FICO Research: Does Student Loan Debt Impact Millennial Homeownership?

Blog: Enterprise Decision Management Blog

In April, we highlighted some of the positive behaviors that people with student loans are exhibiting to help improve their FICO® Scores. Following National Homeownership Month, we examined whether student loan debt appears to impact decisions about when to begin another important step in their financial and credit journey: purchasing a home.

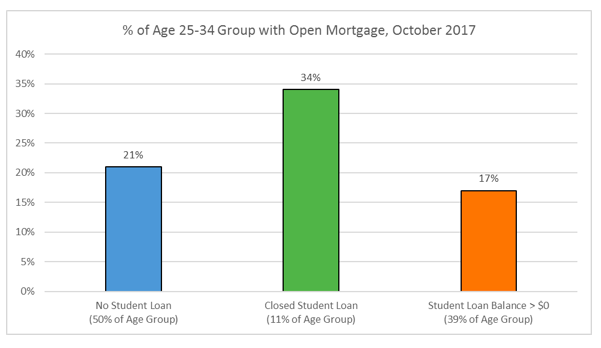

Using a nationally representative sample of FICO scorable consumers as of October 2017, we compared homeownership rates (using presence of an open mortgage loan as a proxy) across Millennial consumers age 25 to 34. Within this population, we distinguished rates of homeownership between those with no student loans on their credit file, those with closed student loans, and those consumers with one or more student loans actively in repayment.

Key Findings: Consumers with closed student loans are more likely to begin their homeownership journey

We found that the 11% of consumers with closed student loans are almost two-thirds more likely to have an open mortgage compared to the 50% without any student loan history on their credit file. The gap is even more pronounced between those with only closed student loans on file and the 39% of the population with active student loan debt. Notably, the active student loan debt population is half as likely to have an open mortgage. A possible explanation for this result is young consumers’ concern about outspending their income by simultaneously servicing both student loan and mortgage debt. Young consumers continuing to pay down their student loans may be less inclined to open a mortgage until they sufficiently increase their income or rid themselves of their student loan burden.

Some of the above difference between these three groups can also be attributed to differences in their credit risk profiles. The average FICO® Score of each group correlates with the rate of home ownership: those Millennial consumers with only closed student loans on file, score on average some 40 points higher, than those with no student loans on file. Those with active student loan debt score slightly lower than those with no student loans on file.

In an effort to control for the effect that these different risk profiles could be having on our analysis, we examined the same chart as above, but for those age 25-34 consumers scoring in the narrow FICO® Score range of 660-679.

While the contrast in home ownership fades when focusing on a specific 20-point score range, we still observe that the 8% of consumers with closed student loans are nearly 50% more likely to have a mortgage than the 41% carrying a student loan balance.

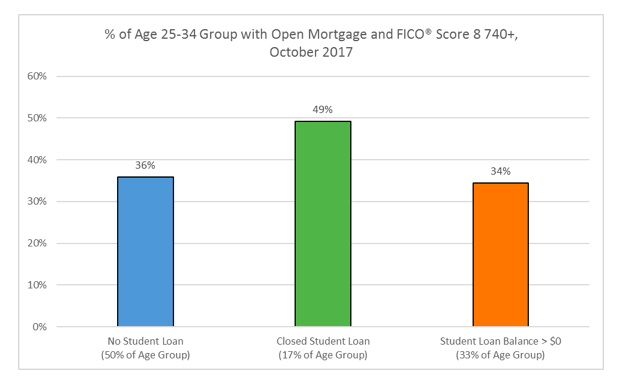

Shifting our focus to a population with higher FICO® Scores of 740+ results in higher overall home ownership rates across all subgroups, as shown in the figure below. In addition, the percentage of this population with closed student loans more than doubles (to 17%) relative to the 660-679 segment. But the difference in mortgage activity between the three subgroups remains relatively similar to the 660-679 band: those with closed student loans are considerably more likely to have begun their homeownership journey than those with no student loans or those still paying off debts incurred from financing their education.

This analysis presents evidence that while demographics, housing preferences, and other economic conditions play a role in the direction of Millennial homeownership according to Freddie Mac, student loan debt is also a factor in driving Millennials to delay home ownership. Bridging the journey from one stage in the credit life cycle (repayment of student loans) to another (taking out a mortgage), we will present FICO research on the credit behaviors that homeowners exhibit, which drives their FICO® Scores upward.

The post FICO Research: Does Student Loan Debt Impact Millennial Homeownership? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.