India’s Thriving Unicorn Club

Blog: NASSCOM Official Blog

India’s Thriving Unicorn Club

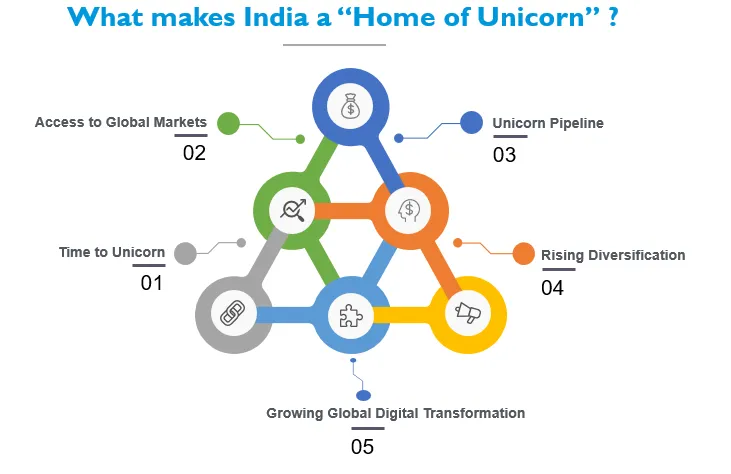

Unicorn has become a buzzword nowadays that too at a time when the world is in the grip of a pandemic. Getting to a billion-dollar valuation is not easy and that too when the market is going through a funding crunch and cautious business activities- these unicorns definitely deserve a big round of applause. With 39 unicorns, India ranks 3rd in the total number of unicorns globally. India added 2nd highest number of unicorns (12) in 2020 after USA. But everyone must be wondering what makes India a hub of unicorns and its record-breaking creation of unicorns every year.

Time to Unicorn: Average time for a start-up to turn unicorn in India is 7-8 years which is at par with the global standards. China leads the race in this with an average time to unicorns as 5-7 years followed by USA with average time of 6-8 years.

Access to Global Markets: Global market has offered huge opportunities to Indian start-ups. If we talk specifically about unicorns, ~50% of them are already working for global markets and this share is 67% of start-ups which turned unicorn in 2020. These numbers clearly show the scalability which overseas market has given to Indian start-ups to turn them unicorns.

Unicorn Pipeline: Unicorns today must have been soonicorn or potential unicorn someday and that rise in potential unicorns list has been impeccable in the past few years. There are 55+ start-ups with more than $50mn in total funding out of which 23 start-ups have raised over $100mn in funding deals. Also, 1.5X growth is observed in the base of start-ups with more than $50mn in total funding from 2019.

Rising Diversification: Start-ups in India are showcasing vast diversifications:

- Unicorns are emerging in diverse sectors like – Automotive, EdTech, Advertising & Marketing Tech, SCM & Logistics & Food Tech

- Rising share of SaaS Unicorns (6) in the list.

- One third of Unicorns added in 2020 are based out of Hyderabad, Pune, Chennai

- 18% of all Unicorns as of 2020 are based outside Bengaluru, Delhi NCR, and Mumbai.

Growing Global Digital Adoption: Access to the global market is incomplete unless the market is ready to adopt new technology solutions built by Indian start-ups. This acceptance is directly related to the growing digital adoption/transformation which was already happening from the past many years but accelerated after the pandemic. As per a recent 2020 executive survey1:

- 90% of companies are prioritizing an increase in capital allocation towards digital transformation

- 75% of organizations are likely to make considerable investments in IoT and app and web-enabled markets

- 73% of organizations are likely to make considerable investments in machine learning

Other than the points mentioned above, India’s changing reforms and policies towards start-ups and various initiatives by the government have also favored the Indian start-ups to scale. Last but not the least, Indian entrepreneur’s zeal to expand and grow.

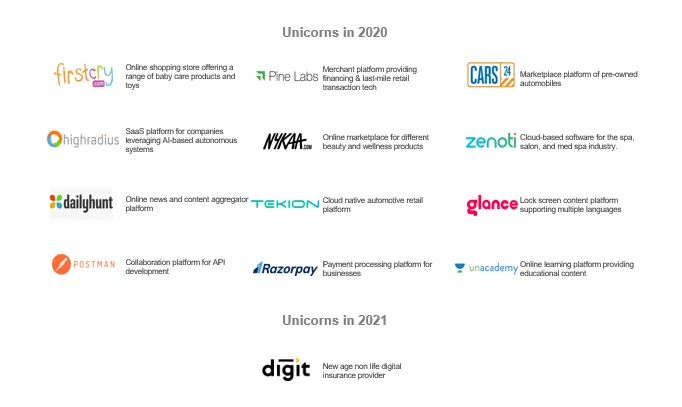

If we go by current predictions, India is on track to have 50+ strong Unicorn club by 2021. 30 of 38 active Indian Unicorns achieved $1Bn+ valuation in last 3 years. Our potential Unicorn pipeline of start-ups with more than $50Mn+ in cumulative funding is also at an all-time high with a majority of them reporting growth during 2020, with a few already reporting $1Bn+ valuation in secondary markets. As investments return and markets stabilize, we anticipate India to add at least 9-11 Unicorns in the calendar year 2021.

Source: Yourstory, Inc42, 1EY, NASSCOM Start-up Report 2020

The post India’s Thriving Unicorn Club appeared first on NASSCOM Community |The Official Community of Indian IT Industry.