FinTech – Cracking the Millennial Code.

Blog: NASSCOM Official Blog

“Millennials are often portrayed as apathetic, disinterested, tuned out, and selfish. None of those adjectives describe the Millennials I’ve been privileged to meet and work with” ~ Chelsea Clinton

So, what do we know about the millennials?

A Millennial is someone born amidst the years of 1980 and 2000 (opinions can vary). Brought up in the age of instant gratification alongside the era of growing technology, they have been labeled as “Screen addicts,” “Show-offs”, “Liberals” (as if it’s an awful thing), and the list continues…

Let us thwart that mindset with a new perspective. Millennials think differently to Generation X (1961-1980). They tend to see things differently, faster, and the need for speed is faster than Generation X, which has been proven in many ways.

Firstly, Laptop and phone technology have led to various smart apps, the ability to find data quickly. There is an interesting statistic that says that the average attention span of Generation X is 3 mins 20 seconds, and the average attention span of a millennial is under 30 seconds, 29 seconds to be precise. Let’s play this on a personal life situation; if you are driving your car and listening to Spotify, your teenage children in the car are 30 seconds into a song and boom, they change it because they are bored.

London Business School did a study of 21 years old where they were asked how many jobs they expect to have before they were 30. The average was 10, this doesn’t mean they are going to work for ten different companies, but it means that they need to be challenged continuously. Learning the job is the job for millennials, and once they have learned, they want to learn something else.

“The more time you spend considering each groups’ desires and problems, the more likely you are to attract-and keep-them as customers” ~ Borshoff.biz

“How do FinTech trends come to the rescue”?

- Digital Identity – Technology should also be about simplification; its difficult to remember so many passwords. When we talk about digital identity, its supportive digital identity like facial recognition, not any digital identification such as AADHAR, logging in using facial recognition by identifying almost 7000 facial features using AI (Artificial Intelligence), it does simplify your login. Digital Identity also includes Iris scans, biometric, but with facial recognition, we have so much complex data that it is more secure and speedy.

- Precision Underwriting – By precision underwriting what is meant that today because all underwritings are into lending or insurance because of unavailability of data, buffers are added, and the cost becomes higher, which can be eliminated using machine learning and Big data.

- Behavioural Banking – Digital Banking is moving towards behavioral banking. This means, today, digital is a form of service on the phone, laptops, etc. but it is not intelligent enough to understand the behavior of the targeted customer in terms of saving, spending, borrowing pattern. If you look at it, the data is available and if combined with AI and Big Data.

- Neo Banking – As digital natives, millennials seek customized products and services that recognize their financial certainties. That’s where Neo-banking came into the picture and is becoming more popular amongst millennials as compared to traditional financial institutions. Neobanks are the institutions that render checking, a prepaid debit card, and some form of savings account without the conventional brick-and-mortar building.

Neobank is the mobile-first banking experience that has moved away from the traditional banking experience. According to Sujith Narayanan, Co-founder, epiFi (digital banking solution that focuses on young millennial workers), “Neo-banks provide a wide umbrella of financial services that tech-savvy millennials prefer. The convenience of opening and operating accounts, fund transfer, money lending, budgeting, investments, and personalized financial products are some features that are attractive to millennials, micro and small companies, and underbanked or unbanked customers. It also helps them manage their short-term and long-term financial needs from a single hub,”

The question here is,” Why should a business vertical be concerned with this segment of customers.”

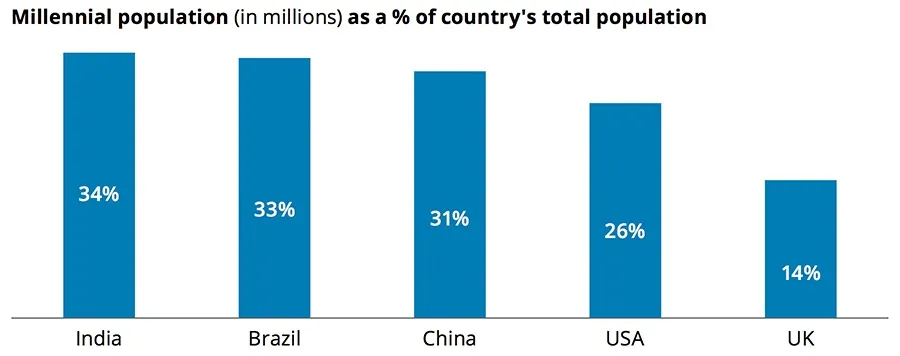

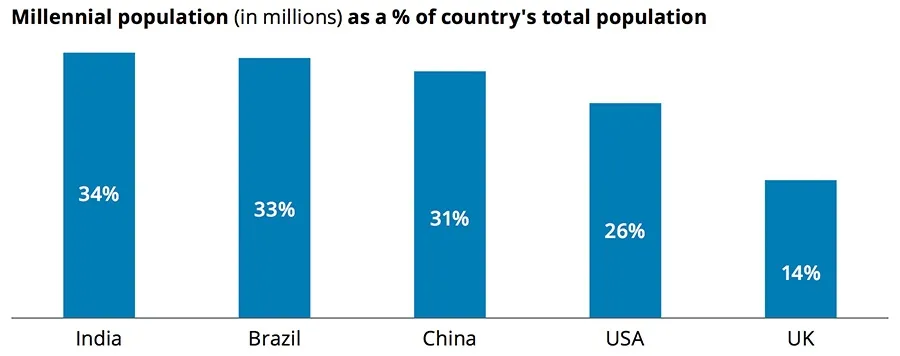

The average age of India is 29 years. The country’s population is around 1.35 billion, and Millennials account for 34% of the country’s population. People are serving their financial needs through only 6% of regulated entities. So, if you account in for 25000(₹) p.m., you can account for a market size of 1.37 lakh crore annually. The market potential is enormous, and the demand for fast-paced financial service will only increase. Also, millennials understand technology like anything.

(source: consulantacy.com)

FinTech is all about speed, its about safety, its about technology that works effortlessly. Millennials are not interested in technology that slows down because of traffic. The technology needs to assure, however busy an application gets, it has incremental horizontal scalability; this means it is fast now, it is fast when it’s busy and can adapt to the needs of the customer.

Apart from a great user experience that resonates with Millennial, Fintech app developers need to think about how best to win over the trust. This generation trusts large tech firms such as Google and Facebook. In my view, Fintech firms that distribute their products through these services will win.

Attracting Millennials by providing products and services that they can’t get with a traditional financial

services institution—for example, Moneybox, which allows you to save pennies through your spending. This app rounds up your purchases to the nearest pound and put the spare change in savings or investment product. For example, each time you buy your morning coffee for £3.50, Moneybox will round that purchase up to £4 and put away 50p in your selected product. Nutmeg enables you to build an investment portfolio and manages a diversified portfolio at a fraction of the cost using Robo-advisory. Cuvva is another excellent example allowing millennials to buy car insurance on a pay as you go basis via an app rather than a flat yearly rate.

In summary, to attract millennials, you need to win over their trust and then provide them with products and services that they can’t access in mainstream markets.

The post FinTech – Cracking the Millennial Code. appeared first on NASSCOM Community |The Official Community of Indian IT Industry.