Increasing consolidation will lead to rapid digitalisation

Blog: Solitaire Consulting Blog

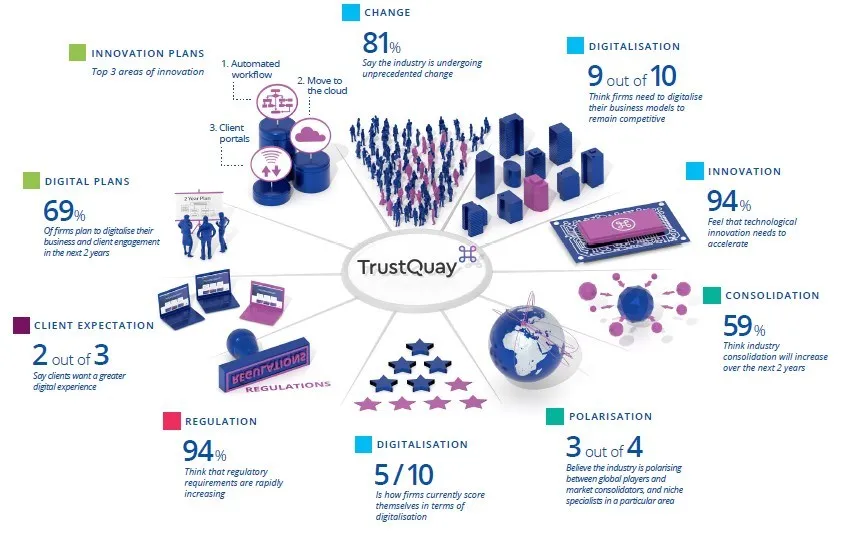

A new survey from TrustQuay finds:

- 81% say the industry is undergoing unprecedented change

- 59% think industry consolidation will increase over the next 2 years

- 3 out of 4 believe the industry is polarising between global players and market consolidators, and niche specialists in a particular area

- 9 out of 10 think firms need to digitalise their business models to remain competitive

- The top 3 areas of innovation over the next 5 years: automating workflows, moving to the cloud and implementing client portals

TrustQuay has announced the release of its Future Focus Report, a new survey which reveals a rapidly changing industry in which firms need to digitally transform their business models in order to adapt to a new environment of increasing consolidation and polarisation, and to meet the rising demands from regulators and end clients.

In a global survey of 90 wealth managers, private banks, family offices, corporate services providers, trust and fund administrators, the survey found that 81% of respondents felt the industry is undergoing unprecedented change. The current highly fragmented industry is expected to consolidate at an even faster pace, with 59% of respondents predicting that consolidation will increase over the next 2 years, with 41% of those surveyed saying that they also expect their own firms to increase levels of M&A activity.

In tandem with consolidation, polarisation is accelerating, with three-quarters of survey respondents saying they are seeing an increasing divide between larger global players or market consolidators and those which are specialists in niche markets and service areas.

Compared to many industries, even those within financial services, the corporate services, trust and fund administration market lags far behind in terms of digitalisation, often still relying on highly manual and labour-intensive working practices. This is reflected in the survey with an average ranking of 5 out of 10 in terms of how far firms felt they had progressed on their digitalisation pathway. However, two-thirds of respondents rated their firms as low as 6 or under, with a quarter rating themselves 4 or under on the digitalisation scale.

The need to improve efficiencies was almost

TrustQuay

unanimously recognised, with 98% of

respondents agreeing that operational efficiency

is becoming increasingly important, with 59%

agreeing strongly.

In terms of regulation, 94% of those surveyed felt that regulatory requirements are continually increasing as a result of the ever-rising tide of regulation since the global financial crisis which, combined with a drive for transparency, has constantly increased the regulatory and compliance burden on firms.

The survey also found that expectations of end clients are rising, with 2 out of 3 respondents saying their clients want a greater digital experience and, as a result, 69% of firms now plan to digitalise their business and client engagement in the next 2 years.

In response to these challenges, 94% of those surveyed felt that technological innovation within the industry needs to accelerate, with 50% of them agreeing strongly. The top 3 areas of innovation identified by the industry over the next 5 years will be automating workflows, moving to the cloud and implementing client portals.

Commenting on the survey findings, Keith Hale, Executive Chairman of TrustQuay, said: “The significance of this increasing consolidation and accelerating polarisation of providers between global consolidators and niche specialists cannot be underestimated and is driving a once in a generation change in the industry. Our prediction is that in the next 5 years the industry will shrink from thousands of players to hundreds, coalescing around a small group of global players, alongside specialist firms who focus on a specific niche market or product offering. As a consequence, the current middle tier of providers will be squeezed into one camp or the other.

“Digital transformation is a real challenge but will become a key enabler for firms to provide levels of service efficiently and a high-quality digital customer experience. The industry digital offerings currently lag far behind other sectors and so the pressure is on to digitally transform in a much more compressed time frame than has happened in other sectors of financial services.

“One area where we expect to see a rapid increase is the roll-out of interactive client portals as part of corporate service and trust digital offerings. These portals should provide end clients with a secure but intuitive window onto all the rich data the service providers already have in the core system or systems. With the ever-increasing demands of digital-native clients, it is impossible to think that those firms who don’t provide this access will have viable and competitive business models 5 years from now.

“Despite the challenges, this time of unprecedented change can be a great opportunity for those firms who are able to successfully adapt to change. But firms need to act now – in 5 years’ time the successful firms will have already digitally transformed and the industry will look back at 2020 as a turning point for the future growth and opportunities in corporate services, trust and fund administration.”

To access the full report, please click here: TrustQuay Future Focus Report

The post Increasing consolidation will lead to rapid digitalisation appeared first on Solitaire Consulting Limited.