From Abacus to Chief Innovator: The Quiet Revolution Happening in a Finance Department Near You…

Blog: Bizagi Blog

Whilst it has been a while since you will have seen an abacus used in the finance department, many still struggle to keep up with the growing pressures upon them. Whether it’s increased compliance requirements or shareholders demanding more innovation, it’s a siege mentality out there.

So, finance must move with the times but it’s challenged by disconnected systems, organizational barriers and inefficient financial processes. Before we put this in the ‘too hard’ bucket and kick it into the long grass, let’s look again and see what practical steps can be taken.

One such trailblazing organization is Stone Coast Fund Services who are a global hedge fund administrator based in North America. In their line of work, one key aspect they must deal with is creating regulatory reports for their clients. It goes without saying, these must be 100 percent accurate all the time. Yet like a lot of businesses, they were challenged by lots of data silos and offline information. This made it a manual process every time they needed to report on their business transactions. So how were they able to revolutionize their operation in just six weeks?

Standardize, automate and scale up

First things first you must identify what processes need automating. In Stone Coast’s case, they picked ‘cash movement’ as this touched nearly every part of the company. It also had the greatest potential to be handled a few different ways so it was ripe for standardizing. They built a rules engine that mapped to SSAE16 requirements which effectively became a safety net, ensuring consistency in how they reported their client dealings. Scaling to meet demand was important too as there were naturally peak times.

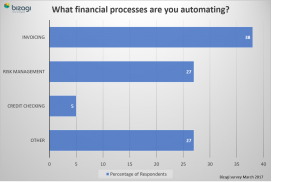

In Bizagi’s own recent survey, we found that most respondents were looking to automate invoicing processes. This might explain the growth in companies looking to take

advantage of distributed ledger systems such Bitcoin, future proofing and anticipating potential compliance requirements down the road.

Lesson learned: Stone Coast realized early on it was important to prioritise. There is a temptation to overstate what can be achieved and risk the project being mothballed before it gets going. They stayed focused on delivering one core process well rather than several averagely so.

Break down silos by investing in end-to-end finance processes

Once you’ve identified what to automate you must map the process in its entirety. TOO HARD ALERT!!

Mapping a process that touches many departments can engender that response but it should act as an incentive to press on. Hard usually means there’s untapped potential. This was true in Stone Coast’s case. Whilst cash movement was a core process it meant everyone had a view on what needed to be done. But everyone saw the potential to rationalize and drive efficiencies.

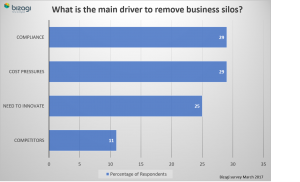

In our survey, we found that 29% of respondents were rationalizing due to compliance or cost reasons. Interestingly, the need to innovate wasn’t far behind these two. This perhaps is a recognition that, to differentiate, it’s just as important for companies to look at long term investment versus any short term gains there are to be had.

Lesson learned: Whilst Stone Coast were primarily looking to meet compliance and regulation requirements, the greater insights achieved also benefitted staff. Whatever the driver, make sure you have a full grasp of all the anticipated benefits to make a strong business case.

Accelerate digital innovation in day-to-day operations

It’s important to take an agile approach starting small and tightly scoping the first phase, as Stone Coast did. Once initial results have been established then it’s important to expand to other processes and iterate to maintain momentum.

Lesson learned: With fast delivery times, it needed complete alignment from senior executives through to the project delivery team to ensure things progressed swiftly and without too many bumps.

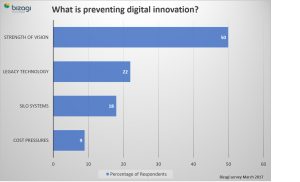

Our survey backs up this view as we found that 50% of respondents said transformation projects fail due to there not being a strong enough connection between the company vision and execution.

Seek new customer insights to generate competitive advantage

Becoming a data driven organization, ensures your people are more informed and effective in their jobs. In turn, they will be more engaged. Engaged employees will improve your customer’s experience tenfold. Happy customers are, generally speaking, loyal customers, win:win.

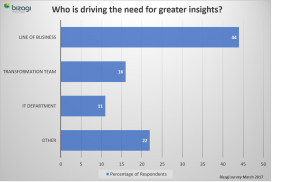

Who is driving this need to be more insights led? Our survey showed 44% of respondents said the demand was coming from the business. This makes sense, these days a CMO or VP of Sales need to be just as tech savvy as IT. Understanding buyer behaviour and transactions makes them more effective in their work.

Lesson learned: Stone Coast saw a huge demand from employees to understand how they were performing. A new level of transparency meant far greater accountability and attention to detail with new reporting in place.

Conclusion

Meet your compliance requirements, build a more data driven business and drive better engagement across the organization all within a quarter. Stone Coast are an exemplar to others, operating in a highly-regulated market, they are doing more than just surviving, they are thriving because of the agile approach they have taken to digitizing their core operations. Finance really has stepped up, revolutionized its operations, helping the business to compete and innovate too.

What next?

If you’re coming to terms with building a finance team to meet the challenge in today’s compliant world. Why not invest the time to listen to our latest webinar with Rob Larson from Stone Coast and our assembled panel, who will share their experiences of meeting these challenges head on.

The post From Abacus to Chief Innovator: The Quiet Revolution Happening in a Finance Department Near You… appeared first on Bizagi Blog – Ideas for Delivering Digital Transformation.

Leave a Comment

You must be logged in to post a comment.