FinTech meets TechFin – The Future in Focus.

Blog: NASSCOM Official Blog

We have heard so much buzz around FinTech and TechFin bidding against each other on “who will disrupt financial services,” “which is better,” etc. Let us shift our focus from this paradigm to a different outlook. For that, we must first understand the underlying meaning of the above.

FinTech looks at how we do financial services today and deliver it in a better, quicker, cheaper, and more efficient fashion with technology. E.g., PayPal, UPI, etc.

TechFin doesn’t start with the concept of finance or how we do finance today; it begins with technologies we have now and works at how to exchange values(products/services) in a new form in the ecosystem. e.g., Google, Amazon, etc.

The focus should be more on expanding the size of the plate rather than eating somebody’s lunch.

We frequently hear, “we might not need banks anymore.” Don’t we? We might not need banks to make payments, savings we can make payments with other alternative companies., we might not need banks for loans, it can be done through peer-to-peer lending. Financial Services does include the above, but it also adds much more, and the core of banking is being a trusted source of value and intermediary for sharing that value with other institutions that you don’t trust. Financial services being a highly regulated sector, one can’t do away with banks.

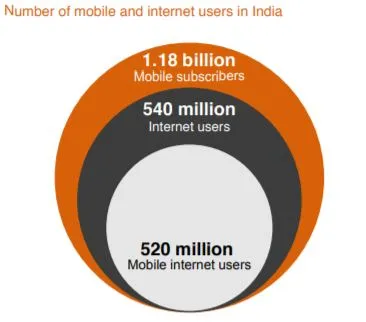

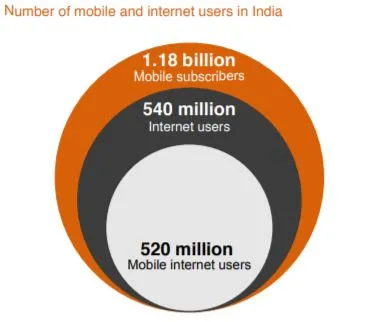

The big thing about technologies is that what we have right now is that we can serve anybody, anywhere and everywhere cheaply and easily with the mobile network so effectively.

Source; PWC analysis

The above diagram talks about India, but there are 7.8 billion people out there on earth and technology can cater them all, the trade transactions all done automatically and quickly in real-time; this could never have been done historically in Industrial Era because we couldn’t serve everyone, the cost of serving people was prohibitive. Right now, we are in a digital era, and technology includes Artificial Intelligence (AI), Blockchain, Automation, Big Data, and many more that can lead to prominent developments, advancement in the sector.

“There are two big opportunities in the future financial industry. One is online banking, where all the financial institutions go online; the other is internet finance, which is purely led by outsiders.” Jack Ma

When you look at it, it’s truly an engagement/enablement of the partnership between “FinTech” and “Techfin” example, Google/Amazon using UPI for payment services, or for that matter WhatsApp pay which is now compliant to all RBI’s data localisation norms is a UPI-based payment service. These Techfin firms are generating a level of trust into a certain segment of customers -one of them are millennials- which was previously reserved for traditional banks, and the result is an increasing percentage of consumers. Home Capital, a Mumbai-based fintech startup, focused on accelerating housing among millennials in India.

“The mind loves competition; The heart loves collaboration” ~ Dr. Amit Nagpal.

There might be a collusion between these two approaches; one is FinTech as the store of value and how they can get user information along with getting innovative about the products. Other is TechFin that has user information, so now how can they innovate and capture store of value. It is immaterial if we talk about FinTech or TechFin, it is going to be a new world where everyone is going to look at it the same way. So, the tech people will have to learn the Fin -Financial Services- and the Fin people will have to learn the Tech -Technology-.

As Financial Services and Technology organizations espouse a broader view of banking, offering both banking and non-banking services, the ultimate winner will be the consumer indifferent to which provider they select.

The coming years hold immense potential for both FinTech’s and TechFin’s to revolutionize the Financial Service landscape and uplift India’s economy by accelerating the consumption. However, success in this digital economy would be dictated by an organization’s inclination to innovate, along with its capability to manage partnerships and organize ecosystems across both Financial Service and non- Financial Service players to provide financial solutions at the point of consumption.

The post FinTech meets TechFin – The Future in Focus. appeared first on NASSCOM Community |The Official Community of Indian IT Industry.