HELOC Resets: Cause for Concern?

Blog: Enterprise Decision Management Blog

Worries about widespread home equity line of credit (HELOC) resets have been growing slowly but steadily in recent years.

Over the next few years, HELOCs granted to millions of US homeowners prior to the Great Recession will reach their 10-year mark, which is when the bulk of HELOCs “reset” – that is, they become closed-end loans, and any remaining balance must be paid off in the following years. When these lines of credit convert from interest-only to principal + interest, consumers will likely see significant increases in their monthly payments. While some may refinance into another loan, there is concern that those who do not refinance may charge-off at increased rates.

As a result, the banking industry faces a potential double-whammy of larger volumes of HELOCs hitting their reset dates, along with greater loss rates on those larger volumes. With that in mind, we undertook a research study to better understand the scope of the issue and HELOC credit performance.

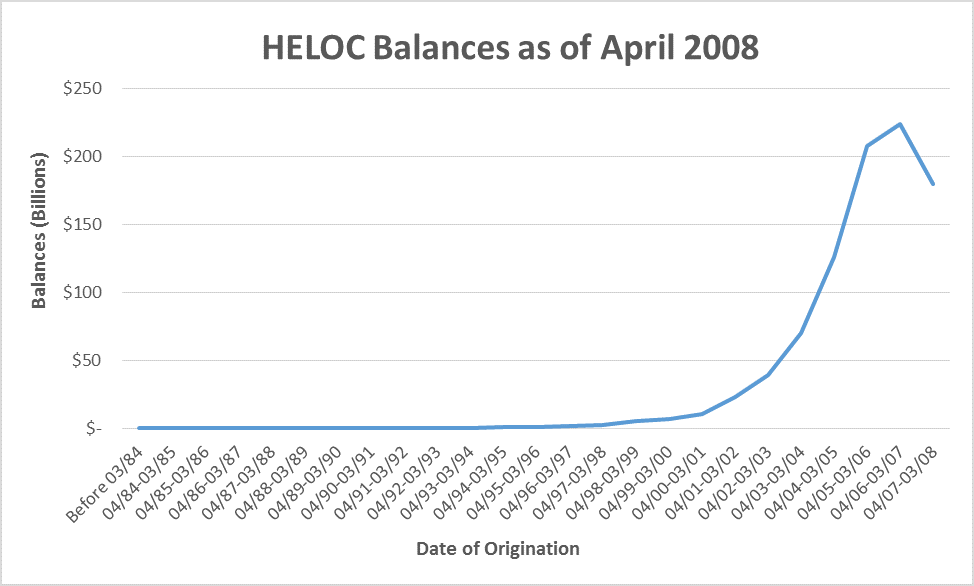

The following chart shows the total balances of HELOCs as of April 2008 based upon a random 5% credit bureau sample of the total US population. Note the dramatic upswing in HELOC volume prior to the Great Recession:

In April 2008, there were $903 billion in outstanding HELOC balances. A majority – $557 billion – was booked in the three-year pre-recessionary period between April 2004 and March 2007.

