How Automation is Changing the Banking Industry

Blog: ProcessMaker Blog

Automation is nothing new in the banking industry. We first saw automation take hold with the first automatic teller machine (ATM) in 1969. Since then the ATM paved way for the banking industry to focus more on customer service and other banking needs. With the invention of the internet and cellphone came mobile banking, further dissipating the need for tellers to do basic tasks like withdrawing money or account inquiries. Now, with the advancements in AI and machine learning, what does the future hold for the banking industry?

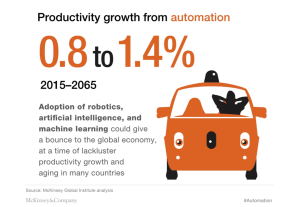

Automation in terms of productivity

Since the Industrial Revolution, automation has had significant impact on economic productivity around the world. In the current Fourth Industrial revolution, automation is improving the bottom line for companies by increasing employee productivity. The repetitive tasks that once dominated the workforce are now being replaced with more intellectually demanding tasks. This is spurring redesigns of processes, which in turn improves customer experience and creates more efficient operations.

Automation and robotics to improve processes in banking

While automating functions in finance is enticing as a concept, CFOs need a clear understanding of what kind of tasks can be automated. Research from the McKinsey Global Institute concludes that 40 percent of financial activities such as cash disbursement, revenue management, and general operations can be fully automated. Furthermore, some finance institutions are exploring a category of automation technology called robotic process automation (RPA) that can automate transactional tasks at scale.

There are four streams of RPA:

- Highly customized software streams that will work with only certain types of processes.

- The slow lane which involves web scraping.

- The second lane in which a template is provided and programmers design the robot.

- The fast lane is enterprise software that is reusable and can be scaled.

The key to getting the most benefit from RPA is working to its strengths. RPA helps perform redundant tasks quickly without error. Tasks such as reporting, data entry, processing invoices, and paying vendors. Financial institutions should make well-informed decisions when deploying RPA because it is not a complete solution.Choosing the right type of tasks to automate is critical to success. Some of the most popular applications are using chatbots to respond to simple and common inquiries or automatically extract information from digital documents. However, the possibilities are endless, especially as the technology continues to mature. A lot of the tasks that RPA perform are done across different applications, which makes it a good compliment to workflow software because that kind of functionality can be integrated into processes.

Another way to extend the functionality of RPA with exponential returns is integrating it with workflow software to automate processes end-to-end. Workflow software compliments RPA technology by making up for where it falls short – full process automation. Integrating RPA capabilities into workflow software means that financial institutions can automate entire workflows, like customer support requests and loan approvals, to eliminate human intervention where it is needed the least. For example, a customer interaction with a chatbot can trigger a support ticket or application process in workflow software without the customer entering a brick-and-mortar location or tying up staff. This way, human resources can be reapplied to tasks that are more integral to the company. The right workflow software can mean the difference between a financial services company that is efficient and customer-oriented and one that with outdated processes that will eventually put it at a competitive disadvantage.

Automation in terms of jobs

It’s no secret that the rise of automation means that some current jobs will eventually be displaced. According to the Financial Times, Micheal Corbat, CEO at Citigroup said that digitalization could help eliminate tens of thousands of jobs at call centers. Adding to that sentiment is the Chief Executive of Deutsche Bank, John Cryan: “In our bank we have people doing work like robots. Tomorrow we will have robots behaving like people. It doesn’t matter if we as a bank will participate in these changes or not, it is going to happen.”

The other side

While many analysts are predicting that there will be massive layoffs, others see a different side to the story. One such analyst, Kallum Pickering, stated “Producers will only automate if doing so is profitable. For profit to occur, producers need a market to sell to in the first place. Keeping this in mind helps to highlight the critical flaw of the argument: if robots replaced all workers, thereby creating mass unemployment, to whom would the producers sell?”

The future of automation

The future of banking is automation. the deciding factor is if a financial institution can implement the processes accordingly. As Leslie Wilcocks, professor of technology, work, and globalization at the London School of Economics’ department of management, states:

“In the longer term, RPA means people will have more interesting work. For 130 years we’ve been making jobs uninteresting and deskilled. The evidence is that it’s not whole jobs that will be lost but parts of jobs, and you can reassemble work into different types of job. It will be disruptive, but organizations should be able to absorb that level of change. The relationship between technology and people has to change in the future for the better, and I think RPA is one of the great tools to enable that change.”

As a part of the fourth industrial revolution, it seems inevitable that RPAs will inevitably revolutionize the financial industry. Banks are faced with the challenge of using this emerging technology effectively. They will need to redefine the relationship between employee and systems and anticipate how best to use the new freedom RPA affords its people.

The post How Automation is Changing the Banking Industry appeared first on Open Source Workflow & BPM Blog.

Leave a Comment

You must be logged in to post a comment.