Government Collections Analytics: 3 Ways To Collect More Money

Blog: Enterprise Decision Management Blog

The business of collecting debt is getting more challenging. The current environment where debtors don’t pick up the phone or answer the mail has made collections even more difficult. And people who owe you money, likely owe money to many others and you are challenging for your fair share. It used to be if a department had a strong collection system they could collect their fair share. Now, that is just table stakes. The following article from Dataconomy discusses how government collections analytics are needed to truly increase collection performance. In addition, new collection strategies that take advantage of this analytics are needed which enable you to work smarter, not harder in order to collect more money using cost-effective strategies.

Government Collections Analytics: Predictive Models – Who will Self-Cure

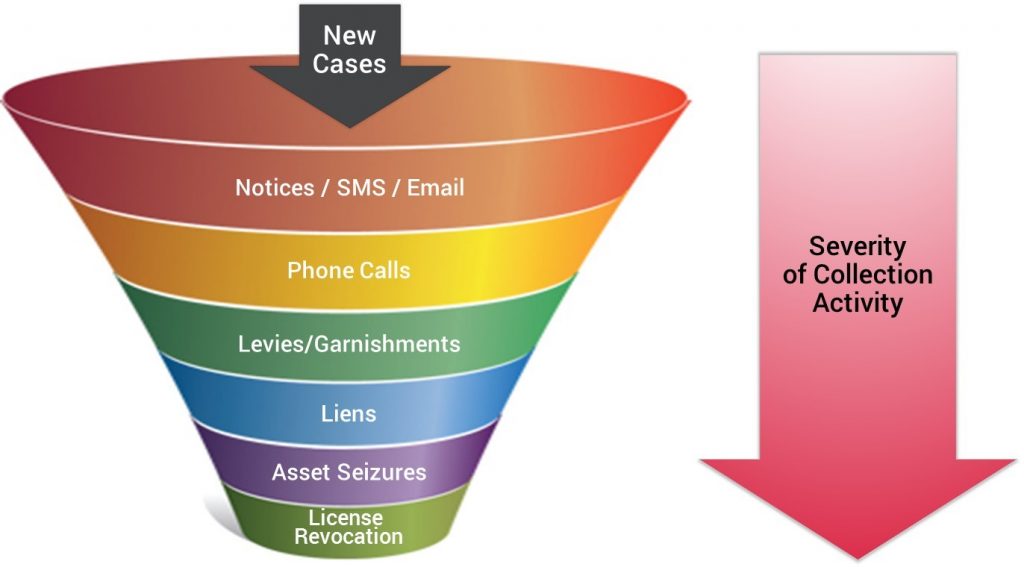

All of us who have worked in the collections industry understand that different strategies work for different customers (“debtors”). Some debtors only need to be informed about their debts, some need more direct conversations about the bad things that will occur if they don’t pay, some may require multiple communications across multiple channels, while others will require even more intense collection activities.

The challenge and opportunity for debt collectors is to predict which strategy or strategies will work best for each individual debtor before attempting collection. The more intrusive the action, the more it likely costs to collect the liability and the greater the negative impact on the debtor. If you know that your lowest cost collection technique is likely to be effective, albeit, after a slightly extended period of time, you would likely be willing to keep that case in an early stage technique longer. Conversely, if you could predict, for instance, that the only way you will achieve collections on a particular case is with your most expensive collection technique, then it would likely drive your behavior on how you treat that taxpayer.

As you can see in the graphic below, the farther you get in the collection process, the more intrusive they become for your debtors, and the more expensive it becomes to collect the debt.

Government Collections Analytics: Moving from Prediction to Optimization.

The goal should be to collect as many cases as feasible and do so at the lowest cost, with the least intrusion to your debtors. That is where government collection analytics and specifically optimization can assist with the collection process. Analytics can predict the likelihood that each step in the collection process will be effective. By collecting with the lowest cost and least intrusive action you can lower your cost of collections, increase the amount collected, and reduce debtor complaints.

By moving from predictive analytics to optimization, you can further maximize your results by having the models take a more holistic view of your operations. Optimization takes each case and expands to look across your full inventory of cases, taking into account your constraints (staffing, practices, budgets) to determine how best to allocate your resources (staff and budget) across the full inventory to achieve the best overall outcome.

Some workloads are required by statute or contract, these represent activities you must perform. Once those tasks are assigned, it is typically up to the collections management to allocate the remaining resources. Optimization and analytics can help you define the best use of those resources to maximize your output. While seasoned managers can use their experience and intuition to make those assignments, optimization models have been proven to deliver higher performance outcomes. This likely represents millions of dollars in increased collections, along with reduced complaints and intrusion without additional staff being needed.

Government Collections Analytics: Enhancing your contact strategies using Analytics

Your contact strategies can also be enhanced using analytics. Many behavioral studies have shown that better communications results in more collections. Rather than trying one version of a letter or one set of wordings on an email, text message or verbal communication, organizations should use champion/challenger strategies and analytics to determine the optimal wordings for each taxpayer. Many people are surprised at how minor changes in verbiage can result in measurable increases (or decreases) in collections. Studies have shown that the placement of call-out boxes, simple edits to sentences, and bolding or highlighting words can materially improve collections. Analytics can determine which versions of letters work best for different types of debtors.

For example, behavioral scientists have demonstrated that individuals react more strongly to negative incentives over positive incentives. Whether stated or only thought about subconsciously, people often follow rules because of the perceived consequences of non-compliance. Meaning, someone is more likely to do the right thing when they understand there will likely be penalties from noncompliance than when they are told about the good thing that will happen to them if they do the right thing.

What do I do on Monday morning to begin?

What can you do as a first step? Take inventory of your data available to create analytics. While you can buy pre-built models, custom predictive models using your own data will be more accurate. As part of this effort, you can also review the models you have (if any). How well are they performing? How well are you operationalizing them? What is their performance? Understanding where you are is a good first step as you work to improve.

Once you know where you are, talk to practitioners like FICO. We can help you estimate the improvement opportunities that are available, and develop an estimate for the lift analytics and optimization can help you achieve based on the real experience of similar customers, given your current operations, data, and debt inventory. From here you can make informed decisions on next steps, including an approach to develop and implement models and optimization within your operation.

The post Government Collections Analytics: 3 Ways To Collect More Money appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.