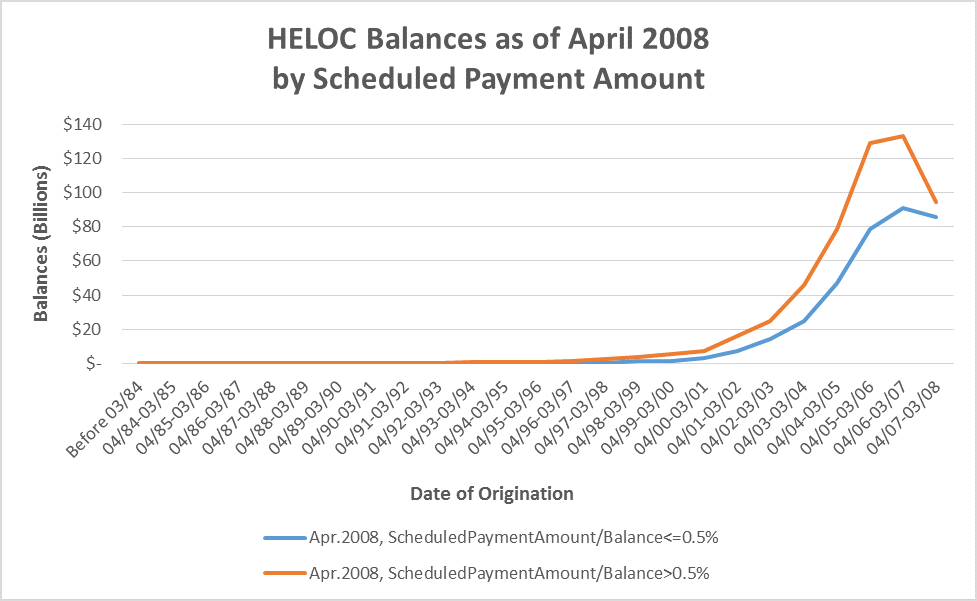

Next, we divided this population into two groups to take a look at those with higher versus lower monthly payments. We used the ratio of the most recent month’s scheduled payment to the balance of the loan at month end and divided them into two roughly equally sized groups, which occurred at a payment rate of 0.5% of the balance.

In the higher interest environment near the on-set of the recession, the majority of loans booked prior to March 2007 were scheduled to pay more than 0.5% of their balances each month.

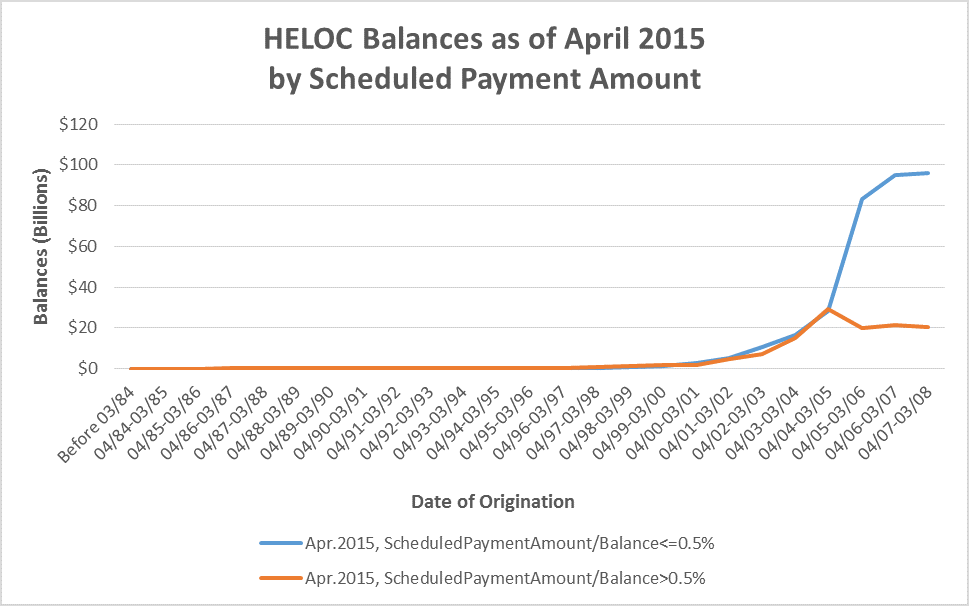

Here is how the balances on those two groups look now:

Some $468 billion in outstanding balances remain on HELOCs booked prior to April 2008, of which $227 billion was booked between April 2004 and March 2007. Looking at loans less than 10 years old, the vast majority have a scheduled monthly payment of less than 0.5% of the balance.

But once HELOCs hit the 10-year reset point, monthly payments usually increase, and our research shows that the gap in outstanding balances between the high and low payment groups disappears. Therefore, there is good evidence that HELOC borrowers are indeed paying more and/or refinancing as their accounts hit the reset date.

Higher monthly payments are, of course, an added financial burden to consumers. With so many HELOCs hitting their reset mark, it begs the question: do HELOCs that continue beyond their reset date have a drop in credit performance?

I’ll answer that in my next post and, over the coming weeks, delve into other key research findings from this HELOC study. Stay tuned to our blog.

I’d like to gratefully acknowledge the help of intern Lingling Peng in conducting this analysis.

The post HELOC Resets: Cause for Concern? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.