How Do FICO Scores Bounce Back After Negative Credit Info Is Purged?

Blog: Enterprise Decision Management Blog

In the depths of the Great Recession, tens of millions of consumers had lapses in meeting their credit obligations. Some seven years down the line, those missed payments are being purged from credit reports in accordance with the Fair Credit Reporting Act, and these consumers may now be looking at a clean (or at least cleaner) slate.

To find out how the FICO® Scores of these consumers might be impacted by this negative information being purged, FICO conducted research on a random representative sample of the 28 million US consumers who had a serious delinquency (defined as 90 or more days past due) between 2009 and 2010. This sample was divided into two groups:

- Those who had a delinquency removed from their credit report between May 2016 and July 2016. We’ll refer to this group, which numbers about 6 million nationally, as the “delinquency purge” population.

- Those who did not have a delinquency removed from their credit report between May 2016 and July 2016, presumably because their delinquencies were removed either before or after the May-July period. We’ll refer to this group, which numbers about 22 million, as the “delinquency baseline” population.

Our top findings were:

- The removal of a serious delinquency was correlated with positive score movement. The average score in the “delinquency purge” population increased 14 points, while there was no change in the average score in the “delinquency baseline” population.

- Consumers who had all of their remaining serious delinquencies removed between May 2016 and July 2016, which we’ll call the “full recovery” population, had even higher positive score movement, with a 33-point increase in the average score.

How Much Do Scores Improve?

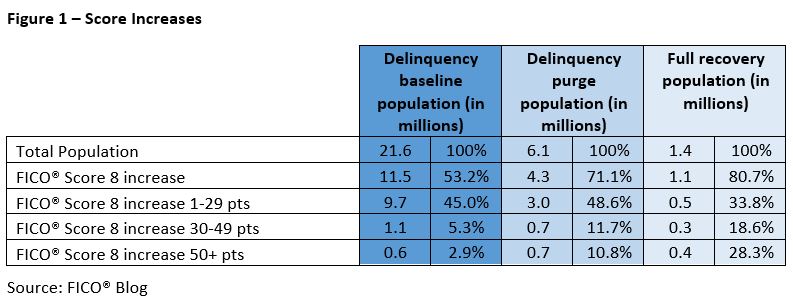

In Figure 1, we see that on the “delinquency baseline” population, 53% of consumers had a score increase between May 2016 and July 2016. 45% of the population, the vast majority of the score increasers, had a relatively modest score increase of 1-29 points, while just 3% had a score increase of at least 50 points.

Consumers in the “delinquency purge” population were more likely to have a score increase, and more likely to have a large score increase, but the overall impact was still fairly modest. Even in this group, many more consumers had moderate score increases of less than 30 points than large score increases of 50+ points. From May-July 2016, 71% of consumers with a delinquency purge had a score increase, 49% had a score increase of 1-29 points, and 11% had a more sizeable increase of at least 50 points.

Some 22% of those consumers in the “delinquency purge” population were part of the “full recovery” population. These consumers tend to have much larger score increases: 28% have a score increase of 50 or more points, compared to just 11% of the “delinquency purge” population.

Why Don’t Scores Rise More?

In the “delinquency purge” population, 29% of consumers had no score change or a score decrease, despite the removal of a major negative item from their credit report. This may seem unusual, but keep in mind that we’re examining score change over a three-month window, so the score change is not due solely to the purged information. A lot can happen – a new delinquency, or running up credit card balances, for example.

We also suspect that the impact of the removed delinquencies is reduced by two main factors:

- The FICO® Score gives considerable weight to how recently the delinquency occurred. If a consumer’s removed delinquency was from 7 years ago, its impact was already diminished compared to a very recent delinquency.

- Some of these consumers have other, more recent serious delinquencies or derogatory information on their files, which means the removal a serious delinquency would not improve their score a great deal.

Do These Score Rises Improve Credit Availability?

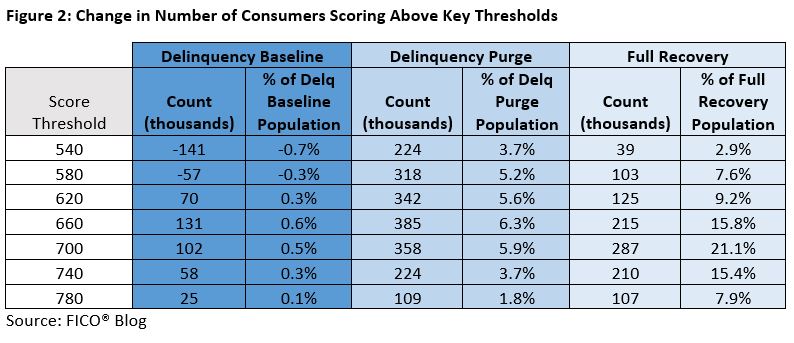

Credit availability would increase if the consumers’ score rises resulted in the consumers now meeting lenders’ baseline score thresholds. Figure 2 shows the movement of consumers across some key score thresholds that relate to common score cutoffs for lenders.

In the “delinquency baseline” population, movement over these thresholds is relatively infrequent. In the “delinquency purge” population, larger volumes of consumers are crossing each of these thresholds, yet the increases are still relatively small, with volumes in the hundreds of thousands. For the higher thresholds, we can see that the majority of the increases come from the “full recovery” population. For example, the proportion of consumers scoring above 700 in the “delinquency purge” population increased by 5.9 percentage points. Yet most of these additional consumers — 287,000 out of 358,000 — belong to the “full recovery” population, who have a much greater tendency to cross these score thresholds. “Full recovery” consumers have put the credit struggles from a period of extreme economic stress behind them, re-established credit, demonstrated responsible management of that credit, and have experienced higher FICO® Score increases as a result.

For those with financial distress over multiple years (who have other serious delinquencies that have yet to be purged), we anticipate that FICO® Scores will increase similarly when those delinquencies are purged. In the next blog post in this series, we’ll assess whether these different groups of consumers have differing appetites for new credit.

The post How Do FICO Scores Bounce Back After Negative Credit Info Is Purged? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.