How Credit Actions Impact FICO Scores

Blog: Enterprise Decision Management Blog

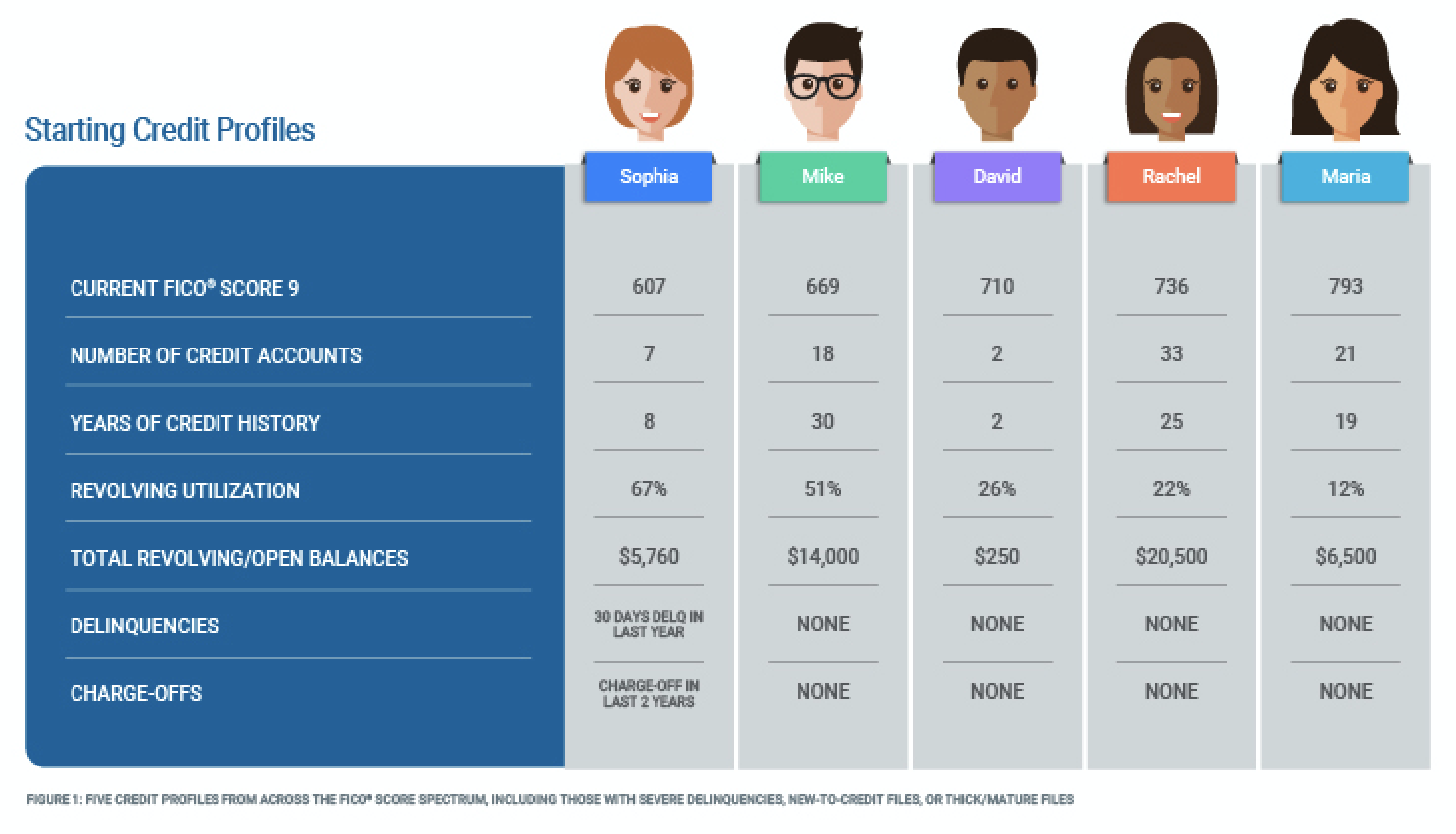

How much does missing a payment impact a FICO® Score? What about reducing credit card balances? New FICO research simulated how different credit events may impact FICO® Score 9 for five different credit profiles, as seen in Figure 1 below. These representative profiles were selected because they had credit characteristics (payment history, utilization, etc.) that were generally typical of the five score categories considered.

Sophia has the only profile with delinquencies, and she also has the highest revolving utilization. Since payment history (35%) and amounts owed (30%) represent the 2 most important categories of the FICO® Score, she unsurprisingly has the lowest FICO® Score of the group. David has a thin file and is relatively new-to-credit, while Mike, Rachel, and Maria all have thick and mature files with varying debt and utilization levels.

