the right products: How do we deliver relevant products/offerings to customers?

For instance, lockdowns related to the current pandemic scenario and new work-from-home norms find many of us storing our vehicles in garages, yet we continue to pay premiums even though the risk is significantly lower than when we were taking to the streets.

Insurers that leverage customer data to derive intelligence will have a competitive advantage. A comprehensive data capture, transfer, and processing strategy will help achieve desired results.

Today’s insurers can gain real-time insights from IoT devices and can leverage NLP-based support systems for efficient data capture. They can use advanced analytical techniques for smarter data analysis, and apply intelligent process automation to achieve significant operational efficiency. A 360-degree customer view is a pre-requisite for proposing relevant products and services. On-demand and usage-based insurance are examples likely to experience growth soon.

Reaching customers at the right time: There are critical events in life when it makes sense to think about buying insurance. These can include situations in which they are about to make a high-cost, high-value purchase, during financial/tax planning, or during important life events such as marriage or retirement.

Timing can be everything for insurers, particularly when it comes to targeting customers effectively. Agents/brokers empowered with digital tools can leverage intelligent sales strategies. Assessment of a policyholder’s life stage simplifies cross-selling other insurance products. And, leveraging AI helps to track external data about incidents in a policyholder’s life.

Right channel: While there are significant differences in distribution preferences across geographies and products, most customers turn to insurers’ websites and mobile apps before making a purchase decision. The right channel strategy will enable customers to research the firms that best meet their requirements and then translate this information into a purchase decision.

There is no magic potion or a one-size-fits-all solution. It is up to each firm to redefine its customer engagement strategy to align with its unique business goals. Feel free to connect with me to exchange ideas about this topic.