Fraud Detection: Adaptive Analytics and Self-Learning AI

Blog: Enterprise Decision Management Blog

This is the fifth in my series on five keys to using AI and machine learning in fraud detection.

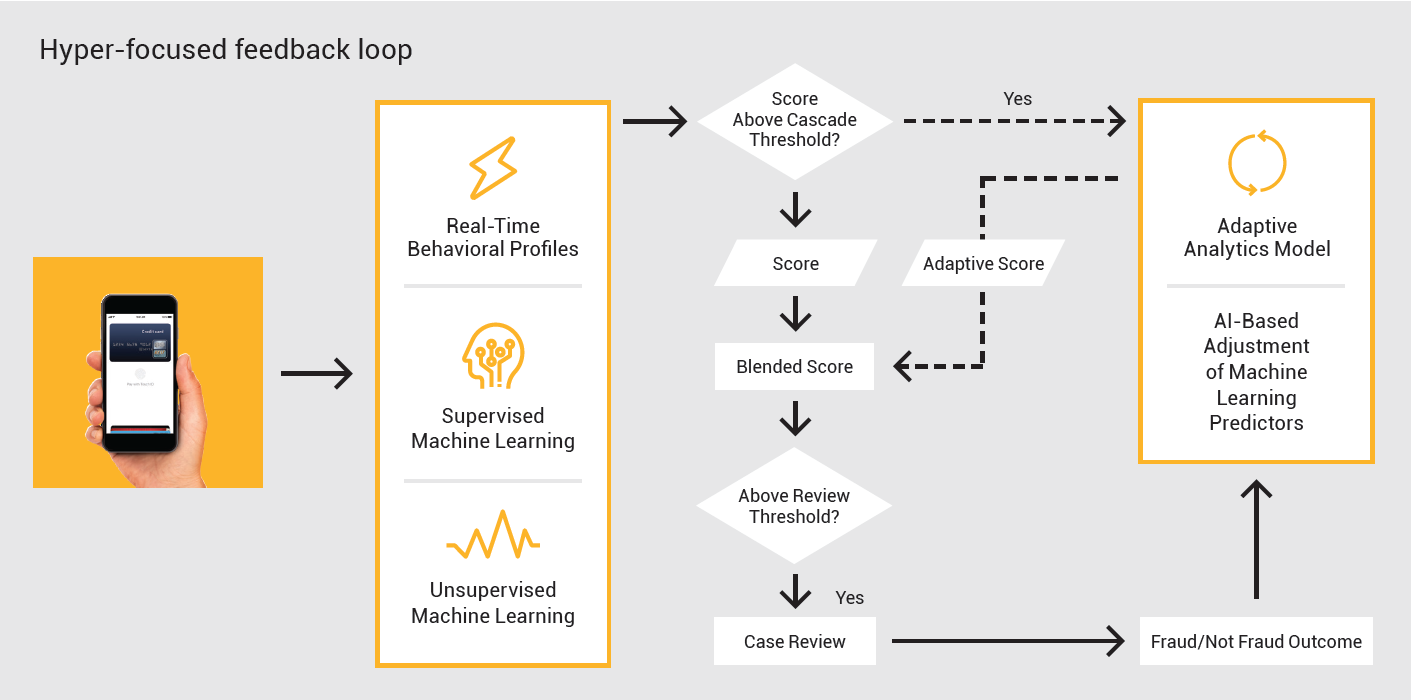

Fraudsters ensure that protecting customers’ accounts is very complex and dynamic, a challenge where machine learning thrives. For continual performance improvement, fraud detection professionals should consider adaptive technologies designed to sharpen responses, particularly on marginal decisions. These are the transactions that are very close to the investigative triggers, either just above or just below the cutoff. It is on these margins where accuracy is most critical as there is a fine line between a false positive event — a legitimate transaction which has scored too high, and a false negative event — a fraudulent transaction which has scored too low. Adaptive analytics sharpen this distinction with up-to-date knowledge of the threat vectors an institution is facing.

Adaptive analytics technologies improve sensitivity to shifting fraud patterns by automatically adapting to recent confirmed case disposition, resulting in a more precise separation between frauds and non-frauds. When an analyst investigates a transaction, the outcome — whether the transaction is confirmed as legitimate or fraudulent — is fed back into the system to accurately reflect the fraud environment that analysts are facing, including new tactics and subtle fraud patterns that have been dormant for some time. This adaptive modeling technique automatically modifies the weights of predictive features within the underlying fraud models. It is a powerful tool that improves fraud detection performance on the margins and stops new types of fraud attacks.

FICO uses adaptive analytics to balance the benefits of a model developed with data from thousands of institutions with the ability to quickly learn unique fraud patterns from an individual institution and boost fraud performance and responsiveness. These adaptive analytics are a critical part of our Cognitive Fraud Analytics.

What Do You Need Besides the 5 Keys?

If properly applied, machine learning and artificial intelligence help provide the foundation for highly effective fraud detection controls. But that’s not enough. Proper awareness is necessary to navigate the haze surrounding these topics and develop a clear strategy that will scale and adapt with your needs.

That’s where we come in! On our website, you can learn more about how machine learning and artificial intelligence can help you prevent enterprise fraud.

Hey, we’re done! You can read more from me on fraud detection on Twitter @FraudBird.

For more information:

- Review Key 1: Integrating Supervised and Unsupervised AI Models in a Cohesive Strategy

- Review Key 2: Applying Behavioral Profiling Analytics in Fraud Detection

- Review Key 3: Distinguishing Specialized from Generic Behavior Analytics

- Review Key 4: Leveraging Large Datasets to Develop Models

- Download our white paper, 5 Keys to Using AI and Machine Learning in Fraud Detection.

The post Fraud Detection: Adaptive Analytics and Self-Learning AI appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.