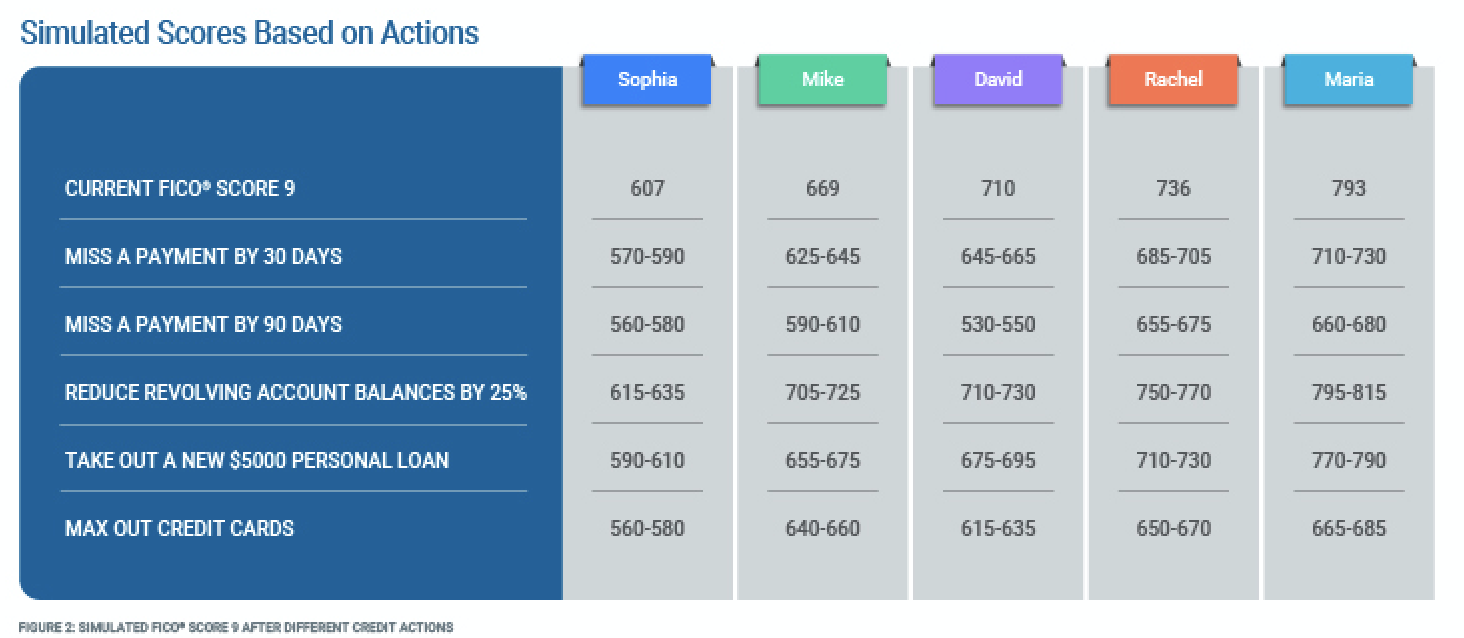

The key takeaway of the results of five different simulations (Figure 2) is: The impact to FICO® Score of a given credit action is highly dependent on the starting credit profile of the consumer.

A FICO® Score measures credit risk based on a credit file at a single point in time. So when considering why a score changed from a particular credit event, it’s helpful to consider what the credit file looked like before and after the event. If the credit file indicates significantly greater (or lesser) credit risk than before, then a FICO® Score will change more than if the credit risk is similar before and after the credit action.

Here’s a breakdown of how the FICO® Score 9 change varies based on these profiles:

- Missed payments typically have a greater impact on those with clean files – Not surprisingly, missing a payment has a substantial impact on a FICO® Score. All five individuals see a substantial loss of points when they fall 30 days behind on a payment, and lose even more points when it hits 90 days past due. We see that Mike and David would lose more points for the same missteps as Sophia. That’s because Sophia’s lower score of 607 already reflects her riskier past behavior of missed payments. So, the addition of one more indicator of increased risk on her credit report is not quite as significant to her score as it is for Mike and David – who have no reported previous history of delinquency. The impact is even greater for David, who has just two credit accounts and only two years of credit history reported. Since David is relatively new-to-credit, he does not have as much positive information on his credit report to “soften” the impact of missed payments.

- Increasing revolving debt typically has a greater impact on those with lower utilizations – Revolving balances and utilization is also heavily weighted by the FICO® Score. David, Rachel, and Maria see large score drops when they max out their credit cards – especially Maria, whose starting credit utilization percentage is relatively low. Sophia and Mike’s scores decrease as well, but less so since they already have medium to high revolving utilization percentages and that risk is already factored to a degree into their starting score. Conversely, paying down debt would help all five individuals, as their score increases when reducing revolving balances by 25%. Mike has the most to gain from this action given his higher starting credit utilization percentage and lack of late payments. Sophia’s ability to increase her score in the near future is limited by the recent delinquency and charge-off on her credit file.

- Opening new accounts typically has a greater impact on thin/new-to-credit files – Opening up new credit may affect the FICO® Score as it usually results in an inquiry posting and a newly open credit account being reported. This could impact the length of credit history (15% of the FICO® Score calculation), search for new credit (10%), and credit mix (10%) categories of the FICO® Score. This action had the biggest impact on David, as he is bringing on a new credit obligation to a new-to-credit profile. As David and the other individuals demonstrate over time that they can successfully manage the new credit, any negative score impact from opening the new account will decrease.

While this study provides good benchmarks of potential score impact from various credit actions, keep in mind that that this research was done only on select consumer credit profiles. Given the wide range of credit profiles that exist, results may vary beyond what’s in the table above. Still, this analysis clearly illustrates how the same action can have different impacts to a FICO® Score depending on the starting profile. That’s because the change in credit risk represented by these actions is different for each profile.

The post How Credit Actions Impact FICO Scores appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.