How Intelligent Automation increases turnover in the financial sector

Blog: AuraQuantic Blog

One of the most innovative and ambitious ways to approach business digital transformation is through intelligent automation. i.e. automating the maximum number of processes using diverse technologies like Business Process Management (BPM) to manage business processes and Robotic Process Automation (RPA) to relieve employees from carrying out routine and repetitive tasks.

If we also use Artificial Intelligence (AI) to convert all the data in our CRMs or ERPs into business intelligence and improve decision making, all that’s left is to integrate everything to place ourselves in front of the most competitive companies. In addition, this will result in an increase in turnover.

Let’s take a closer look at the case for financial services.

Intelligent automation increases the productivity of a company since all the processes involving people, systems and data work with the precision of a Swiss watch. Times and costs are reduced. In fact, according to PWC, in the financial services sector process costs can be reduced by 15% simply by eliminating manual and repetitive tasks.

Likewise, the loss of data and errors attributable to human failures are reduced. This ensures strict compliance with current legislation on such sensitive issues as data protection (for example GDPR).

So far, the financial services sector has used RPA solutions to improve productivity and reduce costs, achieving employee cost savings of anywhere from 10% to as much as 25%, according to the report “Rise of the Machines: Automating the Future” by Morgan Stanley. These savings could rise to 50% by implementing RPA plus AI technology.

GREATER BUSINESS VOLUME

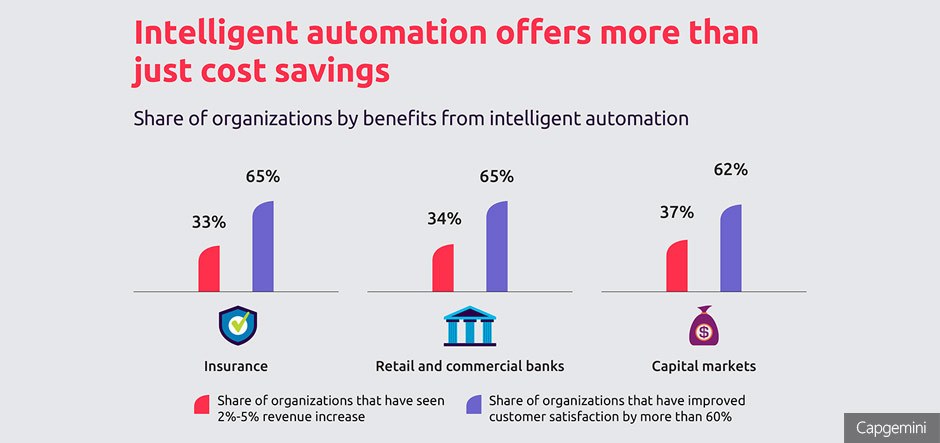

The main financial services companies have gone a step further and not only reduced costs, but also increased their revenues by putting the customer at the center of their strategies. Thus, according to the study by Capgemini Digital Transformation Institute, over a third (35%) of financial services players have seen a 2%–5% increase in topline growth thanks to intelligent automation.

They have achieved this increase in turnover thanks to faster time to market and an improved cross-selling strategy. Customers see products and services that respond to their needs quicker and more easily than before.

And of course, intelligent automation has also contributed to improving customer satisfaction by increasing brand loyalty, increasing customer retention and renewal of contracted products and services.

As we can see, the implementation of intelligent automation solutions, in addition to the usual cost savings and increased productivity, contributes to a greater volume of business. This is all thanks to new technologies that result in a better service for the end customer.

The post How Intelligent Automation increases turnover in the financial sector appeared first on AuraPortal.

Leave a Comment

You must be logged in to post a comment.