Fraud Detection: Applying Behavioral Analytics

Blog: Enterprise Decision Management Blog

This is the second in my series on five keys to using AI and machine learning in fraud detection. Key 2 is behavioral analytics.

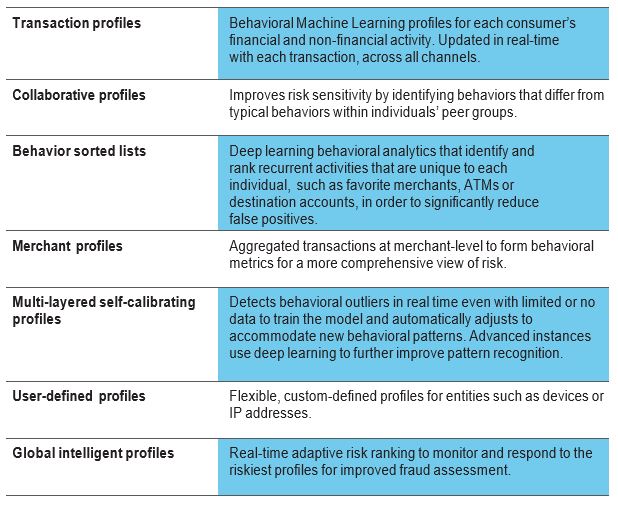

Behavioral analytics use machine learning to understand and anticipate behaviors at a granular level across each aspect of a transaction. The information is tracked in profiles that represent the behaviors of each individual, merchant, account and device. These profiles are updated with each transaction, in real time, in order to compute analytic characteristics that provide informed predictions of future behavior.

Profiles contain details of monetary and non-monetary transactions. Non-monetary may include a change of address, a request for a duplicate card or a recent password reset. Monetary transaction details support the development of patterns that may represent an individual’s typical spend velocity, the hours and days when someone tends to transact, and the time period between geographically disperse payment locations, to name a few examples. Profiles are very powerful as they supply an up- to-date view of activity used to avoid transaction abandonment caused by frustrating false positives.

A robust enterprise fraud solution combines a range of analytic models and profiles, which contain the details necessary to understand evolving transaction patterns in real time. A good example of this occurs in our FICO Falcon Fraud Manager, with its Cognitive Fraud Analytics.

Given the sophistication and speed of organized fraud rings, behavioral profiles must be updated with each transaction. This is a key component of helping financial institutions anticipate individual behaviors and execute fraud detection strategies, at scale, which distinguish both legitimate and illicit behavior changes. A sample of specific profile categories that are critical for effective fraud detection includes:

Key 3 is distinguishing specialized from generic behavior analytics. Watch for that post, and follow me on Twitter @FraudBird.

For more information:

- Review Key 1: Integrating Supervised and Unsupervised AI Models in a Cohesive Strategy

- Download our white paper, 5 Keys to Using AI and Machine Learning in Fraud Detection.

The post Fraud Detection: Applying Behavioral Analytics appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.