HELOC Resets: Here We Go Again?

Blog: Enterprise Decision Management Blog

In my last post, I shared new FICO research on home equity line of credit (HELOC) resets. The good news: after examining credit performance of HELOCs older than 10 years, we found little evidence that HELOC bad rates increase dramatically after their reset dates.

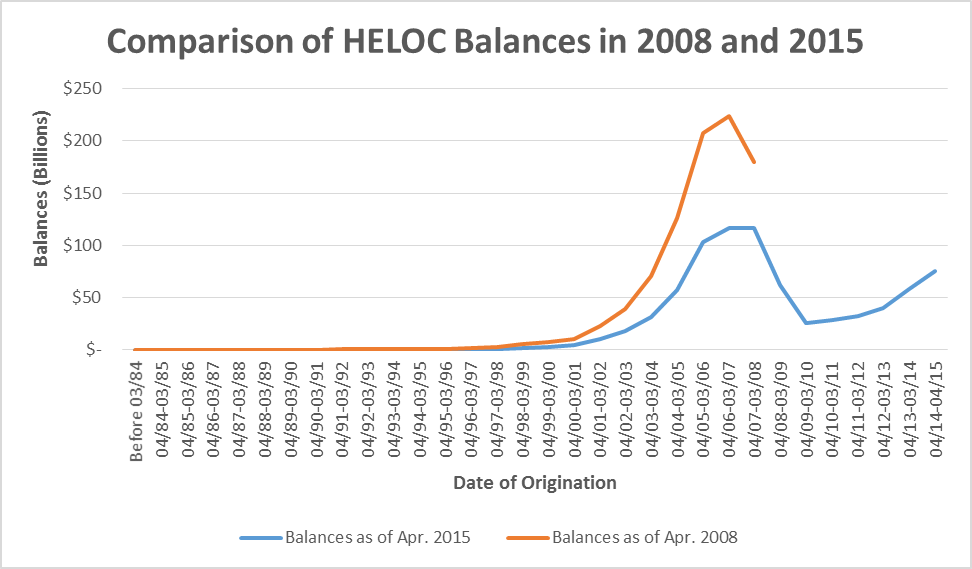

However, our research uncovered a potential new concern: with the US housing market recovering, consumer appetite for HELOCs appears to be increasing again. Consider the current balances of HELOCs by the year booked:

As house prices fell during the Great Recession, significantly fewer HELOC loans were booked. However, as house prices recover, consumers are once again taking advantage of these loans in large numbers, as shown by the increase in the blue line in the graphic above.

In the past year, we find balances on HELOCs similar to what was booked in 2003. While recent HELOC growth is slightly less pronounced compared to the years prior to the recession, there is no question that HELOC balances are accelerating – just as they did prior to the recent housing crisis.

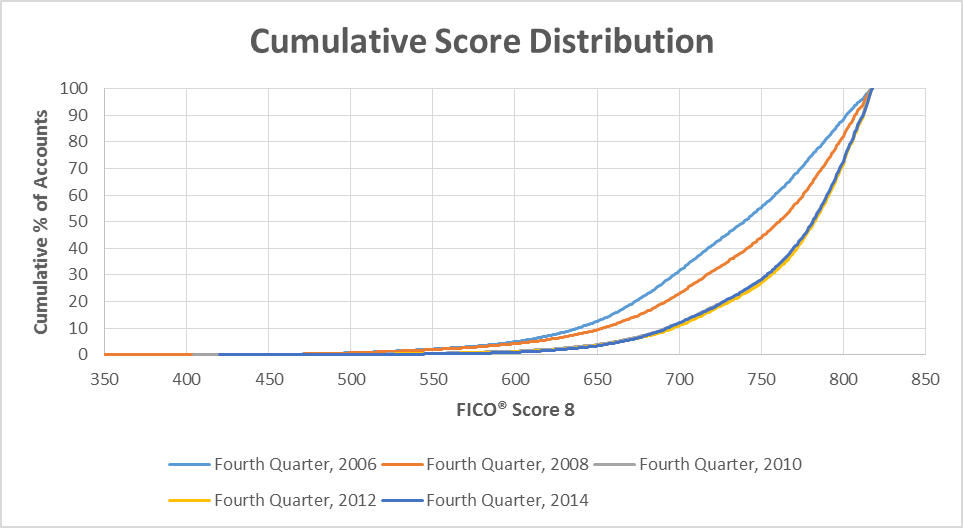

Interestingly, the growth appears to be the result of greater demand and increasingly available equity, not loosening credit criteria. Banks have not changed their credit standards much since 2010, at least when measured by the FICO® Scores of those being approved for new HELOCs. The following chart shows that while the FICO® Score distribution on consumers approved for new HELOCs clearly shifted upwards from 2006-2010, the distribution of this population since 2010 has remained notably consistent.

Nevertheless, increased leveraging of home equity was part of what made the last housing downturn so steep, and may well be a leading indicator of possible troubles ahead in the home loan industry. Consequently, FICO will continue to keep a close eye on the performance of HELOCs and other second mortgages.

As the appetite for HELOCs appears to be increasing again, millions of consumers may be drawing nearer to a position where they are over-leveraged against the value of their property. In the near term, this could cause problems for any regional markets facing downward housing price pressures and/or economic stress on the local job market. In my next blog post, I’ll share research on whether there are any regions that may fit this bill and be at risk of overheating.

The post HELOC Resets: Here We Go Again? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.